A multi-disciplinary panel of experts gave their perspectives on the economic health of Hudson Valley in on Oct. 5. Sponsored by Orange Bank & Trust Co.

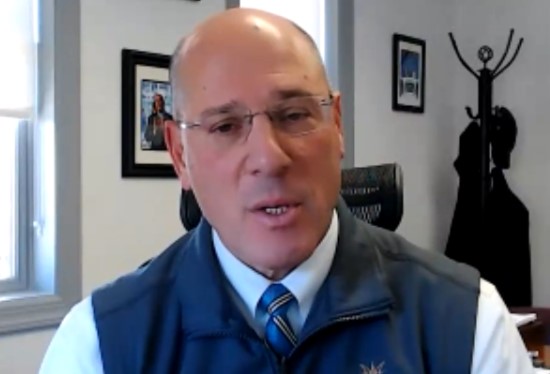

Michael Gilfeather, the bank’s president and CEO, opened the webinar by detailing his institution’s commitment to the region.

“The strategy and focus of our bank is to be the premier business bank and wealth management bank in the Hudson Valley,” he said. “Our lending, which now totals almost $1.7 billion is almost exclusively focused on commercial real estate, construction, supply companies, and operating businesses. In other words: lending requirements for all of the participants in this program.”

Gus Scacco, CEO of Hudson Valley Investment Advisors Inc., a subsidiary of the bank, was the webinar’s opening speaker.

“We’ve been hearing about how we’re going into a recession for a little bit over a year, and the data does not support that,” he said. “What we’ve seen over the last 12 months is the construction sector as well as consumers have been very strong.”

According to Scacco, the economy has shown a vibrant GDP, which he predicted to end at around 5% growth at the close of the quarter. He forecast declining inflation on the horizon, with prices in housing and services coming down and the return of supply chain stability.

Scacco added that many housing markets were already facing an oversupply of stock, and that the Hudson Valley could see a similar situation soon.

“That should actually be seen in the New York Metropolitan area 24 months out,” Scacco said, explaining that this assertion was based on the latest data from Zillow, combined with salaries and jobs numbers beginning to plateau.

In addition, Scacco said that the U.S. has been successful in efforts to return jobs that were offshored, especially manufacturing jobs that had previously gone abroad to China. Increases in work force participation among women, minorities and the disabled after those numbers cratered during the Covid pandemic helped to stabilize the labor supply.

“We’re actually moving to a point where we have gotten back 10 million workers in the US economy from the bottom in terms of the percentage of people that are participating in the economy,” Scacco said, claiming that the “prognosticators” who say a recession is imminent have been misled by the negative yield curve. But unlike previous times, he noted, the curve has accurately predicted the start of a recession, the economy still has $7 trillion in capital injected directly by the government.

“That should sustain us six to 12 months minimum,” he said.

Scacco advised the audience that interest rates may continue to rise, but that a broader market improvement and a rebound in earnings into the next year can be expected, alongside bonds reverting to the 3.5% to 4.5% range.

Carmen Bauman, the president-elect at the Hudson Gateway Association of Realtors Inc. and the owner of Green Grass Real Estate, expressed hope that Scacco is right, but noted in the short term there were still challenges.

“Our market area has been experiencing high demand and high price,” Bauman explained. “And the current lack of inventory is only pushing the pricing higher, and consumers are facing the additional hurdle of rising interest rates.”

Bauman also noted that much of the exodus from more densely populated areas associated with the pandemic was absorbed by luxury high rises and mixed-use buildings, which has kept the rental market throughout the Hudson Valley strong.

However, she warned, the pandemic had also shifted the demands for commercial real estate away from retail space and towards light industrial or warehouse spaces. According to Bauman, regional commercial space was tracking with national trends, including office space which she described as a “tough asset class” in today’s market.

“I do want to leave you on something of a positive note,” Bauman said in closing, “which is our locale has historically been a hotspot for investment sales and development and redevelopment, and I believe that will continue to be the case.”

John T. Cooney Jr., executive director of the Construction Industry Council of Westchester & Hudson Valley, noted that the construction sector had seen a shift away from low interest rates driving commercial construction and healthcare investment. In its place, funds from the Infrastructure Investment Job Act and American Rescue Plan Funds – along with other Covid relief programs that reached municipalities – had led to a strong industry largely working for cities and towns.

“How have our companies met this increased demand and the demand for manpower?” Cooney asked. He answered it was partially the result of newer, more productive recruitment along with an increased emphasis on employee training and retention along with strong recruiting among those already in the work force.

“The industry is drawing these people from lower paying jobs that exist in the region,” Cooney said. “They’re being kind of stripped away from the lower paying jobs. And essentially, for the construction industry if an individual has the will than our partners in labor and companies themselves can build the skills.”

Cooney observed that the industry is working its way through a four-to-five-year backlog of planned construction, which even with increasing costs for materials and unfavorable interest rates means that the construction sector will likely weather the immediate future, if not thrive.

Marsha Gordon, CEO of the Business Council of Westchester, said that her fellow panelists’ comments matched what the members of her organization were saying.

“Business is going well,” Gordon said. “Members are joining the Business Council of Westchester and other organizations. It’s a reflection of the health of the Westchester and Hudson Valley economy.”

The biggest challenge Gordon identified was in recruiting. “Attracting good talent and finding the match between the skills that people have, especially people in transition, and the talent that businesses needs is something we have watched very carefully.”

Gordon reported that apart from an August uptick, the region’s unemployment rate has hovered between 2% and 3%. She said the biosciences sector, alongside film production companies and professional services, continue to grow and undergird the local economy, with the opening of Empire City Casino representing another bright opportunity on the horizon.

Alan Seidman, executive director of the Construction Contractors Association of the Hudson Valley, noted that he would have to echo many of Cooney’s sentiments, adding “I do see a robust few years on projects coming down the pike.”

Medical and school related work with government financing, particularly with regards to projects pertaining to the U.S. Military Academy at West Point were also highlighted by Seidman. He noted Port Authority projects, an expansion of Woodbury Commons, and a Legoland project are all moving forward as well.

However, Seidman expressed fear that many of the businesses mentioned by other speakers were going to be driven from the state by a hostile regulatory environment.

“The biggest negative,” Seidman asserted, “is a hostile business and tax environment in our state. The amount of tax dollars leaving our state on a daily basis is scary. Our children leave for college and very few return to work and raise their families here.”