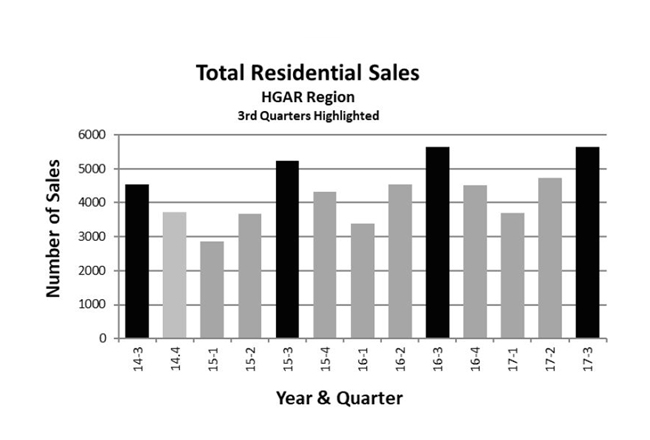

Real estate sales in the Lower Hudson Valley saw a slight slowdown during the third quarter, according to market analysts at the Hudson Gateway Association of Realtors.

Real estate sales in the Lower Hudson Valley saw a slight slowdown during the third quarter, according to market analysts at the Hudson Gateway Association of Realtors.

Third-quarter property sales were down less than 0.5 percent year over year across the region, with 5,646 residential sales of single-family houses, condominiums, cooperatives and two- to four-family buildings in Westchester, Putnam, Rockland and Orange counties.

In Westchester, sales fell 0.6 percent compared with the same period last year, following a trend seen in both Rockland and Putnam counties, where sales fell 5.2 percent and 8.2 percent, respectively. The only exception was Orange County, where sales increased by 7.9 percent year over year.

Market analysts cited a lack of inventory as the primary driver of the “spotty” sales figures. End-of-quarter inventory was down 8.6 percent in Westchester compared with the same period last year, while Orange and Putnam counties saw a 16 percent decrease in inventory year over year. Inventory fell 15 percent in Rockland County compared with the third quarter of 2016.

“Inventory has been consistently lower each quarter in each of the last four years, which could indicate a headwind for healthy sales numbers going forward,” analysts noted. “It is difficult to ascertain at what point rising prices, due to lack of supply, will begin to affect sales.”

Homes priced under $500,000 in Westchester saw a 25.1 percent drop in the number of active listings year over year, falling from 686 homes for sale in 2016 to 514 homes in 2017. Similarly, the number of pending sales in that price range dropped 18.6 percent.

Despite a year-over-year decline, housing sales still remain “unusually heavy” across the region, according to The Elliman Report, a market analysis from New York-based Douglas Elliman Real Estate. The report noted that housing sales across Westchester, Dutchess and Putnam counties reached the third-highest figures seen since 1982.

“This can largely be attributed to the continued influx of buyers from the city who are seeking out greater affordability for both primary and second homes,” said Scott Durkin, Elliman”™s chief operating officer. “The Hudson Valley, in particular, is proving to be an eventual competitor to the affordable second-home market.”

Year-to-date sales figures also continue to trend “significantly higher” than the previous year for most of the region, Hudson Gateway analysts said. Factors including attractive mortgage rates, high employment and a healthy economy “should be an indication that the market will remain vibrant,” the report stated.

Westchester, the most populous county and the county with the highest number of sales, recorded a median sale price of $680,000 for a single-family home, up 1.8 percent from $668,000 for the same period last year, according to Hudson Gateway.

Orange County saw the largest percentage increase in sales price at 4.3 percent from $245,000 to $255,000 year-over-year.

In Rockland County, the median sale price rose 3.7 percent to $445,000 for the third quarter. The median sales price in Putnam County of $340,000 was unchanged compared with the same period last year.

In Westchester, the luxury market continues to show signs of weakness during the quarter, with a 13.5 percent drop in the number of sales, according to Houlihan Lawrence. However, the segment”™s median sale price increased 5 percent to $2.62 million.

“The market continues to remain soft at the top on a price basis as the luxury market saw prices slip after edging higher over the past year,” said Jonathan Miller, author of the Elliman Report.

Across the state line in Greenwich, though, the luxury market is seeing a resurgence. Houlihan Lawrence analysts noted that homes priced at $3 million or higher saw a 10.5 percent increase in the number of sales year over year, and a new median sales price of $4,427,500, up 6.7 percent from last year.

In Darien, the number of luxury sales shot up 123.1 percent, with 29 homes sold this quarter compared with 13 in the same quarter last year, though the median price dipped 8 percent.

“Market sensitive initial pricing continues to be a key driver in reducing days on market and achieving the highest possible selling price in today”™s market,” said David Haffenreffer, branch manager of Houlihan Lawrence”™s Greenwich office. “Buyers today, in many cases, won’t even visit a home that they determine is mispriced when they see it online. This puts pressure on sellers to resist the temptation to fish for an unrealistic price when coming to market.”