With total enrollment figures likely to be down compared with last year and the future of the Affordable Care Act still in doubt, Jim Wadleigh, CEO of the state”™s health insurance exchange Access Health CT, said the preferred way of continuing to do business is continuing to do business.

“If and as changes are made, we will react accordingly,” Wadleigh said from Access Health CT”™s office in Hartford. “Since the election in November, we have seen different permutations of what could happen, and they have continued to change.

“One can,” he deadpanned, “go crazy trying to keep up with all of it.”

Wadleigh said the exchange”™s employees meet regularly to discuss possible scenarios should the Affordable Care Act be altered, repealed, replaced ”“ or left the same ”“ under the Trump Administration. Should major changes occur, Access Health CT and similar exchanges in the other states could face radical modifications, if not outright disbandment.

“It”™s still too early to say anything with any certainty,” Wadleigh said.

Indeed, the only certainty so far is Trump”™s Jan. 20 executive order to “minimize the economic burden of the Affordable Care Act pending repeal.” But as with his Jan. 27 executive order involving the detaining, barring and/or removal of certain refugees and immigrants, implementation of such orders can be a tricky business.

In any case, Wadleigh was quick to affirm that even should the ACA, or Obamacare, be completely done away with, Connecticut policy holders will remain insured through the calendar year under Connecticut Insurance Department policy.

He also noted that the law still requires that residents have coverage, and that anyone failing to sign up for coverage could be liable to a tax penalty of $695 or more.

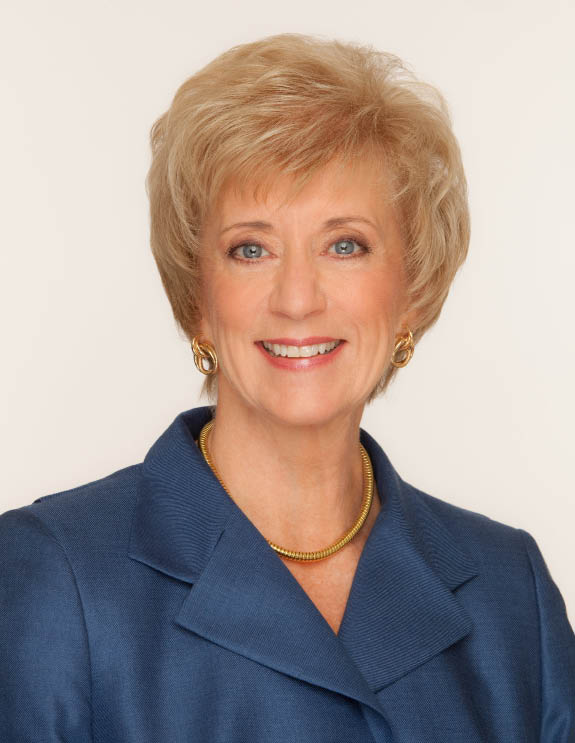

That”™s a message that Access Health CT, Wadleigh and Lt. Gov. Nancy Wyman, who also serves as the exchange”™s board chair, strove to get across via a media blitz in the waning days of the group”™s open enrollment period, which ended at midnight on Jan. 31.

As of Jan. 26, 107,412 people had enrolled in health insurance coverage for 2017, a figure that Wadleigh said would probably increase to 110,000 to 112,000 by the end of open enrollment. Those numbers are down from 2016”™s enrollment of 116,000.

Not a huge shortfall, but Wadleigh said that based on the phone conversations his staff had with some residents, “confusion in the marketplace” had apparently led many to believe they didn”™t have to buy health insurance. Along with that $695 penalty, Wadleigh said he was “very concerned that a year from now, if no changes are made (to the ACA), a lot of people are going to be angry with us.”

As previously reported, Access Health CT”™s board recently tightened its regulations for people trying to buy health insurance after the open-enrollment period, having found that some people were abusing the system by waiting to buy insurance only after becoming sick and dropping the insurance after they had recovered.

Such people were using as a loophole an open-enrollment exemption that allows customers to enroll in the wake of such life-changing events as marriage, divorce, being laid off and the like.

Wadleigh said that tightening the review process for such potential customers ”“ to confirm that each one truly qualifies for the exemption ”“ was driven by the exchange”™s insurance carriers, ConnectiCare and Anthem. Those carriers told Access Health CT that such moves could result in a reduction of 6 to 10 percent in insurance rates, “and that”™s what we hope we see,” Wadleigh said.

In addition, the board voted to require insurance companies to pay commissions to brokers who help customers sign up for 2018 coverage. This year, both ConnectiCare and Anthem stopped paying commissions, with the percentage of customers receiving help from brokers declining from 50 percent to 25 percent.

Under the new guidelines, the insurers must pay broker commissions for plans sold for 2018 coverage. While not specifying how much the insurers must pay, the board ruled that they must pay the same commissions for individual-market plans sold both through Access Health CT and outside of the exchange.

“We want to help our customers make informed decisions,” Wadleigh said, “and having brokers involved to help explain and advise them on what the best plan for them might be is a part of that.”