As businesses braced for an increase in the minimum wage and workers looked forward to putting more money in their wallets, it remains unclear whether the first round of pay increases in 2017 had much of an impact.

New York enacted a minimum wage schedule in 2016 that will increase wages from $9 an hour to $15 over six years.

Gov. Andrew Cuomo and progressive groups characterized the initiative as an economic justice issue that will have minimal impact on jobs, increase worker productivity and lift the standard of living for many people.

Gov. Andrew Cuomo and progressive groups characterized the initiative as an economic justice issue that will have minimal impact on jobs, increase worker productivity and lift the standard of living for many people.

Business groups predicted that New York will lose hundreds of thousands of jobs as companies resort to automation, cut hours, fire workers or go out of business.

But as New York has just completed year one of the $15 target timetable, there are no definitive studies that document the impact of the first phase of higher wages.

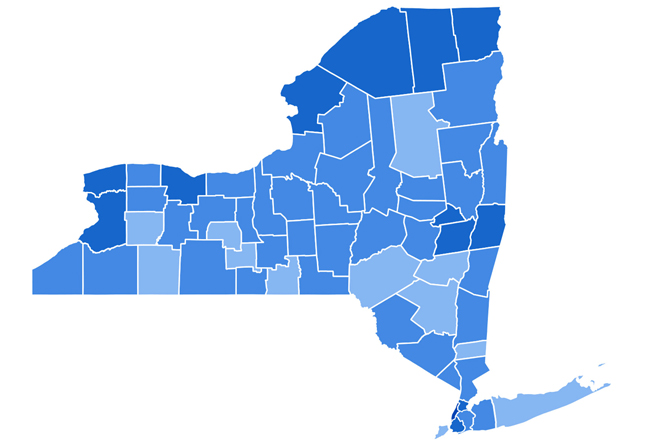

Previously, New York had one minimum wage rate for everyone. Now different rates apply to different areas of the state.

On Dec. 31, the general minimum wage in Westchester County increased from $10 to $11 an hour. Fast-food workers are getting $11.75, an extra dollar an hour.

Tipped food-service workers still get $7.50 in Westchester, with the expectation that they will receive $3.50 in tips for a total hourly take of $11. Other tipped service workers are getting an extra 80 cents, bringing their pay to $9.15, and the presumption that $1.85 in tips will elevate their pay to $11 an hour.

Any government mandate that increases business costs makes it harder to grow and profit, said Zack Hutchins, communications director for The Business Council of New York State. “And that is what the minimum wage did and will continue to do.”

While he has no hard facts yet to bolster the business group”™s argument, Hutchins has noticed changes.

Some fast-food restaurants in Albany now take orders at electronic kiosks rather than by workers, for instance, and he has heard of businesses closing because they can no longer afford to pay employees.

The impact of higher wages will also have to be teased out from other new workplace regulations.

Paid family leave became mandatory this January, allowing employees to receive partial pay for several weeks while they care for infants or for family members with serious health conditions.

The state Department of Labor is working on regulations on how employees will be compensated for “call-in pay,” such as working an unscheduled shift or being kept on standby for a shift.

Cuomo has proposed ending separate wage schedules for tipped workers. Certain workplaces, like car washes and restaurants, the governor said in a Dec. 18 news release, combine low wages and low tips. So instead of rewarding good service, tips serve as a subsidy to bring wages up to the legal minimum.

John Ravitz, executive vice president of The Business Council of Westchester, is particularly concerned about the impact of annual minimum wage hikes on nonprofit organizations, small businesses and firms that employ seasonal or part-time workers.

“I don”™t know if I can say anything about the impact yet,” said Ravitz, “but I think we have to be laser-focused as they continue to roll out the minimum wage schedule.”

Rockland County has had a smooth transition, due to its inclusion with upstate counties, or more precisely, everywhere outside of New York City, Westchester and Long Island, where the minimum wage is set at a lower rate.

Rockland”™s minimum wage increased by 70 cents, to $10.40. It will top out at $12.50 at the end of 2020, after which a higher rate could be required.

Westchester and Long Island will reach $15 in 2021. New York City firms with fewer than 11 employees will phase in to $15 at the end of 2019. Larger city firms will have to pay $15 by the end of next year.

The difference is important, said Al Samuels, president and CEO of the Rockland Business Association, because two-thirds of the county”™s businesses are small, employing four or fewer workers.

“Those businesses are grateful and every Main Street business is grateful,” he said.

Business is expanding, he said, but he is unable to attribute growth to companies moving in from Westchester or New York City to take advantage of the regional minimum wage differential.

Samuels sees a cluster of challenges that cumulatively, with higher wages, will cause problems. His members are concerned about paid family leave regulations, and they are talking about the state”™s $4.6 billion budget deficit.

Samuels is also worried about new federal tax law that trims deductions for local taxes and mortgage interest.

“Our cost of living and taxes are so much higher here,” he said. “Our region will see more negative than the rest of the state.”

Gonzalo Cruz, day laborer organizer for Don Bosco Workers Inc. in Port Chester, sees mixed results for Latino immigrants.

He said day laborers in construction can command pay that is even higher than the minimum wage. General laborers can ask for $15 an hour. Skilled laborers, especially those who have their own tools, can ask for $20 an hour.

But the work is difficult, dirty and dangerous, he said, and jobs typically run for only two or three days.

The extra money from a higher minimum wage helps, he said, and the resulting overtime pay makes a big difference.

But Cruz said people who work for restaurants and grocery stores are struggling, with pay at around $10 an hour. Many of them work only 16 to 20 hours a week, so they can”™t collect time-and-a-half pay for overtime.

Workers have to cobble together part-time jobs, but then they incur high transportation costs that cut into their income, said Cruz.

Wage theft, he said, in which bosses cheat workers on their hours or on overtime, remains a problem.

“The American economy used to have full benefits,” Cruz said. “Now you need to have three part-time jobs.”

businesses cut employees hours to avoid paying insurance costs, start at the source…