The founder of Brother Jimmy’s BBQ chain has filed for bankruptcy protection, citing numerous financial setbacks over the past five years.

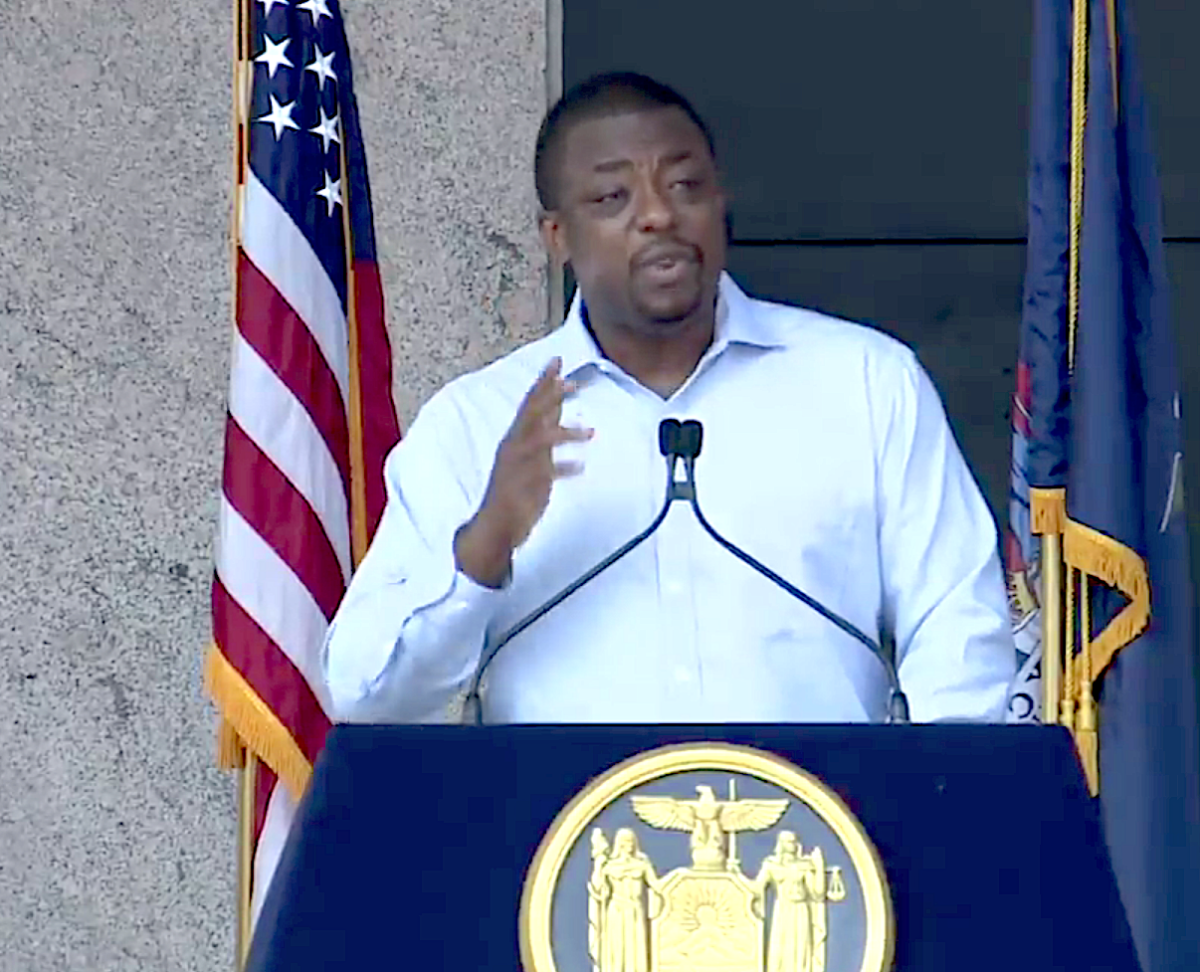

James Goldman, of Pleasant Valley, Dutchess County, declared $969,500 in assets and nearly $3.6 million in liabilities, in an affidavit filed April 7 in U.S. Bankruptcy Court, Poughkeepsie.

A “landlord’s hardline tactics,” he states, “coupled with continuing losses solidified my decision to file for Chapter 11 as a small business debtor.”

Goldman has been in the restaurant business since at least 1988 when he opened a Carolina BBQ in New York City. He opened his first Brother Jimmy’s in 1989.

He has cultivated a roadhouse and sports bar brand featuring Southern comfort food and slogans such as “Put some South in yo’ mouth.”

Goldman has owned, operated and franchised Brother Jimmy’s joints and other restaurants in Manhattan, Long Island, White Plains, Stamford, New Jersey, Washington, D.C., Maryland, Chicago, West Palm Beach, Florida, Puerto Rico, and St. Maarten in the Caribbean.

“While initially the chain was extremely popular and highly successful,” he says in the affidavit, “over the years it has experienced financial hardships. At various times I have had to dilute my interests in order to raise additional capital needed to keep the chain afloat.”

In 2017, for instance, Hurricane Irma destroyed two of his restaurants in St. Maarten.

He says the Covid-19 pandemic has been devastating: restrictions on capacity and in-person dining, vaccine requirements, severe labor shortages and supply problems “that have created a toxic environment for my restaurants.”

Before the pandemic, five Brother Jimmy’s operated in Connecticut, Florida and Maryland and five more were to open. Now, only the Maryland franchise is operating.

Even before the pandemic, his finances were becoming untenable. A Brother Jimmy’s across the street from Pennsylvania Station and Madison Square Garden “suffered continuing losses due primarily to the downturn in the economy and the now habitual, awful performance of the New York Rangers and Knicks.”

The business stopped paying rent and  abandoned the premises in May 2019, according to a 2019 lawsuit by 416 8th Owner LLC, the landlord.

Goldman had guaranteed the lease, and last year a Manhattan Supreme Court judge awarded a $1.8 million judgment against him and his corporate entities.

Goldman says he tried to settle the debt but the landlord “undertook aggressive collection efforts — moving to seize his bank accounts, vehicles and even a sentimental, souvenir collection of decorative masks from New Guinea and New Orleans — “which seriously compromised my ability to focus on my business.”

He lists seven pending lawsuits, including the 416 8th Owner LLC landlord case that is on appeal.

His assets include $800,000 for his half of the Pleasant Valley Home; a $90,000 Winnebago RV; $54,000 in furnishings, jewelry and collections; and a potential $20,000 tax refund.

Liabilities include $2.1 million in unsecured claims “subject to dispute,” $1 million in child and domestic support; and $491,000 for two home mortgages.

Goldman is represented by White Plains bankruptcy attorney Anne Penachio.