In its first interest rate announcement of the Trump Administration, the Federal Reserve said it is holding interest rates steady. The Federal Open Market Committee (FOMC) voted unanimously to hold rates where they are in the 4-1/4% to 4-1/2% range.

“Recent indicators suggest that economic activity has continued to expand at a solid pace,” the FOMC said. “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.”

The FOMC said it still seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. It said the economic outlook is uncertain. The committee said it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that “could impede the attainment of the committee’s goals” and that it “will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

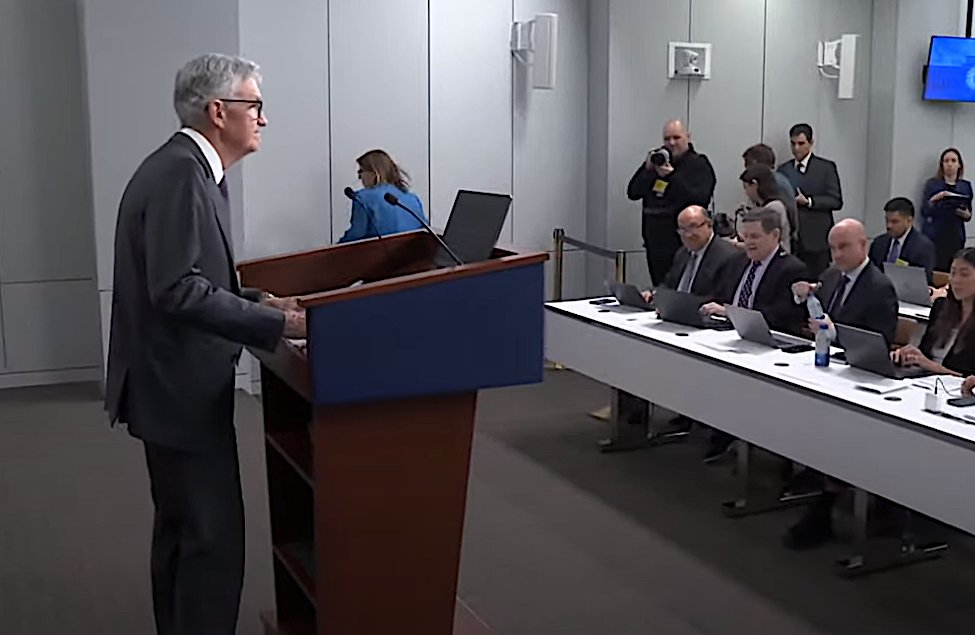

Speaking with reporters, Fed Chairman Jerome Powell said, “My colleagues and I remain squarely focused on achieving our dual mandate goals of maximum employment and stable prices for the benefit of the American people.”

Powell said that while economy is strong overall, labor conditions have cooled from what he described as their former overheated state and remain solid.

“Inflation has moved much closer to our 2% longer-run goal though it remains somewhat elevated,” Powell said. “Recent indicators suggest that economic activity has continued to expand at a solid pace.”

Powell said that following weakness in the middle of last year the housing market seems to have stabilized.

“Overall a wide set of indicators suggest that conditions in the labor market are broadly in balance,” Powell said. “The labor market is not a source of significant inflationary pressures.”