Shelton-headquartered Northeast Private Client Group represents real estate investors and property owners in midmarket multifamily, mixed-use and retail real estate between $1 million and $50 million. Since it opened in 2010, the company has tallied more than 700 transactions over $2 billion in value within submarkets around the Northeast and Southeast regions.

Shelton-headquartered Northeast Private Client Group represents real estate investors and property owners in midmarket multifamily, mixed-use and retail real estate between $1 million and $50 million. Since it opened in 2010, the company has tallied more than 700 transactions over $2 billion in value within submarkets around the Northeast and Southeast regions.

In this edition of Suite Talk, Business Journal Senior Enterprise Editor Phil Hall speaks with Edward Jordan, the company”™s CEO, on his latest endeavors and the state of the commercial real estate market.

Last month, your company announced it was updating its brand messaging with changes to its logo, colors, fonts and patterns. Why did you decide to refresh the brand messaging at this time?

“When we started this business, my ambitions were fueled in large part by generating wealth for me and my family, growing a business and building something of my own. I teamed up with some very talented people ”” some of whom are still with me ”” and we”™ve spent the last decade building a business that we”™re proud of, with a very collaborative culture that we take pride in.

“We are very relationship based, not so much focused on being intermediaries in a transaction but instead on having long-term relationships with people who choose to invest in income-producing real estate. And that approach, in large part, has fueled our growth.

“That said, I wasn”™t entirely comfortable with our branding. Over the years, I’ve seen that the ability to generate wealth and real estate is not an end to itself ”” families use that prosperity, that material wealth to pursue things that are important to them. I’ve met families that have put their children through higher education because of an apartment building.

“I wanted to communicate that in a more open way, in a more accessible way, to people that the end result is not to make money with us ”” the end result is to achieve some sense of opportunity of what”™s right for them and their family. And I”™ve lived that evolution and thinking my own family and I have seen it in the lives of my clients. We want to kind of reposition the brand around that idea.”

Where is your business focused today?

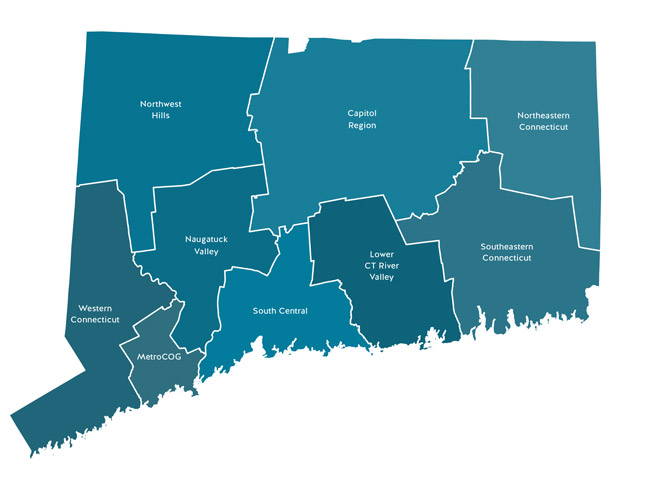

“We do business in Connecticut and we”™re also very active in Massachusetts and Rhode Island, and increasingly in the Southeast where there’s arguably more favorable policies in the business climate and, demographically, more growth in demand for multifamily and other kinds of property types.”

What is the greatest concern for your investors today?

“I think the great fear that I see across all product types and all geographic areas is the fear that the mechanism known as the 1031 Exchange will be taken away. There”™s a provision in the tax code that is referred to as 1031, which allows real estate investors, if they meet certain criteria, to sell a building and use the proceeds to purchase another building. And if they execute that transaction, according to the government’s guidelines, they can defer any tax on the gain that they’ve made from the sale of the first building because they’re reinvesting it in another piece of property.

“Most of our investors are people who invest professionally ”” they sell to buy, and then they continue to start with an amount of equity and can buy a property and then sell it and buy another one and sell it and buy another one. And if they comply with the IRS regulations, their tax on all that gain is being deferred until the very last sale when they don’t buy something else after it or until they die, in which case their heirs take the property through the estate and the tax basis has stepped up to current market value.

“Without getting too technical, this is the mechanism that, in large part, fuels our industry. And if investors were required to pay tax on the gain every time they sold the building, it would have a very detrimental effect to the overall real estate market.

“I think it”™s being floated as a possible way for the government to capture, in the short term, revenue that they might otherwise not see until the longer term. But that”™s the big one that”™s on everyone”™s agenda right now.

Your company is also involved in retail real estate. What is that sector like today?

“Retail only accounts for about 15% to 20% of our business, at best, and that would be multitenant retail properties, multitenant shopping centers or strip malls.

“Retail is taking a hit on many fronts ”” it’s taken kind of a generational hit based on the move from physical shopping to online shopping. But then, obviously, the pandemic has also played havoc with store operations, whether it be mom and pop stores or chain stores.

“When an investor values a property, they look at their projections for occupancy and rate and rent growth and their ability to increase rents when they renew leases. And no one’s really stretching too far these days on their forecasts with regard to retail.”

And how is the multifamily sector holding up today?

“Multifamily is holding up better than any other product type. There”™s been some shift out of urban apartments into suburban apartments with the pandemic. But places like Westchester and Connecticut or Metro West of Boston or Hartford and Springfield are the net beneficiaries of that migration, whereas in Manhattan south of 96th Street or downtown Boston, rents are a little soft right now.”

What do you have on your corporate agenda for the remainder of this year and into 2022?

“We”™re pushing forward with a pretty ambitious growth plan. We just wrapped up our first 10 years and we”™ve accomplished much of what we set out to accomplish: We built a platform that supports our clients.

“So now, we”™re hiring. We”™ve brought on six or eight people since December, in the middle of this pandemic, and we found that it”™s been a great time to bring on new people and take the time to train them properly, team them up with senior mentors and empower them. Our model is really about empowering the people who come to work with us.

“As a dad, it’s kind of encouraging to have this generation of 20- and 30-year-olds who I’ve been able to mentor, not just in real estate but in sharing my values and the values of the company and the nature of what we do with the money we make.

“Our firm has been very committed to service and we work with partners like the Bridgeport Rescue Mission and partners overseas. I spent three months with my family doing mission work in Africa from January through March of this year. We try to instill throughout the team that we”™re always giving, especially in the communities that we work in because we work in communities of renters that are not always the most affluent neighborhoods. So, it”™s a lot of fun.”