As the first quarter of 2024 comes to a close, a robust economy, plentiful employment, and moderating inflation, continue to support the consumer’s ability and inclination to spend, creating a virtuous cycle that further contributes to economic growth and financial market confidence. Yet, profound uncertainty persists, an outcome of the pandemic period and present-day geopolitical tensions.

Westchester Multifamily in a Privileged Position

Boasting a vacancy rate in the low 4% and uninterrupted positive trends in rental rates, fundamentals for Westchester multifamily are strong. Deliveries of new units have slowed markedly, compared to the last few quarters, further tightening supply-demand.

Under construction pipeline has declined to 8.4% of inventory from a high of 12.4% a couple of years ago. Deliveries were 0.2% of inventory during the first quarter, a modest amount compared to deliveries of 1.5-2% of inventory that took place during 2022. This moderating supply of new units contributed to re-accelerating multifamily rent growth during Q1 2024.

Westchester Retail Appears to Improve

Consistent with better demand and occupancy improvements taking place in Manhattan retail, Westchester enjoyed positive retail space absorption and improved leasing activity during the quarter. Both direct leasing and sub-let spaces experienced increased demand. Businesses are feeling more confident that consumer demand will hold up and are actively committing to new leases.

Westchester has experienced increased demand from successful NYC businesses that are following their clients who have moved north to Westchester. Limited inventory of retail in Westchester has translated on firm pricing for retail assets and low availability rates for quality space.

Westchester Office Market Remains Depressed

Westchester offices had a difficult quarter with reduced leasing activity and a net supply demand imbalance driven by tenants giving back space to landlords. Despite poor fundamental demand, lease pricing held stable. As businesses reconfigure their approach to offices, we are likely to continue experiencing office footprint reductions for a prolonged period of time. Unfortunately, office to residential conversions have proven to be much more costly and difficult than originally expected, creating hurdles for an adaptive reuse of obsolete office assets.

Westchester Industrial Supported by Consumer Trends

Industrial space in Southern Westchester is scarce. Zoning changes have reduced the amount of available industrial space for rent and development possibilities are hard to find and costly. At the same time, increased consumption of goods and services has created a collateral demand for industrial assets. During the quarter, a large lease turnover led to a modest increase in industrial vacancies while pricing continued an upwards ascent. According to Costar, during the first quarter, average industrial space leasing rates increased 8% year-over-year and 2.4% versus the prior quarter.

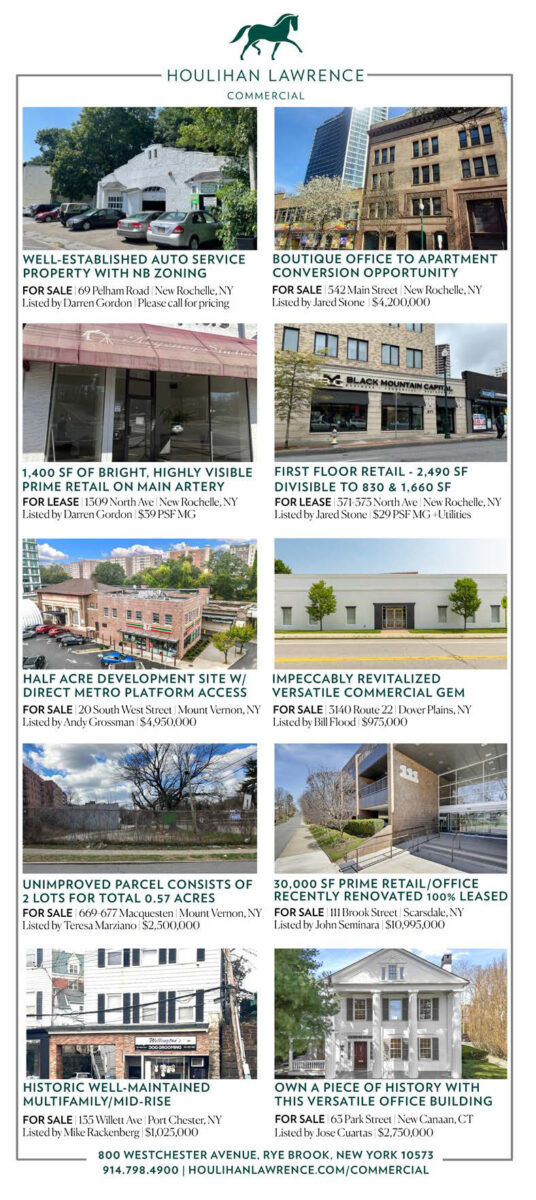

HOULIHAN LAWRENCE COMMERCIAL TEAM

Commercial real estate has entered a challenging period as low interest rate maturities start to come due. Interesting commercial real estate investment opportunities are likely to become available. Liquidity is only available for strong sponsors and poorly capitalized owners will seek to sell. However, there are numerous market and economic risks that will add to the complexities of acquiring commercial real estate. Understanding the market forces that are shaping the fundamentals for each property requires a deep knowledge of the property, local and regional insights, and close contacts with the right financial partners. Our Team is highly skilled in all these areas.