With Westchester County”™s commercial office market showing what one brokerage called “lackluster” fourth-quarter leasing activity, tenants signing deals near year”™s end received larger concessions on rents and space improvements from competing landlords.

And market analysts at Jones Lang LaSalle Americas Inc. said the widely hailed repurposing of the county”™s office market and rising dominance of health care and biotech companies will likely drive the Westchester economy”™s further growth at the expense of other industries in a market that needs industry diversification.

Jones Lang LaSalle”™s regional office in Stamford, Conn., reported an overall fourth-quarter vacancy rate of 20.2 percent in 2013, up from 18.5 percent one year earlier. The county”™s vacancy rate for Class A buildings rose to 22.4 percent in the quarter, up from 20 percent at the close of 2012.

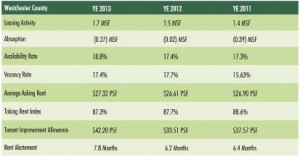

However, market researchers at CBRE Inc. reported a lower office vacancy rate of 17.4 percent at the end of 2013, a slight decline from the county”™s 17.7 percent vacancy rate at the end of 2012.

Despite weak demand, both Jones Lang LaSalle and CBRE reported modest increases in landlords”™ average asking rental rates at the end of 2013. JLL said overall office asking rents rose to $26.53 per square foot in the fourth quarter, up from $25.74 one year earlier. CBRE said the fourth-quarter overall average asking rent rose to $27.32 per square foot from $26.61 at the close of 2012.

Jones Lang LaSalle put the Class A average asking rent for the quarter at $27.30 per square foot, up from $26.94 at the end of 2012.

CBRE reported taking rents in Westchester in 2013 ”“ a tenant”™s initial base rent excluding all landlord concessions and tenant electric costs ”“ as 87.3 percent of asking rents on a yearly rolling average. Taking rents averaged 87.7 percent of asking rents in 2012 and 88.6 percent in 2011, according to CBRE researchers.

Jones Lang LaSalle said the higher rents sought by Westchester building owners last year were “more a function of higher-quality space coming online than fierce competition for availability.”

A veteran broker in the Westchester market, Christopher O”™Callaghan, managing director at Jones Lang LaSalle”™s Connecticut office, in a statement noted the “continued deleveraging of office product throughout the county.” While reducing debt on their properties, “Landlords are continuing to invest in their buildings”™ infrastructure and amenities to make them competitive in today”™s market,” he said.

Landlords are also competing for lease deals by offering more generous rent abatements and tenant improvement allowances, CBRE researchers found.

Looking at new leases for more than 5,000 square feet of space completed in the recent fourth quarter, CBRE said the average landlord allowance for tenant build-outs and renovations amounted to $42.20 per square foot. That is a 26 percent increase from the average allowance of $33.51 per square foot at the end of 2012. The 2013 year-end average was 12 percent above the county market average in the fourth quarter of 2011, according to CBRE.

Looking at that same block of fourth-quarter leases, CBRE said rent abatements ”“ the time between the start of a lease and the start of a tenant”™s rent payments ”“ averaged 7.8 months at the end of 2013, up from 6.2 months in 2012 and 6.4 months at the end of 2011.

Jones Lang LaSalle said fourth-quarter leasing totaled nearly 300,000 square feet, slightly lower than activity in the third quarter. Office leasing for the year totaled 1.9 million square feet, down from 2.04 million square feet of space leased in 2012, the real estate services company reported.

CBRE reported an uptick in Westchester leasing activity last year, with deals inked for 1.7 million square feet of office space. Leasing activity totaled 1.5 million square feet in 2012 and 1.4 million square feet in 2011.

But leasing volume failed to keep pace with the amount of office space in the county that went on the market in 2013, led by MBIA Inc.”™s marketing for sale or lease of its approximately 287,000-square-foot headquarters in Armonk. The year ended with more than 365,000 square feet of office space available than at the start of 2013, raising the availability rate in the county to 18.75 percent from 17.36 percent at the close of 2012, according to CBRE.

One of the largest lease deals of 2013 closed in the fourth quarter, when Jackson Lewis P.C., the fast-growing labor and employment law firm, newly leased 44,713 square feet of space at 44 S. Broadway, the Westchester One office tower in White Plains. The firm is relocating a short distance from its former downtown headquarters at 1 N. Broadway.

Jones Lang LaSalle reported that Westchester One”™s owner, Beacon Capital Partners L.L.C., also notched the second largest deal in the fourth quarter when the state Department of Taxation and Finance took 40,331 square feet in the 21-story, 852,000-square-foot tower.

More than half of the deals signed in the fourth quarter were new leases or relocations and subleasing was nearly absent, Jones Lang LaSalle noted. As in previous quarters, renewals represented about one-fourth of transactions.

Near the close of 2013, 32 tenants were seeking space in Westchester and required a total of nearly 800,000 square feet, according to Jones Lang LaSalle. Realtors reported “lackluster” touring activity by tenant prospects and no new large space requirements looming in 2014.

Jones Lang LaSalle said manufacturing and distribution-related companies dominate space requirements in Westchester, with five tenants in the market for nearly 200,000 square feet of space.

“A positive outlook for Westchester County continues to hinge on job recovery and industry diversification ”“ a common thread among many secondary markets,” Jones Lang LaSalle analysts said in the firm”™s quarterly Office Insight report.

While that recovery and growth in industries has begun with the effort by public and private partners to develop Westchester and the lower Hudson Valley region as a biotech industry hub, analysts said real growth “can come only after the formation of much stronger incentive programs and a more business-friendly environment.”

Jobs-creating development projects that will add medical and health services offices and biotechnology research and development space “should help to focus efforts and gear the local economy for further growth, but likely at the expense of other industries,” analysts said.