New York has shot down a National Rifle Association insurance program for violations of state laws, in consent orders with the program”™s underwriter and administrator.

New York has shot down a National Rifle Association insurance program for violations of state laws, in consent orders with the program”™s underwriter and administrator.

Chubb Group Holdings and its Illinois Union Insurance Co. subsidiary, consented to a $1.3 million penalty on Monday and to stop underwriting the NRA”™s Carry Guard insurance, in an agreement with the state Department of Financial Services.

Last week, the Lockton Companies consented to a $7 million penalty and agreed to stop issuing Carry Guard policies in New York.

“Today”™s action is another step in addressing the unlicensed and improper activity connected with the NRA”™s unlawful Carry Guard program,” Maria T. Vullo, state financial services superintendent, said in a press release announcing the Chubb agreement.

She said DFS would continue to ensure that “consumers are no longer conned into buying so-called “self-defense” insurance coverage.”

The NRA was not fined or made party to the agreements, but the gun rights organization is described throughout as an unlicensed marketer of insurance.

An NRA spokesman put the blame on Lockton, stating that the organization had relied on the insurance company to comply with all state regulations.

“The NRA acted appropriately at all times,” said William A. Brewer III, outside counsel for the NRA.

He also depicted the DFS actions as politically-motivated and an attempt to suppress free speech by blocking affinity-type insurance programs with the NRA.

“This could fairly be seen as an attempt to restrict the NRA”™s ability to operate in the political arena and marketplace of ideas,” he said.

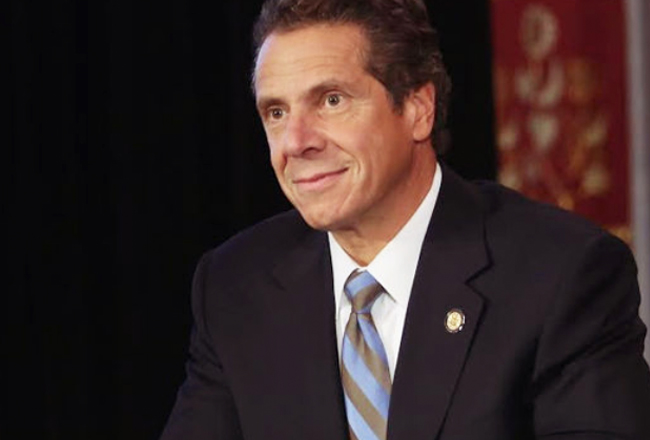

DFS began investigating in October, and it imposed the sanctions after Gov. Andrew Cuomo directed the agency to put pressure on banks and insurance companies to consider ending their relationships with the NRA.

“New York may have the strongest gun laws in the country,” Cuomo said in a public statement on April 19, “but we must push further to ensure that gun safety is a top priority for every individual, company and organization that does business across the state.”

Vullo cited the killings of 17 students and staff at Marjory Stoneman Douglas High School in Parkland, Florida, in a memorandum to all insurers doing business in New York.

She encouraged insurers to manage reputational risks “that may arise from their dealings with the NRA or similar gun promotion organizations.”

Insurers were urged to “take prompt actions to managing these risks and promote public health and safety.”

Carry Guard policies were issued to 681 New York residents from April through November 2017, according to the consent orders, and no claims have been submitted.

The NRA describes Carry Guard as a two-pronged program that provides firearms safety training and insurance to mitigate financial and legal consequences of “armed encounters.”

“Although millions of Americans are prepared to use a firearm in self-defense,” the NRA website says, “very few families can withstand the financial consequences that may come next. The legal fees to clear your good name could be enormous. Likewise, the costs of defending and potentially losing a civil lawsuit could cripple your finances for the rest of your life.”

Chubb and Lockton suspended their participation in the Carry Guard program in November, weeks after DFS had begun its investigation.

Chubb, the world”™s largest property and casualty insurance company, based in Zurich, Switzerland, served as the Carry Guard underwriter through its Illinois Union subsidiary.

Lockton, the world”™s largest privately-owned independent insurance brokerage firm, based in Kansas City, Missouri, administered Carry Guard policies through its Lockton Affinity subsidiary.

Carry Guard violated New York laws, according to the consent orders, by offering liability insurance to people who may be charged with a crime, who use firearms beyond reasonable force, who used the coverage for psychological counseling, and for promoting insurance at the behest of an unlicensed entity, the NRA. Lockton improperly tied the insurance policies to free NRA membership for a year.

Lockton had also provided insurance to 11 other NRA-endorsed programs, from 2000 through this past March, such as retired law enforcement officer self-defense insurance, gun collector insurance and gun show insurance.

Lockton sold 28,015 policies since 2000 and received $12.8 million in premiums and administrative fees. The NRA got $1.9 million, the consent agreement states.

The insurance companies agreed to pay the penalties within 10 days, to not participate in Carry Guard or similar programs, to cancel the policies and refund their customers. They agreed to testify at hearings, trials and other proceedings, if asked to do so by DFS, on matters related to Carry Guard.

Last week, the NRA sued Lockton in federal court, Alexandria, Virginia, accusing the company of breach of contract for rescinding regulatory guidance the organization had relied on, buckling under political pressure from DFS and abandoning its obligations to the NRA and its members.