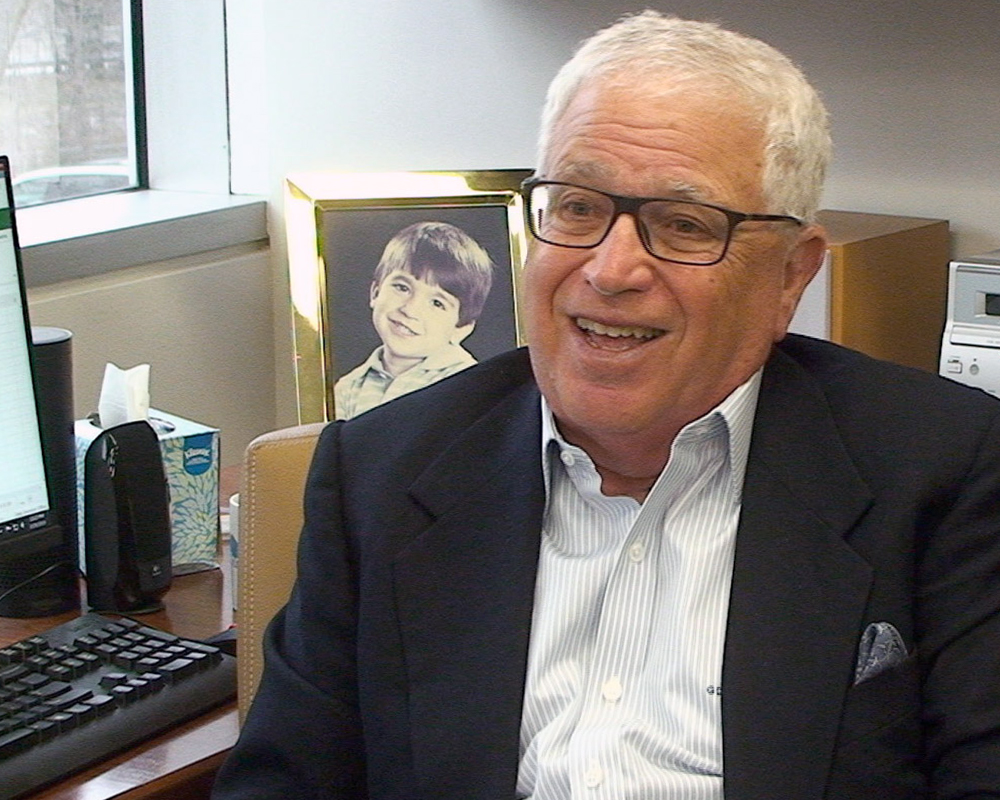

Terence Floyd is vice president and community relations consultant at Wells Fargo Bank in Meriden and president of the Connecticut Mortgage Bankers Association (CMBA), a position he was elected to in October 2018 for a two-year term. In this edition of Suite Talk, Business Journal reporter Phil Hall met with Floyd to discuss the state of Connecticut”™s mortgage profession.

Do you see a lot of younger people in Connecticut coming into the mortgage profession?

“I”™d say yes and no. We created something called the Future Leaders Association, a subset of the CMBA, and that group is tasked with finding younger people who work for the company members and saying, ”˜Have them come to some of the networking, educational, developmental functions. It can give them something that can help keep them employed at your firm.”™

“It is a huge problem, not just in Connecticut, but nationwide. Especially on the sales side, where originators are averaging 54 years old. If you start now ”” 22, 23, 24 years old ”” and by the time you are 30 and you work hard and really enjoy it, you can make a really good living.”

What is keeping the younger generation from wanting to pursue this line of work?

“When we try to teach the young people what their careers could be, we don”™t think of mortgage sales as a career. I think it is just a lack of information. We tell them to work for an insurance company or something that could be considered stable. We”™ve seen a lot in the mortgage field in the last 20 years ”” it fluctuates ”” and most mortgage companies do not pay a salary. If you start, you might get a stipend for a few months to feed yourself, but at some point you are a straight-commission employee.

“At 23, 24 or 25, the thought of ”˜I”™m going to bust my butt and work and six months from now I may not be making a lot of money”™ is not something that a lot of young adults want to do. I get it, but at the time you”™re 30 you can be in six figures, and where else at the age of 30 can you earn six figures?

“But this is not easy work ”” it”™s not for everybody. However, if someone wants to make a good living, especially on the sales side, the business is still strong and people are still lending.”

Mortgage bankers suffered from a bad reputation during the 2008 economic crisis and for several years after. Is that stigma still there? And if so, can it be corrected?

“Our government”™s done a lot to correct that. One of the things the Dodd-Frank Act did was streamline things and gave us standardization across the industry. It brought in certifications ”” back in 2004-2006, people would come to me saying they heard they could make a lot of money doing mortgages. I asked them what they did and they would say, ”˜Oh, I teach yoga.”™ And that was what was happening and it put a negative slant on the entire business. While some of us were working hard, following the rules and doing the right things, a lot of people weren”™t.”

Are you seeing more Connecticut millennials aspiring to become homeowners?

“I wouldn”™t say there is a large rush. One of the problems with younger adults is student loan debt ”” it is huge and it is hard at 25 when you have $100,000 in student loan debt that you have to start paying back to go out and buy a house.

“There are some ”” their families planned well, their student loan debt is low or they went into the military instead of college, and everybody is trying to grab that pocket of people. The real growth is in the Latino homeownership population ”” that is the growth over the next few years. That is the fastest-growing population in the country and they”™re buying houses. Every entity has to be ready to figure out a way to address that population. With some, English isn”™t their primary language, so do you have Spanish-speaking originators, processors, underwriters or staff to meet their needs?”

What can be done to increase homeownership within the African-American community?

“I don”™t know. That has been a personal thing of mine for 20 years. Before the crisis hit, we were very close to 50 percent, which is still well below the national homeownership rate.

“I wish I knew the answer to that. I know a number of large lenders have initiatives that are targeting people of color. But everywhere I go and with everyone I talk to, it”™s about how we can level that playing field. Unfortunately, we still have some racism ”” not only in Connecticut, but around the country ”” and there will always be people out there who think ”˜those people”™ don”™t deserve it. I think it will always be there. But there will be organizations like the CMBA and the national Mortgage Bankers Association that will say, ”˜Not so fast. Here are some great programs that our members have that you can benefit from.”™”

There have been several financial industry surveys recently that found many borrowers are confused over down payment information, with people believing you will be shut out of the process if you cannot put 20 percent down. Is it incumbent on the lender to educate borrowers on down payments, or is it the borrower”™s responsibility to know the answers before making the mortgage application?

“I think the banks and mortgage companies and the mortgage brokers who want that business have a responsibility to get the word out. The nonprofits do a great job of advertising down payment and first-time borrower assistance programs. Yes, you can put 20 percent and it”™s not a bad idea if you have it ”” you”™ll help yourself out with this thing called mortgage insurance. But if you don”™t, it”™s not a barrier. We have FHA and just about every bank has some sort of portfolio program that they can offer a first-time homebuyer that”™s a 3 percent or 3.5 percent down ”” some have no mortgage insurance, some do.

“But as a consumer, you have to do your homework and comparison shop. I did a lot of years on the sales side and I would tell people, ”˜Shop me last because I have the best deals.”™ And you have to see who gives you the best deals and the best service, because any institution can give you a great rate. But you want a loan officer who is knowledgeable, especially with first-time homebuyers.”

Community banks and credit unions pride themselves on offering excellent customer service. What is the level of customer service like in today”™s mortgage industry?

“The institution has a lot to do with it ”” and you have to ask about the culture of the institution. While we cannot throw out a member from the CMBA if we find out they are doing poor customer service, there are some things we can do if there are problems. We can sit down with them and say, ”˜Look, you are a reflection of the industry and a member of the CMBA. We have resources we can offer to help you. Let”™s work together and improve some of the areas.”™

“But it is also about the person. Does the person care? I worked with people who were brokers and had their own broker shop but couldn”™t survive for whatever reasons, left, went to national banks and did phenomenal jobs. The conventional wisdom was, ”˜Oh, if you worked for a broker, you couldn”™t go and originate for a bank.”™ Yes, they could ”” if they have the right attitude.”