Positivity was the keyword at the CBIA”™s “Connecticut Economic Update” event on April 30, though a Federal Reserve executive warned, “We still have a long way to go” and the head of Pitney Bowes said the state still needs to get its financial ship in order.

CBIA President and CEO Chris DiPentima opened the proceedings with, “There is no doubt that this is a really exciting time,” with about two-thirds of adults having received at least one dose of a Covid vaccine ”” about 50% have been fully vaccinated; roughly 60% of the jobs lost during the pandemic now recovered; 7% GDP growth in the state during the fourth quarter of 2020, which he said was the fourth highest growth during that period; and an influx of some 17,000 people and the creation of over 40,000 jobs over the past year.

Also of note are the over $3 billion rainy day fund and the projected $800 million surplus by the end of this year, he said. And with the scheduled lifting of all Covid-related restrictions (except for indoor mask-wearing) on May 19, “We”™ll be the first state in the Northeast to fully reopen,” DiPentima said. “How great is that?”

The CBIA chief further noted that the state will likely make a nine-figure payment on its pension liabilities for the second consecutive year, and that its workforce development initiatives and reformation of its unemployment compensation system all prove that “Momentum is clearly on our side.”

“What is the biggest threat to our recovery? Ourselves,” he continued. Imperatives include continuing vaccinations, safety measures and wise spending of the billions of dollars of federal aid that is coming to the state.

DiPentima also reiterated opposition to the “package of costly new workforce mandates being pushed by the Labor Committee” ”” a reference to bills under consideration that were the subject of a letter sent to the General Assembly earlier this month by the CBIA and 43 other employer organizations.

DiPentima also reiterated opposition to the “package of costly new workforce mandates being pushed by the Labor Committee” ”” a reference to bills under consideration that were the subject of a letter sent to the General Assembly earlier this month by the CBIA and 43 other employer organizations.

Andrew Haughwout, senior vice president and policy leader at the Federal Reserve Bank of New York ”” whose second district includes New York state, Fairfield County, northern New Jersey and Puerto Rico ”” repeatedly expressed pleasant surprise at how well the region and the country as a whole have rebounded from the economic slump caused by the pandemic.

He warned, however, that there are still plenty of potential pitfalls remaining ”” including the specter of what could happen should there be a widespread end to the loan, rent and other forbearances that have been put in place to help during the Covid era.

Nevertheless, he presented plenty of reasons for cheer. U.S. GDP, which plunged by almost 10% during the second quarter of 2020, grew at an annualized rate of 6.4% in the first three months of the year, according to data released by the Commerce Department. Most economists had predicted growth of 4.3%.

Further, Haughwout noted that Real GDP stood at $19.1 trillion in the first quarter, close to the $19.3 trillion reported during the pre-Covid fourth quarter of 2019.

He also noted that the Fed is now predicting Real GDP for 2021 to grow by 6.5%, up from the 4.2% it forecast in December.

Haughwout said good news is also being seen in unemployment. The national unemployment rate, which skyrocketed to 14.8% in April of last year, now stands at about 6%. He noted that while it took eight years for the country to recover jobs lost during the Great Recession, it has taken only 18 to 24 months to do the same post-Covid. The Fed is expecting a 4.5% unemployment rate by the end of this year.

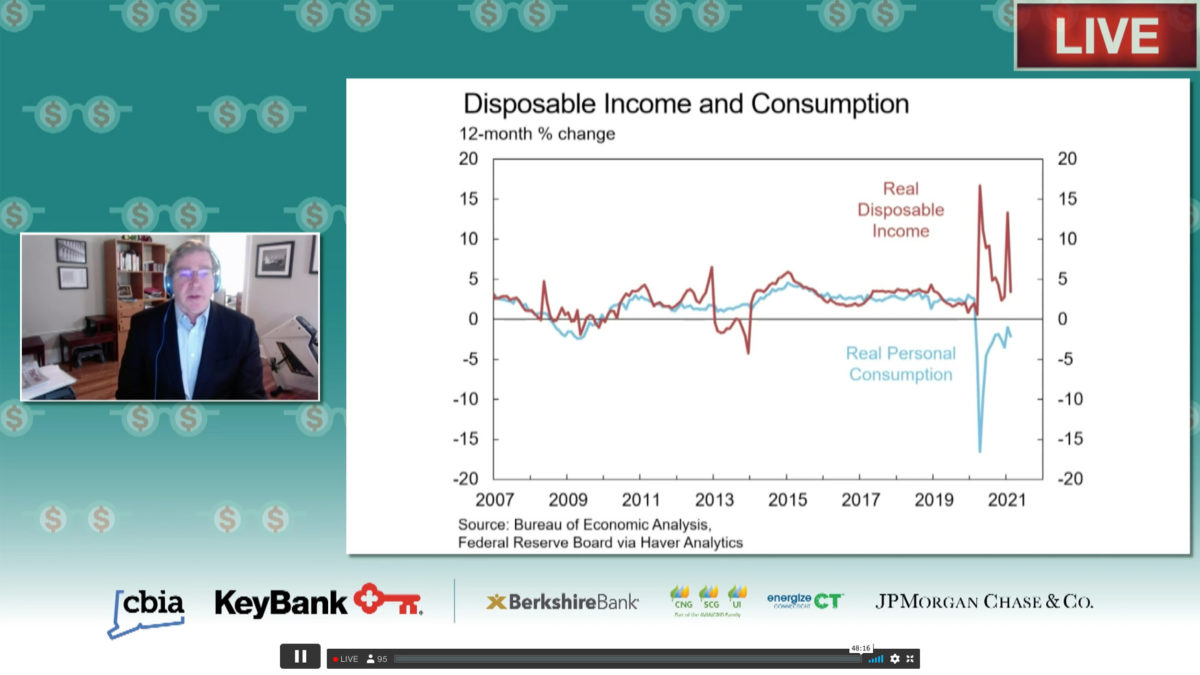

Real disposable income and real personal consumption spiked in nearly perfect opposition to each other during the worst of the pandemic, he said, as “People actually had money but they couldn”™t spend it” due to store closings and other Covid concerns ”” a highly unusual development during such a severe economic downturn.

Haughwout also noted that government spending, which was about 21% of the nation”™s GDP before the pandemic, now stands at over 33%, largely thanks to the multiple trillion-dollar-plus relief bills being passed by Congress and signed into law. Earlier this month it was reported that the country”™s budget deficit grew to a record $1.7 trillion in the first half of this fiscal year.

On a year-over-year basis, as of March private sector jobs have increased only in Idaho and Utah; Connecticut and New York have, like many other states, are still down 5% to 10%.

The Nutmeg State”™s state and local government employment, which was down by 8% before the pandemic, has continued to swoon; it currently is down by 15% from December 2007.

As for the residents moving into Connecticut, and a slow uptick in house prices ”” still below both New York and the U.S. as a whole ”” Haughwout said that they could represent “some silver linings” for Connecticut, but added that questions remain over whether those residents have moved here permanently.

Pitney chief: ”˜Stay flexible”™

DiPentima interviewed Pitney Bowes President and CEO Marc Lautenbach about not just the Stamford company”™s challenges pre- and post-pandemic, but also about the current and future state of Connecticut”™s business economy.

Noting that Pitney was declared an essential business by the Lamont administration last spring, Lautenbach said that once his firm had initial issues such as employee safety and how the day-to-day would change in place, “the orientation changed to coming out of this terrible, terrible period of time a stronger company.”

Pitney turned 100 last year, Lautenbach said, pointing out the “certain symmetry” involved: The company essentially began at the end of the 1918-1920 Spanish flu pandemic and marked its anniversary in the midst of another.

“Months of dislocation are always opportunities,” he said. To that end, Pitney shored up its corporate citizenship efforts by making what he called “a small contribution” to Stamford Hospital when it was running short of PPE.

In addition, when last summer”™s series of riots broke out around the country, Pitney organized a group of companies, including Xerox and Synchrony, to provide support for a number of organizations devoted to making changes for those with disadvantaged backgrounds; those included the Fairfield County Community Foundation.

Lautenbach said the Stamford company has long believed that in order to successfully enjoy a long future, they must understand why their investors, customers and employees are drawn to them, as well as why a given populace “allows you the license to operate in their various communities.

“You have to earn and re-earn their business,” he said. Such efforts, he added, create long-term value for shareholders and, “It”™s just the right thing to do.”

Shortly after Lautenbach was named head of the company in 2012, he said, a decision needed to be made as to whether it would remain in Stamford. “The war for companies to domicile themselves in particular states, and even countries, is a pretty intense war,” he said, saying that New York, Ohio and Florida had all made overtures to Pitney.

Ultimately, he said, once the economics of one place versus another are assessed, it comes down to talent, where Connecticut and Stamford proved themselves. “The talent dynamic was the one that weighed most heavily” in the decision to remain here, he said.

The company currently expects to record its fifth straight year of profit, Lautenbach said, having successfully pivoted into e-commerce logistics and shipping, which he said now makes up over 50% of its revenues. He noted that the percentage of total retail purchases made over the internet was 17% before the pandemic, with that number rising to 27% last year.

Challenges to Connecticut”™s economy remain much the same, even with the mostly buoyant outlook most observers have, Lautenbach said. He cited the state”™s ongoing problems with pension debt ”” “I give the current governor credit for trying to step into it” ”” and that the administration, General Assembly, and business at large all had a role to play.

“Getting involved and trying to ensure the state has the right set of economic policies going forward is important,” Lautenbach said, pointing out the large number of businesses ”” including Oracle, Palantir and Hewlett-Packard Enterprise ”” that have left California over the past few years “because of fiscal policy,” among other factors.

“State government and local government make a big difference,” he added.

As for the future of working at home, in an office, or both, Lautenbach said: “It”™s a good time to open our imaginations. Those companies and those states that are most facile take advantage of these opportunities. My advice is to stay flexible.”