BuyTheBronx.com, the insiders’ guide to The Bronx real estate market, recently updated their valuation benchmarks in a fourth quarter review. The blog written by Daniel Hickey of Houlihan Lawrence Commercial employs a qualitative analysis of public and proprietary sale and lease data to construct its valuation benchmarks. In this time of unusual stress and low sales activity, go to the BuyTheBronx.com valuation benchmarks for the latest updates.

Bronx Market Review

Relaxing interest rates in the fourth quarter brought a hopeful thaw to the historic 2023 freeze in The Bronx real estate market. Valuations have held up thus far, but fewer marquee deals and more distressed sales are working their way through the averages. The scarcity of residential properties has boosted some of our benchmarks, although commercial apartment valuations continue to weaken. We see fewer land transactions above our benchmarks, and more below. Other commercial valuations have held steady among a wave of distressed sales.

Total transactions in the fourth quarter were 25% fewer than the prior year, which is better than the 42% decline for all of 2023. As we hope for a return to normal, it’s with apprehension about what the market clearing prices will look like. Leasing activity remains healthy with a slight cooling at the top of the retail market and enduring strength in industrial rents. The timeless advice to invest in middle class housing has lost relevancy in The Bronx apartment market. Landlords are facing rising expenses while new regulations have halted revenue growth. Banks are reluctant to refinance, even if the loans could perform at current rates. Valuations of $100,000 per unit have become common among the few properties being sold. Those brave enough to buy need to wait for stable prices, lower interest rates and a rational regulatory environment. They may have a better shot of hitting a trifecta at Yonkers Raceway.

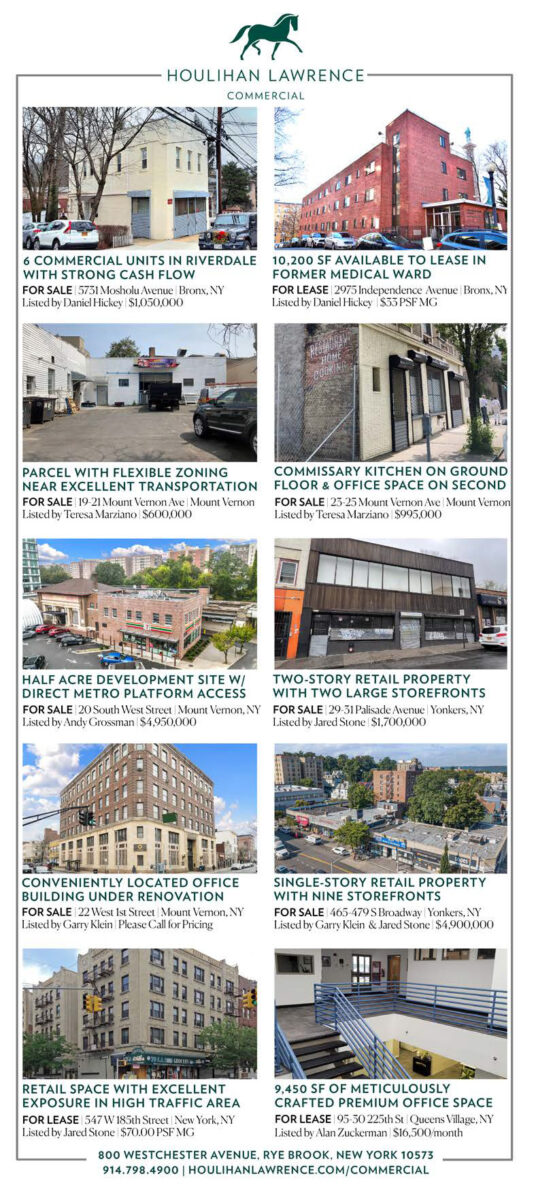

Houlihan Lawrence Commercial is pleased to offer two unique listings in the Riverdale area of The Bronx. The neighborhood has some of the highest income and educational attainment levels in the county. With excellent highways and mass transit access, the area should become more attractive as Manhattan congestion pricing takes effect.

5731 Mosholu Avenue is an impressive cash generator in a small package. The 500 square foot lot is improved by a two story office building with full walk out basement. Six units, including basement storage bring in over $90,000 annual gross revenue. It’s offered for sale at $1,050,000.

If you need more space for all your workers, consider 2975 Independence Avenue with 10,200 square feet available to lease. The second and third floors of a former nursing wing are currently configured as individual medical ward bedrooms, most with their own bath. The configuration is for NYC Use Group 3. Owners welcome office uses too and will reconfigure to tenant’s use within restrictions.

Please contact Houlihan Lawrence Commercial at 914.798.4900 for more information on the Bronx or any of our market areas.