The Tarrytown Planning Board gave unanimous approval last night to two resolutions needed for a proposed Alzheimer’s/dementia care facility at 153 White Plains Road.

An environmental findings resolution determined that requirements under the State Environmental Quality Review Act have successfully been met. The second resolution recommended that the village”™s board of trustees create a floating/overlay zone allowing the type of facility that has been proposed. The planning board will continue to review the proposed site plan.

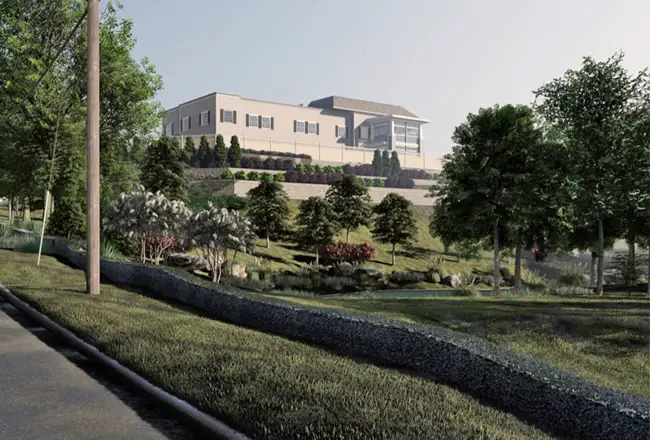

The property is owned by Leon Silverman”™s Crescent Associates LLC. Artis Senior Living LLC wants to operate a 35,952-square-foot facility that would have 64 beds and provide dining, personalized assistance, oversight and support services. The company operates Artis Senior Living of Briarcliff Manor at 553 N. State Road.

On Nov. 14, 2017, an application was made to the Tarrytown Board of Trustees to create the floating/overlay zone, which also could be applied to parcels within 350 feet of White Plains Road. The board referred the petition to create the floating/overlay zone and the project”™s site plan to the planning board.

The parcel at 153 White Plains Road covers 4.64 acres. In July 2009, a 12.672-acre parcel had been subdivided into two lots identified as 153 and 155 White Plains Road. The subdivision was adjusted in 2014. The land at 155 White Plains Road is developed with two office buildings. The 153 White Plains Road parcel remains undeveloped.

A traffic and parking study by Kimley-Horn of NY said there would be 45 parking spaces. It said that the proposed overlay zone would require a parking ratio of 0.5 spaces per patient bed, resulting in 32 spaces.

“Sufficient on-site parking will be provided to accommodate the project”™s parking needs,” the study said. To access the site, vehicles would travel along an access easement through the parking area at 155 White Plains Road, Kimley-Horn said. It also noted that sidewalks and a bicycle rack would be provided on the site. It said the project would add 14 to 17 peak hour trips to the surrounding roadways on a weekday.

There had been previous interest in the location and environmental studies had been done in the early 2000s. The planning board held its first public hearing on the Artis proposal on May 30, 2018, and declared its intent to be the lead agency for environmental review. It told Artis to prepare a Supplemental Draft Environmental Impact Statement (SDEIS).

The applicant prepared the document but the board found additional issues needed to be addressed and directed that a revised SDEIS be prepared. On May 29, 2019, the revised SDEIS was determined to be adequately complete for circulation to solicit public comment and comments from involved agencies. Two public hearings were held and Artis was told to prepare a Final Supplemental Environmental Impact Statement (FSEIS).

In the FSEIS, Artis responded to the comments that had been made about subjects such as water and sewer adequacy, traffic impacts, backup power and the use of green technology. It affirmed that the proposed project would add less to the area in the way of traffic than the proposal for a 60,000-square-foot office building, which previously had been approved for the site.

During a hearing on the FSEIS, Silverman said he had owned the property for close to 15 years. He said that the Artis plan was better than his original plan for a three-story office building. “At that time we had a medical group that was going to take a third of the building,” he said. “Now this is a two-story building instead of a three-story building.” Silverman said the tenants at the Artis facility would put no pressure on the local school system “because it”™s senior citizens. They don”™t drive, so there”™s very little traffic coming in, just the employees and maybe visitors.”

In discussing the financial impact on the proposal, the FSEIS said that the property currently generates $24,000 total tax as a vacant parcel. A little over $15,000 goes to the school system.

“When this facility is built, it will generate a little more than $400,000 per year total taxes to all jurisdictions. So the comparison is now $24,000, when it”™s built $400,000. Just about exactly, as it happens, nine times as much taxes when it is built than it now generates as an empty parcel,” the FSEIS said.