Although Connecticut added another 45 COVID-19-related deaths since yesterday, bringing its total to 380, Gov. Ned Lamont said the rate of increase in hospitalizations is “not going up ”“ in fact, it may be going down a little bit,” a possible sign that the state’s number of coronavirus incidents has peaked.

The news is particularly good in Fairfield County, the first and most significantly impacted of the state’s eight counties, he said. Although the county added another 23 deaths ”“ bringing its total to 178 ”“ its hospitalizations have for the first time decreased, from 655 yesterday to 654 today.

“One day does not a trend make,” Lamont said, “but it is perhaps a glimmer of hope.”

The state conducted another 1,802 tests since yesterday, bringing that total to 33,502, and netted 1,003 positives, bringing that number to 9,784. Statewide, another 46 have been hospitalized, bringing that current total to 1,464.

As of noon today, Stamford led the state with 1,045 positive cases, followed by Norwalk (644), Danbury (622), Bridgeport (429), New Haven (413), Waterbury (358), Greenwich (247) and Hartford (227).

For the first time, the state provided data on hospital discharges of recovered patients. Of about 3,000 total hospitalizations to date, 1,250 have been discharged, Lamont said, with 10% of those going to hospital dying.

In terms of PPE (personal protective equipment), the governor said that 1,027 sources have been identified, only 259 of which were validated (“a lot of them were pretty shaky, to tell you the truth,” he said), and 78 orders have been submitted.

All told, about 18.8 million units of PPE have been ordered, including 5.3 million N95 respirators, 200,000 of which were received yesterday. State COO Josh Geballe said the state has spent about $50 million on those 18.8 million units, but noted that 75% of that sum is reimbursable by the federal government.

Repeating his message that the state has an adequate supply for PPE for the time being, Lamont said, “There’s not much of a stockpile there,” but that most PPE recipients were “managing their supply really thoughtfully.”

With many of those PPE orders expected to arrive within two weeks ”“ “Supply is beginning to catch up with demand,” the governor said ”“ it is possible that the state could “broaden the lens” of who gets it, such as food service workers and day care centers.

LOOKING AHEAD

During a conference call with small-business owners this afternoon, Lamont again noted that the government is beginning to strategize about how best to restart the economy after the crisis has passed. Part of that effort will involve running blood tests of those who were infected over the previous 60 days to determine if they now have antibodies. First to be tested will be first responders and advanced manufacturing workers, he said. The state expects to start rolling out that testing sometime over the next two to three weeks, he said.

At the briefing, the governor said that the state”™s schools, which he ordered closed through at least April 20, will remain shut until at least May 20, as will nonessential small businesses. Commissioner of Education Miguel Cardona said an assessment would then take place to determine “if returning to the classroom this year is even possible” for Connecticut’s roughly 530,000 students.

Cardona also guaranteed that graduation ceremonies will take place when it is considered safe to do so.

STATE AID

Department of Economic and Community Development Deputy Commissioner Glendowlyn Thames affirmed on the afternoon conference call that the department is still processing the 5,000-plus applications it received for its $50 million Recovery Bridge Loan program, which was suspended 24 hours after launching due to the high demand.

“We are rethinking our process to efficiently, quickly and responsibly get that money to small businesses,” she said. “We are evaluating our heavily manual infrastructure.”

Noting that DECD is “not a bank,” Thames confirmed that the department is in talks with a financial technology lender to process the applications, with an eye toward getting the money out by the end of this month.

On the same call, Connecticut Insurance Department Commissioner Andrew Mais said that several insurers have already agreed to his request, issued earlier this week, to lower personal vehicle premiums and expand commercial hired and non-owned auto insurance in light of the disruption caused by the pandemic.

In addition to Allstate and American Family Insurance, which had previously announced they would do just that, Mais said that Travelers, Geico, Liberty Mutual, Safeco and USAA are now on board, and that The Hartford was on the cusp of announcing it would follow suit.

The Hartford Economic Development Corp. (HEDCO), in partnership with the state and the DECD, is offering minority-owned and women-owned small businesses negatively impacted by the pandemic a zero-interest line of credit of up to $20,000 that is potentially forgivable.

Other eligibility requirements include being a for-profit business with no more than 20 employees (full- or part-time), conducting business for at least six months; and in good standing with the Department of Revenue Services. An application can be found here.

The Women”™s Business Development Council in Stamford encourages those interested and qualified to contact Keny锋tta Banks at 203-751-9877 or kbanks@ctwbdc.org to learn more and to book a no-cost, one-on-one counseling session to filling out the paperwork.

FED PROVIDES $2.3 TRILLION ROUND OF LOANS;

REPLENISHMENT OF FUNDS FOR SMALL BUSINESSES STALLS

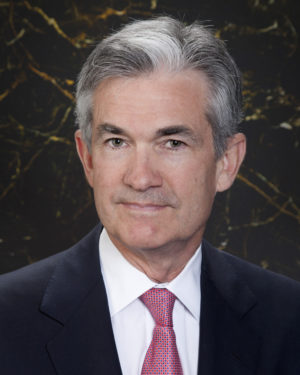

The Federal Reserve today announced a new $2.3 trillion round of loans to help support small businesses and consumers, as well as for states and municipalities ”“ the first time it has addressed those entities.

“People have been asked to put their lives and livelihoods on hold, at significant economic and personal cost,” Fed Chairman Jerome Powell said during a webcast this morning. “As a society, we should do everything we can to provide relief to those who are suffering for the public good.”

The Fed is creating a Municipal Liquidity Facility with up to $500 billion in loans and $35 billion in credit protection in order to “help state and local governments manage cash flow stresses caused by the coronavirus pandemic.” Through the program, the Fed will buy short-term debt from states and Washington. D.C., as well as counties with at least 2 million people and cities with a population of at least 1 million.

It will also supply financing to banks taking part in the Small Business Administration’s Paycheck Protection Program. It is increasing its Main Street Lending Program for small businesses with an additional $600 billion in loans as well as $75 billion in funding from the Treasury Department via the CARES Act.

In addition, it is expanding three existing credit facilities aimed at increasing credit to households and businesses. That effort will target $850 billion through the three facilities, a move backed by $85 billion in protection from the U.S. Treasury.

The Fed”™s move comes one day after the U.S. Department of Labor announced that 6.6 million people filed unemployment claims last week; the nation”™s unemployment rate now stands at about 10%.

According to the U.S. Small Business Administration, some 400,000 Paycheck Protection Program loans, worth a total of $100 billion, have been approved. The program is aimed at helping small businesses and nonprofits with fewer than 500 employees affected by the pandemic.

The White House and congressional Republicans are seeking approval of an additional $251 billion for the program by the end of the week, as its original funding of $349 billion is nearing depletion. However, Senate Democrats are looking to add $100 billion for hospitals and $150 billion for state and local governments, creating an impasse, at least for now.

TRUMP EYING REOPENING MUCH OF ECONOMY BY APRIL 30

According to a Washington Post report today, President Donald Trump is examining ways to reopen as much of the national economy as possible by April 30, and will soon announce the creation of a second coronavirus task force to set an exact date.

U.S. Treasury Secretary Steve Mnuchin told CNBC this morning that much of the economy could be open for business in May.

“I think as soon as the president feels comfortable with the medical issues, we are making everything necessary that American companies and American workers can be open for business and that they have the liquidity they need to operate their business in the interim,” Mnuchin said.

Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, told ABC this morning that the country could see a “bending in the curve” by the end of this month, but that “the virus itself will determine the guideline” on when it”™s safe to loosen social distancing measures.

Asked on CBS if Americans might be able to enjoy vacations and other activities this summer, Fauci replied: ”It can be in the cards, and I say that with caution because as I said, when we do that, when we pull back and try to ”˜open up the country”™ as we often use that terminology, we have to be prepared when the infection starts to rear its head again.”

During an appearance on NBC, Fauci said that social distancing efforts are “starting to have a real effect” and added that the nation”™s death toll may end up being “more like 60,000 than the 100,000 to 200,000” that the White House had predicted earlier this month.

As of this writing, there are about 452,500 positive cases and more than 16,000 virus-related deaths in the U.S., and over 1.58 million positive cases and nearly 95,000 deaths globally.