House sales in the lower Hudson Valley during the fourth quarter continued to show strength following a slower pace seen during the prior quarter, according to market analysts at the Hudson Gateway Association of Realtors.

Fourth-quarter property sales were up 2.2 percent year-over-year across the region, with 4,536 residential sales of single-family houses, condominiums, cooperatives and two- to four-family buildings in Westchester, Putnam, Rockland and Orange counties. Fourth-quarter closings largely resulted from marketing activity and contracts that took place in the late summer and autumn months, the report noted.

Additionally, 2016 posted the region”™s best real estate sales results since 2011 with 18,145 closings, a 12.5 percent increase over 2015”™s total.

Analysts called 2016 “a good year for the real estate market,” with buyers and sellers able to work the market on a level playing field, notwithstanding the fairly low levels of inventory.

According to The Elliman Report, a market analysis from New York-based Douglas Elliman Real Estate, inventory in Westchester reached its lowest third-quarter total since 2003.

The report also noted that unemployment rates decreased through the year, equity markets set records and the Federal Reserve”™s small, incremental rate hikes appear not to be harming the mortgage lending community.

“Both employment and investment security provide confidence to prospective purchasers to act on their intentions,” the report noted.

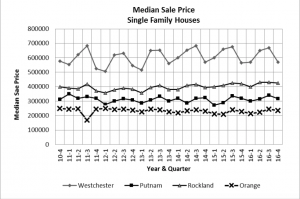

Prices throughout the region have not been pressured upward very much, analysts said. Westchester County experienced a small downward tick in its 12-month median sale price for a single-family house, with prices falling from $628,875 in 2015 to $624,000 in 2016.

“When this happens, it usually means that the high-end market was squeezed by sales inactivity and/or by price reduction,” Hudson Gateway analysts said in the report. “(Multiple Listing Service) Realtors have in fact reported difficulty in the high-end segment of the market.”

The Elliman Report echoed this sentiment, asserting that Westchester price trends slipped due to an increase in sales of smaller homes and a weaker luxury market.

The Elliman Report echoed this sentiment, asserting that Westchester price trends slipped due to an increase in sales of smaller homes and a weaker luxury market.

Westchester Real Estate Inc., a group of independently owned real estate firms, said in its fourth report that “the luxury market is still soft in many areas.”

“There are pockets of demand and strength, but unrealistic asking prices will be ignored until they find their corrected level,” the report continued.

Westchester continues to top surrounding counties and the state in home prices. The median sale price of a Westchester single-family house was $569,500 in the third quarter, according to Hudson Gateway. The third-quarter median price was $425,000 in Rockland County, $316,000 in Putnam County and $235,000 Orange County.

For the fourth quarter, sales of single-family homes were up 1.6 percent in Westchester, while sales of multifamily buildings were up 16.4 percent year-over-year. The county”™s condominium market recorded 330 fourth-quarter sales, down 7.3 percent from the same period last year.

According to Hudson Gateway, the most impressive gains in the region on both a percentage and volume basis were those posted for Orange County. There were 4,083 sales in the county, representing a 24.3 percent increase over 2015.For the fourth quarter alone, sales were up 18.8 percent year-over-year.

“For the past several years the Orange County real estate market has been powered by sales of single-family houses in a rather narrow median price range, about $225,000 to $235,000, but prices have been creeping up,” the report stated.

Orange County, along with the rest of the lower Hudson Valley, continues to face an ever-tightening inventory situation.

Westchester Real Estate noted that the market saw a “short supply of homes for sale in the most desirable locations and price ranges” during the year.

“Inventory is not yet so low as to stall the market but is low enough to create pressure for speedier decision-making by prospective buyers,” Hudson Gateway analysts said.

Orange County”™s year-end supply of listings was 2,190 units in all residential categories, down 20.8 percent from last year. Westchester posted a 21.2 percent decrease, while Putnam and Rockland saw 31.2 percent and 16.1 percent decreases in inventory respectively.

Analysts remain optimistic about the real estate market heading into 2017.

“More and more homeowners have recovered from negative-equity positions through rising home values and several more years of mortgage payments, positioning them to realize gains upon sale so they can move on with their lives,” the Westchester Real Estate report stated.

Hudson Gateway noted that a potential negative could be the new administration in Washington, D.C., tampering with tax and regulatory policies that are important to real estate, including the mortgage interest deduction.

“But that is months away, if it happens at all,” analysts added. “In the meantime, seize the day.”