Despite a spike in property sales that included a $56.6 million purchase of two Platinum Mile office buildings in the fourth quarter, 2014 was another slow year in the Westchester County office market, marked by leasing activity that one brokerage called “anemic.”

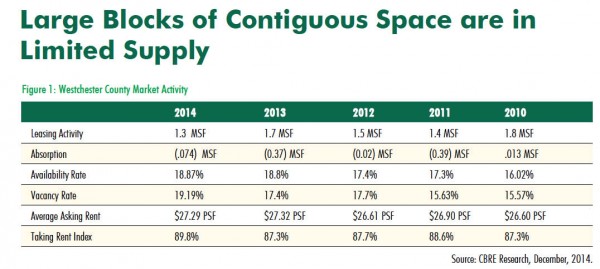

Both CBRE Group Inc. and Newmark Grubb Knight Frank reported a 27 percent drop last year in countywide leasing activity from 2013. CBRE researchers said lease deals totaled nearly 1.3 million square feet of space, while Newmark reported nearly 1.5 million square feet of space leased for the year.

Comparing leasing volume in 2014 with the county market”™s historical performance, Glenn Walsh, executive managing director at Newmark Grubb Knight Frank, recently said new leases and renewals in a typical year total 2.5 million square feet in Westchester.

Both CBRE and Newmark said the county office market for the fourth consecutive year ended with negative net absorption ”“ that is, more space was added to the market than what was newly occupied by tenants. CBRE reported nearly 74,000 square feet of negative net absorption for the year. On the positive side, CBRE researchers noted that was an improvement from the approximately 365,000 square feet of office space added to the market in 2013.

CBRE said the county”™s west submarket, which includes the Route 119 office corridor in Greenburgh and Tarrytown, saw its office availability rate ”“ a measure of both vacant and occupied space marketed for leasing ”“ drop to 16.6 percent in 2014, a 2 percent change from 2013. Leasing activity there was up 157 percent from the previous year, and the submarket ended 2014 with 45,200 square feet of positive net absorption, according to CBRE.

Newmark noted the west submarket racked up one of the largest deals in the county when Prestige Brands renewed its lease at 660 White Plains Road in Tarrytown and expanded to approximately 42,600 square feet of space.

Newmark reported a significantly higher total of 126,352 square feet of negative net absorption in the county in 2014. Leasing volume in the fourth quarter, though, outpaced the amount of space added to the market during the same period, leaving the county with 101,507 square feet of positive net absorption over the final three months of 2014, the brokerage reported.

Newmark researchers said the 27 percent decline in leasing activity for the year was largely due to a 70 percent decline from 2013 in deals for office space of 25,001 square feet to 100,000 square feet. Small deals for less than 5,000 square feet of space dropped 8 percent from 2013.

Brokers and landlords saw deals for offices ranging from 10,001 square feet to 25,000 square feet increase nearly 27 percent in 2014 from the previous year, according to Newmark.

In a sluggish market dominated in recent years by lease renewals, new lease deals with incoming tenants dropped 32 percent in 2014, Newmark reported.

The county”™s finance and insurance sector accounted for nearly 40 percent of total leasing last year, compared with 17 percent in 2013, according to Newmark. MasterCard Inc. completed the largest deal of the year when it renewed its lease at 100 Manhattanville Road in Purchase and expanded to 121,000 square feet of space there. In another top deal in 2014, MBIA Inc. vacated its Armonk headquarters to lease 85,000 square feet of space at 1 and 2 Manhattanville Road in The Centre at Purchase office park.

Newmark researchers said leasing in the technology, health care and manufacturing sectors in 2014 fell significantly from the previous year”™s activity. Medical leasing decreased from about 300,00o square feet of office space in 2013 to roughly 140,000 square feet last year, according to Newmark.

Newmark said capital markets activity was “strong” in Westchester in 2014, with 2.1 million square feet of property sold for more than $250 million. “These figures far exceeded total sales volume in the six years before the start of the recession, indicating that favorable investment conditions still persist in fourth-quarter 2014.”

In one of the year”™s largest capital markets deals, Onyx Equities LLC, a New Jersey-based company, in December paid $56.6 million for 1111 and 1129 Westchester Ave., a 335,000-square-foot, two-building office complex on the Platinum Mile in White Plains.

PepsiCo Inc. has its temporary headquarters at 1111 Westchester while a major renovations project continues at its Anderson Hill Road headquarters in Purchase. The building was vacated about three years ago when Starwood Hotels & Resorts Worldwide Inc. relocated its headquarters and about 800 employees to Harbor Point in Stamford.