Brewers from around the Hudson Valley recently joined U.S. Rep. Sean Patrick Maloney at the Newburgh Brewing Co. to support legislation to lower taxes on small breweries.

According to Maloney”™s office, taxes make up 40 percent of the cost of beer. The Small Brewer Reinvestment and Expanding Workforce Act, or Small BREW Act, and the Fair Beer Act would reduce the cost of beer slightly while encouraging growth in the brewing industry, Maloney’s office said. About 90 percent of federally permitted brewers produce 7,000 barrels per year or fewer, qualifying for the tax cuts in the Small BREW Act and Fair Beer Act.

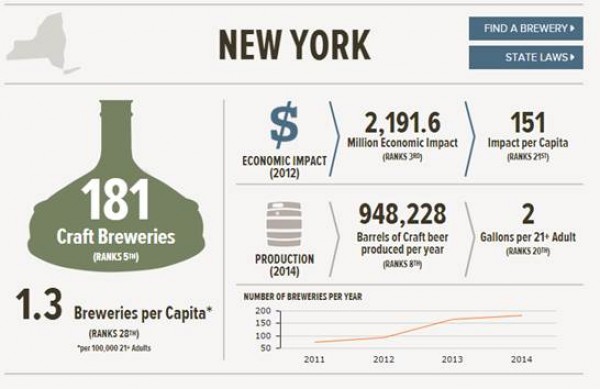

“New York”™s craft breweries employ thousands of people and contribute over $2.2 billion to our economy every year,” Maloney said. “We should be encouraging these small businesses to bolster the economy and create jobs, and the best way to do that is by cutting their taxes.”

According to the New York State Brewers Association, in 2013 the state”™s 207 breweries had an economic impact of $3.5 billion, generating $748 million in state and local taxes and supporting more than 11,000 full-time equivalent jobs.

Representatives from several Hudson Valley breweries joined Maloney, including Captain Lawrence Brewing in Elmsford, Rushing Duck Brewing in Chester, Defiant Brewing in Pearl River, Sloop Brewing in Elizaville, Broken Bow Brewery in Tuckahoe, Plan Bee Farm Brewery in Fishkill and Keegan Ales in Kingston.

The Small BREW Act was introduced by Rep. Erik Paulsen of Minnesota in January and has yet to come to an initial vote.

The Fair BEER Act was introduced in March and is sponsored by Sen. Roy Blunt of Missouri. It also has not come to an initial vote.