A group of small-business leaders and organizations is calling on state lawmakers to use federal Covid-19 relief funds to cover what they term “an unemployment debt crisis that threatens the state”™s economic recovery.”

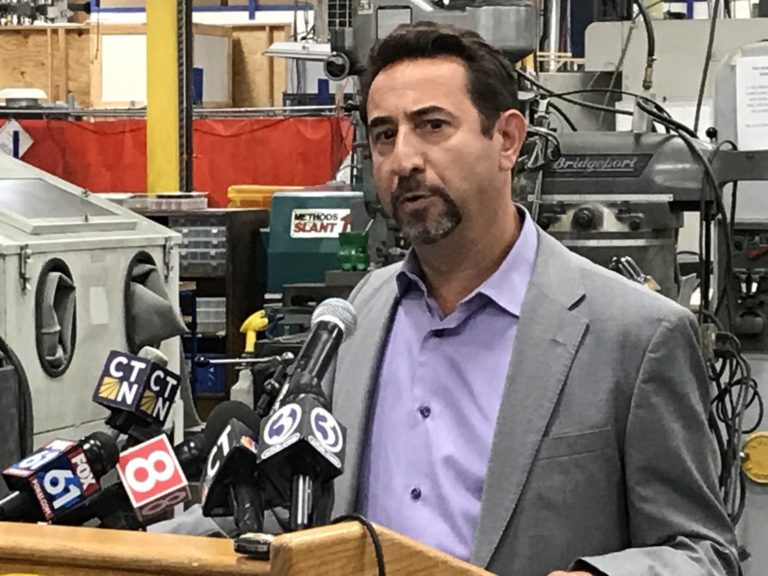

At a press conference April 7, the group warned the Lamont administration and the legislature that the state could face a repeat of the last recession if steps aren”™t immediately taken to address the situation.

As things stand, employers are solely responsible for repaying the $700 million that the state borrowed from the federal government to pay pandemic-related unemployment compensation benefits. With interest, they said, that sum could rise to $1 billion.

The groups include the CBIA, the National Federation of Independent Business Connecticut (NFIB), the Connecticut Restaurant Association, the Connecticut Food Association, and the Greater New Haven Chamber of Commerce.

“We cannot afford what happened after the 2008-2010 recession,” CBIA President and CEO Chris DiPentima said, “with Connecticut employers paying four times the unemployment taxes of those in neighboring states, a financial strain that prolonged the economic downturn and hurt job recovery and economic growth.”

Joining the organizations at the press conference were small-business leaders Kathy Saint, president and CEO of Schwerdtle Inc. in Bridgeport; Wendy Traub, CFO of Torrington-based Hemlock Directional Boring; and Scott Smith, partner at Hartford”™s Max Restaurant Group.

Also in attendance were House Republican Leader Vincent Candelora (R-North Branford) and state Rep. Kerry Wood (D-Rocky Hill), who co-chairs the legislature”™s Insurance and Real Estate Committee and the Moderate Democratic Blue Dog Caucus.

DiPentima said that 24 states are using federal coronavirus relief funds to either help meet unemployment benefit obligations or pay down the principal on their federal loans.

“This is a looming crisis and absent federal relief dollars, businesses in Connecticut will be paying down this debt for many years to come ”“ threatening jobs recovery and the state”™s economic recovery,” he said.

Connecticut has recovered 58% of the 292,400 jobs lost last March and April to Covid-related shutdowns and restrictions. The state”™s unemployment rate is 8.5%, New England’s highest and well above the U.S. rate of 6.2%.

Andrew Markowski, NFIB state director in Connecticut, warned that another round of tax hikes and special assessments will have a devastating impact on the state”™s struggling small businesses.

“The Covid-19 pandemic hit small businesses harder than it did large ones, and while a recovery here in Connecticut has slowly begun, it is uneven and fragile,” Markowski said.

“Without a significant infusion of money, small-business owners will be faced with devastating tax hikes, special assessments and surcharges like they were post-2009,” he said. “By committing federal money to our state”™s unemployment trust fund, lawmakers can avoid placing higher costs on job creators at a time when they can least afford it.”

Connecticut Restaurant Association Executive Director Scott Dolch said Connecticut was one of the last states to pay off its federal loans after the 2008-10 recession, with employers burdened by six years of higher taxes and special assessments.

“Connecticut”™s restaurant industry was among the earliest and most directly impacted sectors of our economy when Covid hit, and what restaurants need now more than ever is stability and predictability,” he said. “Unfortunately the looming problem with our state”™s unemployment trust fund is a crisis that will deliver exactly the opposite.

“Our industry is made up almost entirely of small businesses, and their owners remember what happened after the Great Recession, when they had to foot the bill for borrowing related to this fund,” Dolch continued. “That can”™t happen again ”“ Connecticut needs to address this problem by using available federal dollars, not asking any more of struggling businesses like ours.”

The CARES Act, signed into law in March 2020, provided an estimated $150 billion in direct aid to state and local governments. In addition, Connecticut is slated to receive approximately $2.65 billion following passage of the American Rescue Plan Act.