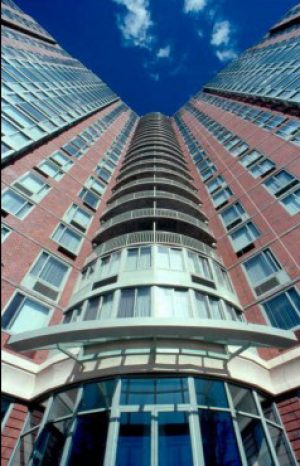

The 25-story La Rochelle apartment tower in downtown New Rochelle has sold for $148.5 million.

An affiliate of DSF Advisors in Waltham, Massachusetts, bought the building at 255 Huguenot St. from an affiliate of Hartz Mountain Industries in Secaucus, New Jersey.

The transaction cost 38 percent more than the $107.5 million that Hartz paid when it bought the building from AvalonBay Communities in 2010.

La Rochelle is near the New Rochelle Station, the transit hub that serves Metro-North”™s New Haven Line, Amtrak and the Bee-Line Bus System. It is around the corner from Halstead New Rochelle, a 40-story tower at 40 Memorial Highway that DSF bought from AvalonBay for $210.4 million in 2013.

La Rochelle is near the New Rochelle Station, the transit hub that serves Metro-North”™s New Haven Line, Amtrak and the Bee-Line Bus System. It is around the corner from Halstead New Rochelle, a 40-story tower at 40 Memorial Highway that DSF bought from AvalonBay for $210.4 million in 2013.

The two residential towers were at the forefront of New Rochelle”™s downtown residential renaissance in the late 1990s. La Rochelle has 412 market-rate apartments, 5,400 square feet of retail space and a parking garage with 707 spaces.

The New Rochelle Industrial Development Agency, which controls the land, approved the La Rochelle sale on Aug. 30.

The agency also approved a mortgage recording tax exemption valued at an estimated $400,000, and transfer of a payment in lieu of taxes agreement. The city and the IDA will receive about $1.5 million in fees and a percentage of the new debt that DSF takes on the finance renovations.

The deed, lease and mortgage agreements closed in mid-October and were recorded on Oct. 31.

DSF borrowed $103 million from Walker & Dunlop, a commercial real estate lender in Bethesda, Maryland. The loan consolidates old debt and a new $31 million mortgage.

DSF has notified the city that it plans to renovate apartments as they become available and to upgrade common areas.

Thomas Mazza, chief operating officer, said in a letter that DSF will apply the same formula it used at the Halstead. For that building, the company renovated the lobby, leasing office, pet park, courtyard and corridors. It created a clubroom and converted a banquet space on the top floor to a health club.

DSF has said it will put the La Rochelle in its $400 million DSF Multifamily Real Estate Fund III, which is expected to close in December.

DSF was founded in 2000 by Mazza, Arthur P. Solomon and Joshua Solomon. It manages about 3,000 rental units in the Northeast corridor that are worth $1.2 billion.