BY ALEXANDER SOULE

Hearst Connecticut Media

Consumer spending appears to have finally rebounded as homeowners begin to see their properties begin to accumulate value once more ”” a trend that should be able to push through any near-term increase in interest rates by the Federal Reserve, according to a Federal Reserve Bank economist who spoke in Stamford on Wednesday.

While speaking to the U.S. Senate”™s banking committee Tuesday, Federal Reserve Chairwoman Janet Yellen signaled the Fed might raise interest rates later this year, amid growing confidence nationally in the economic recovery.

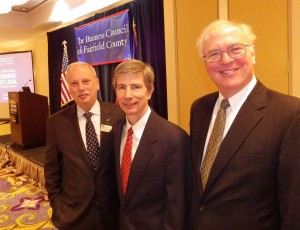

- From left, Rey Giallongo, board chairman and CEO, First County Bank, and board chairman, Business Council of Fairfield County; Joseph Tracy, executive vice president, Federal Reserve Bank of New York; and Chris Bruhl, president and CEO of The Business Council of Fairfield County. Photo by Bill Fallon

That confidence is filtering into the region in fits and starts, as described by Joseph Tracy, executive vice president and special adviser to the president of the Federal Reserve Bank of New York, who spoke Wednesday at The Business Council of Fairfield County”™s 15th annual National Economic Outlook and Regional Forecast event at the Stamford Marriott Hotel & Spa, with some 200 people in attendance.

The Great Recession differed from previous downturns in that households significantly cut spending and increased savings, as they saw the value of their homes plummet by 20 percent or more, Tracy said.

By contrast, housing largely held its value in prior recessions and Tracy said that gave families the confidence to maintain their lifestyles even if income was curtailed. It also previously allowed people who lost their jobs to bankroll loans for startup businesses secured by the equity they held in their residences.

In Connecticut, personal expenditures dropped by nearly $2.5 billion between 2008 and 2009, according to data published by the Bureau of Economic Analysis, a 1.6 percent decline that was the sharpest in the Northeast. Spending by Connecticut residents recovered within a year and as of 2012 personal expenditures were 8.8 percent above the level of five years earlier, though well behind the surge in spending of better than 13 percent in New York and Massachusetts.

With interest rates a key determinant in the housing market, Tracy said under the best scenario the Fed hits the timing right for any increase, with the economy at a self-sustaining stage of growth.

“Even though you”™re raising interest rates and borrowing costs ”” which you might think would act as a bit of a deterrent or a tapping on the brakes ”” that”™s offset by the natural growth that we”™re seeing in the economy,” Tracy said. “The economy basically settles in at roughly what you think the potential growth rate might be.”

Tracy added that with the Fed”™s balance sheet ”” funds banks hold on deposit at the Fed to satisfy reserve requirements ”” at an all-time high, the Fed is entering uncharted territory with respect to any increase in interest rates.

“The central bank has never yet had the experience of trying to raise rates with the kind of excess reserves we have in the system,” Tracy said.

“They”™ve been doing lots of testing of various tools and so they”™re very confident they will be able to raise rates when they feel it is important,” he said. “But this will be the first time they”™ve been trying to do it in this kind of environment with the kind of balance sheet that they have.”

Deloitte, the finance, risk management and tax-advisory firm with new offices in the clock tower of the BLT Financial Centre in Stamford, was event sponsor.

Hearst Connecticut Media includes four daily newspapers: Connecticut Post, Greenwich Time, The Advocate (Stamford) and The News Times (Danbury). See stamfordadvocate.com for more from this reporter.