TD Bank N.A. along with its parent company TD Bank U.S. Holding Company pleaded guilty Oct. 10 to federal charges of violating the Bank Secrecy Act and money laundering. TD Bank has several locations in Westchester and Fairfield.

TD Bank agreed to pay $1.8 billion in penalties to settle the Department of Justice’s charges that it failed to file accurate Currency Transaction Reports and laundered money. The parent company pleaded guilty to causing the bank to fail to have a program that complies with federal requirements and to fail to file accurate transaction reports.

Separately, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) assessed a record $1.3 billion penalty against TD Bank for violations of the Bank Secrecy Act (BSA), the primary U.S. anti-money laundering (AML) law that safeguards the financial system from illicit use.

FinCEN’s $1.3 billion settlement is the largest penalty against a depository institution in U.S. Treasury and FinCEN history. FinCEN’s action also imposes a four-year independent monitorship to oversee TD Bank’s required remediation.

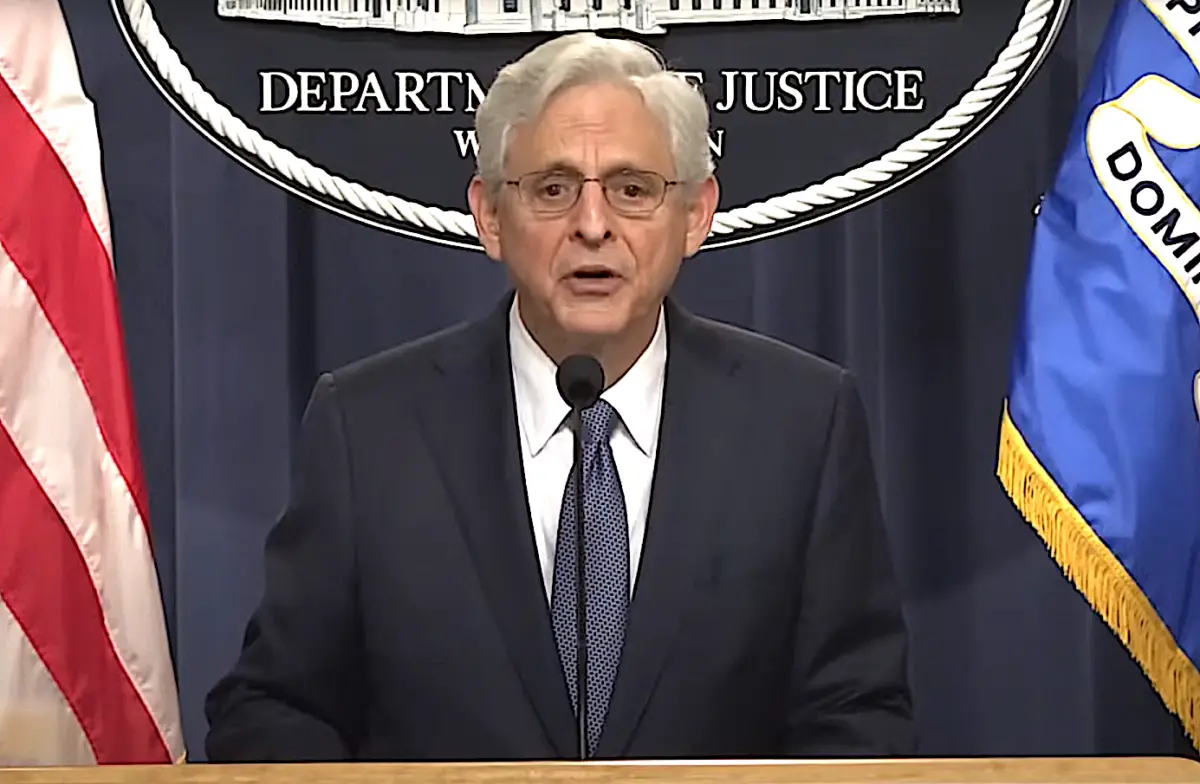

“By making its services convenient for criminals, TD Bank became one,” U.S. Attorney General Merrick B. Garland said. “TD Bank also became the largest bank in U.S. history to plead guilty to Bank Secrecy Act program failures, and the first U.S. bank in history to plead guilty to conspiracy to commit money laundering.”

Garland said that TD chose profits over compliance with the law and said that decision is now costing it in the form of the penalties. Garland added that the Justice Department’s investigation continues.

“As is the case in all corporate criminal matters, no one involved in TD Bank’s illegal conduct will be off limits. We will follow the evidence wherever it leads,” Garland said. “Federal anti-money laundering laws are designed to prevent criminals from using U.S. banks to fuel their crimes. Our laws dictate that the narcotics traffickers who flood our communities with deadly drugs cannot use American financial institutions to move their money. And our anti-money laundering laws dictate that a bank that willfully fails to protect against criminal schemes is also a criminal. That is what TD Bank was, because it failed to maintain an adequate anti-money laundering program between January 2014 and October 2023.”

In a statement, TD said it acknowledges and takes full responsibility for U.S. AML program failures. It said that “significant effort” is underway to remediate its U.S. AML program to meet obligations and is working in close cooperation with regulators and authorities and supporting efforts to bring money launderers to justice.

“We have taken full responsibility for the failures of our U.S. AML program and are making the investments, changes and enhancements required to deliver on our commitments. This is a difficult chapter in our Bank’s history. These failures took place on my watch as CEO and I apologize to all our stakeholders,” said Bharat Masrani, group president and CEO, TD Bank Group. “I want to thank our colleagues, who continue to demonstrate their dedication and who play an important role in preventing criminal activity.”

According to court documents, between January 2014 and October 2023, TD Bank had long-term, pervasive, and systemic deficiencies in its U.S. anti-money laundering (AML) policies, procedures, and controls but failed to take appropriate remedial action.

The Justice Department said that TD Bank intentionally did not automatically monitor all domestic automated clearinghouse (ACH) transactions, most check activity, and numerous other transaction types, resulting in 92% of total transaction volume going unmonitored from Jan. 1, 2018, to April 12, 2024. This amounted to approximately $18.3 trillion of transaction activity. TD Bank also added no new transaction monitoring scenarios and made no material changes to existing transaction monitoring scenarios from at least 2014 through late 2022, according to the Justice Department.

The Justice Department said that three money laundering networks collectively moved more than $670 million through TD Bank accounts between 2019 and 2023.

Between January 2018 and February 2021, one money laundering network processed more than $470 million through the bank through large cash deposits. Banks are required by federal law to report cash deposits of $10,000 or more. The Justice Department said that the operators of this scheme provided bank employees gift cards worth more than $57,000 to ensure employees would continue to process their transactions. And even though the operators of this scheme were clearly depositing cash well over $10,000 in suspicious transactions, TD Bank employees did not identify the conductor of the transaction in required reports.

In a second scheme between March 2021 and March 2023, a high-risk jewelry business moved nearly $120 million through shell accounts before TD Bank reported the activity.

In a third scheme, money laundering networks deposited funds in the U. S. and quickly withdrew those funds using ATMs in Colombia. According to the Justice Department, five TD Bank employees conspired with this network and issued dozens of ATM cards for the money launderers, ultimately conspiring in the laundering of approximately $39 million. The Justice Department has charged over two-dozen individuals across these schemes, including two bank insiders. TD Bank’s plea agreement requires continued cooperation in ongoing investigations of individuals.

The Justice Department said that TD failed to meaningfully monitor transactions involving high-risk countries; instructed people at tis branches to stop filing internal “unusual transaction” reports on certain suspicious customers; and permitted more than $5 billion in transactional activity to occur in accounts even after the bank decided to close them.