CBIA News

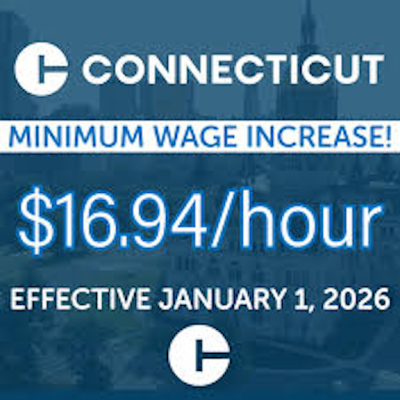

Connecticut’s hourly minimum wage increased 3.6% to $16.94 on Jan. 1, 2026.

A state law enacted in 2019 implemented five annual increases in the hourly wage and tied future yearly increases to the U.S. Department of Labor’s Employment Cost Index (ECI).

The last of those five statutory increases took effect in 2023, when the hourly wage hit $15.

Future increases are calculated based on the change in the ECI “over the 12-month period ending June 30 of the preceding year, rounded to the nearest whole cent.”

Connecticut was one of 23 states that raised the minimum wage for 2026.

At $17.95, the District of Columbia has the country’s highest minimum wage, followed by Washington state ($17.13), and New York City and Nassau, Suffolk, and Westchester counties ($17), while California cities and towns range from $16.90 to $19.60.

Fifteen states link annual changes in the minimum wage to various indexes, with Virginia (2026), Nebraska (2027), and Florida (2028) all scheduled to follow suit over the next three years.

Twenty states set the hourly wage at $7.25, which is the federal minimum wage for covered nonexempt employees.

As of September 2025, average private sector hourly earnings in Connecticut stood at $39.24, up 2.5% year-over-year.

Connecticut employers are legally obligated to pay employees the new hourly wage of $16.94 on and after Jan. 1, 2026.

This means employers can choose to pay employees $16.35 for every hour leading up to Jan. 1, but must adjust payroll from that date.

Connecticut law includes a $6.38 minimum wage for tipped workers, which includes restaurant waiters, and the $8.23 minimum for bartenders.

However, those tipped employees now must be paid at least $16.94 an hour—including gratuities.

State law also includes a 90-day, $10.10 hourly training wage for 16- and 17-year-old workers.