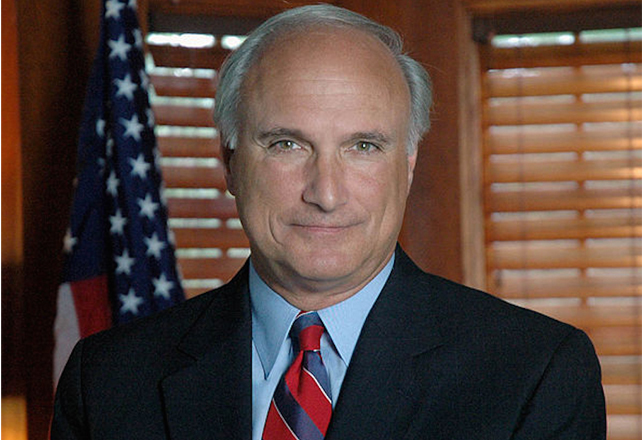

Connecticut Insurance Department (CID) Commissioner Andrew N. Mais is calling on insurers to immediately lower personal vehicle premiums and expand commercial hired and non-owned auto insurance in light of the disruption caused by the COVID-19 pandemic.

As a result of the pandemic and Gov. Ned Lamont”™s emergency orders directing residents to shelter in place and avoid nonessential driving, the CID said it “believes it is generally understood that consumers are driving less during the pandemic and, as a consequence, being less exposed to motor vehicle accidents causing injuries and property damage.”

As a result of the pandemic and Gov. Ned Lamont”™s emergency orders directing residents to shelter in place and avoid nonessential driving, the CID said it “believes it is generally understood that consumers are driving less during the pandemic and, as a consequence, being less exposed to motor vehicle accidents causing injuries and property damage.”

On Monday, two insurers ”“ Allstate and American Family Insurance ”“ announced plans to return roughly $800 million to their auto insurance customers because of the reduction in driving.

Allstate plans to refund about 15% of premiums paid by its customers in April and May, equal to about $600 million, while American Family Insurance will give back about $50 per car that a household has insured with the company via a one-time payment, at a total cost of about $200 million.

Both insurers are also expanding coverage for customers who use their personal vehicles to deliver food, medicine and other goods.

CID is suggesting insurers offer premium credits that could be implemented immediately, as well as allowing filings to be made after-the-fact without penalty.

As for hired and non-owned vehicles, CID is asking insurers to help business owners who have had to begin deliveries by affording them coverage for those who request commercial hired and non-owned automobile insurance.

The department also reminds those businesses that as an alternative to buying commercial auto insurance, they may want to consider partnering with “gig” delivery businesses as a possible delivery source.