Westchester County had $188 million deposited with Signature Bank as of Friday, March 10, before the bank collapsed, the Business Journals learned.

“We have moved those assets in time to other banks that we do business with,” Westchester County Executive George Latimer said on March 13. He was discussing the banking situation that was unfolding following the collapse of New York”™s Signature Bank and California”™s Silicon Valley Bank. Latimer said the county also banks with TD Bank, Chase, Webster and others. Out of an abundance of caution, Westchester County Commissioner of Finance Karin Hablow arranged for electronic transfers to Chase and TD Bank. Additionally, the County has $122 million in Webster Bank and $100 million in TD Bank.

“We”™ve moved our assets. As we understand it, Westchester County as an entity has been protected from what these impacts are so there”™s no loss. We”™re monitoring it so we”™re alert to it and aware of it,” Latimer said. “We all have stories about what happened in the depression. In my generation, my parents told me what it was like to have a run on the bank that did not have enough reserves to meet demands.”

While many people were shaken when the Silicon Valley Bank and Signature Bank failed in rapid succession, bank failures are nothing new. According to data mined by the Business Journals from the Federal Deposit Insurance Corporation (FDIC), there were 561 bank failures from 2001 through 2023. Even though the banks that failed had total assets of approximately $319.4 billion, the U.S. economy survived and the country did not experience a repeat of the 1930s depression replete with runs on the banks when countless people and businesses were wiped out.

Lucjan Orlowski, professor of economics and founding director of the Doctor of Business Administration in Finance program at John F. Welch College of Business at Sacred Heart University in Fairfield, Connecticut, told the Business Journals, “Most of our financial institutions are financially sound and well-positioned to weather the current interest rate risk which is exacerbated by monetary tightening. I do not see a full-fledged systemic crisis in the banking sector.”

Orlowski said Silicon Valley Bank was highly specialized, taking deposits from numerous start-up companies and having exposure to losses in securities such as long-term U.S. Treasuries that paid comparatively low interest and lost value as interest rates went up while their interest payments remained fixed.

In the modern day equivalent of a run on a bank, numerous depositors withdrew an estimated $40 billion from Silicon Valley via electronic means in only about a day. Orlowski noted that Signature Bank had exposure from its involvement with cryptocurrency, as did Silvergate Capital, which had failed a few days before Signature and Silicon Valley Bank.

“I would hope the Federal Reserve would pay much more attention than it has done so far to the repercussions of the interest rate risk in the banking sector,” Orlowski said. “They have not given attention to this factor.”

Orlowski said that the Fed has not been allowing adequate time between rate hikes for those rate hikes to take full effect in reducing inflation.

“There is a lagged response of inflation to rising interest rates,” Orlowski said. “These responses are not instant.”

Orlowski welcomed the government”™s move to protect depositors from losses even beyond the $250,000 insurance limit that the FDIC has in place.

“I worry that some very large banks with assets over $100 billion also have improperly managed liabilities and their exposure to rising interest rates,” Orlowski said.

The New York Department of Financial Services (DFS) had taken possession of Signature Bank, pursuant to Section 606 of New York Banking Law, in order to protect depositors. DFS appointed the FDIC as receiver of the bank.

The FDIC transferred all the deposits and substantially all of the assets of Signature Bank to Signature Bridge Bank, N.A., a full-service bank that was being operated by the FDIC while it marketed the institution to potential bidders. Signature Bank had total assets of approximately $110.36 billion and total deposits of approximately $88.59 billion as of December 31, 2022.

The federal government said that depositors and borrowers automatically became customers of Signature Bridge Bank, N.A. and continued to have uninterrupted customer service and access to their funds by ATM, debit cards, and writing checks in the same manner as before. Signature Bank”™s official checks will continue to clear. The government said that loan customers should continue making loan payments as usual.

There was a bipartisan meeting of New York”™s Congressional delegation with state officials to discuss the ongoing situation.

“It is crucial that New Yorkers continue to have confidence in the stability of our banks and financial markets,” Gov. Kathy Hochul said. “State and federal leaders have been working hand-in-hand to stabilize financial institutions and give depositors the confidence to know their funds will be available whenever they need.”

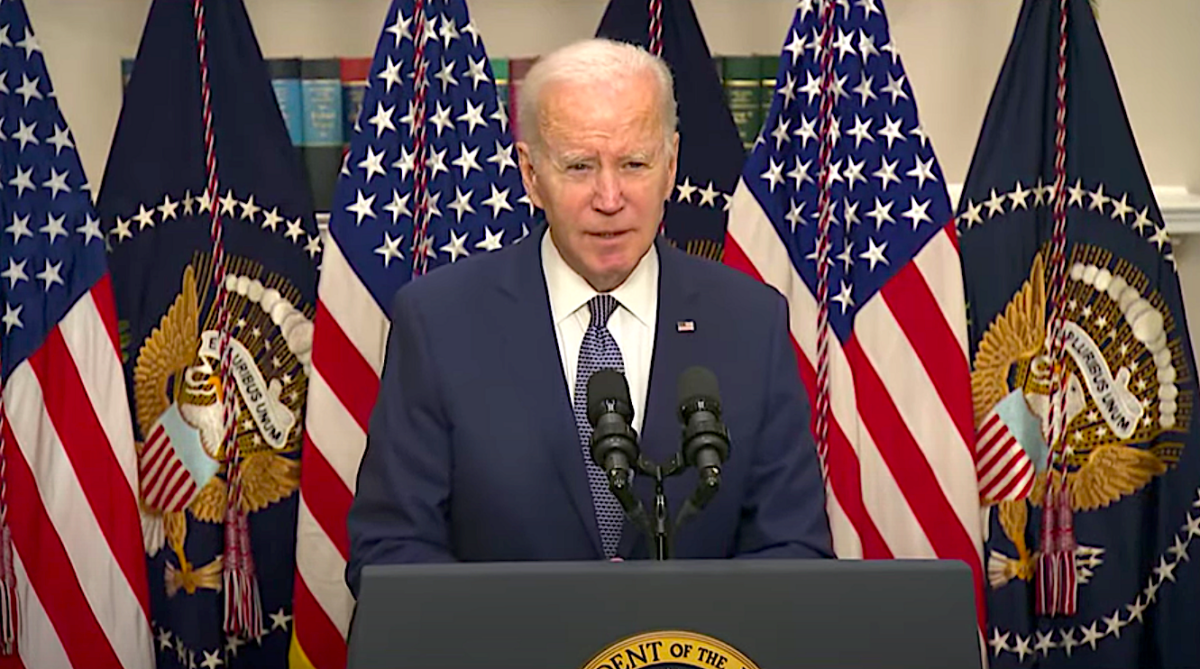

President Biden, speaking in the Roosevelt Room of the White House before the stock markets opened on Monday, March 13, made remarks similar to what President Franklin Delano Roosevelt made about the banking system in his first fireside chat on March 12, 1933, just over 90 years before.

“Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said. “Small businesses across the country that had deposit accounts at these banks can breathe easier knowing they”™ll be able to pay their workers and pay their bills.”

Biden said that the management of the banks that failed would be fired and there would be a full accounting of what happened.

“We must reduce the risks of this happening again,” Biden said, blaming the Trump Administration for rolling back some protections that had been put into place with the Dodd-Frank Law, which was designed to prevent a repeat of the banking crisis that had swept the nation in 2008.

“I”™m going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely that this kind of bank failure will happen again and to protect American jobs and small businesses. Americans can rest assured that our banking system is safe. Your deposits are safe,” Biden said.