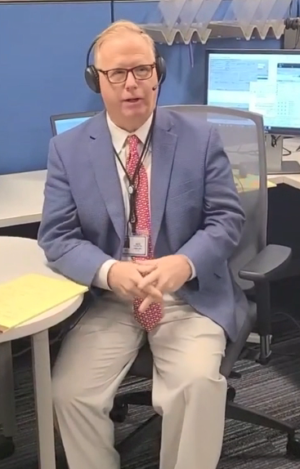

It may seem odd to refer to a 57-year-old as a “warhorse,” but given that Mark Boughton has been in government for roughly 26 of those years ”” including a record 10 two-year terms as Danbury”™s mayor””it seems appropriate.

His 10th term, of course, was cut short in December 2020 when he was tapped by Gov. Ned Lamont to become the commissioner of the state”™s Department of Revenue Services (DRS). Danbury City Council president Joe Cavo was sworn in on Dec. 16 of that year but decided against running for a full term, with Dean Esposito ”” a chief of staff under both Cavo and Boughton ”” defeating Democrat challenger Roberto Alves by fewer than 200 votes. He will be sworn in on Dec. 1.

“Danbury had a great exercise in democracy,” Boughton told the Business Journal. “Dean spent many years as my chief of staff, and I wish him well. But I want to compliment Roberto as well ”” he worked very hard.”

Boughton shrugged off the narrow margin of Esposito”™s victory. “I won by 138 votes (over Democrat Chris Setaro) the first time I ran for mayor” in 2001, he noted. “People today are definitely split, but Danbury is a great place where people come together and let the mayor be the mayor.”

Similarly, he said, Lamont is willing to let the DRS commissioner be the DRS commissioner. “Every commissioner says they”™re going to chase down the tax money that people owe, but the bureaucracy has tripped them up,” Boughton said. “In my case, the governor said, ”˜I”™m going to stay out of your way,”™ which is refreshing.”

Boughton”™s latest tax-collecting effort, the Tax Amnesty 2021 initiative, began Nov. 1 and runs through Jan. 31, 2022. The program provides a 75% reduction in interest and waives penalties and the possibility of criminal prosecution to those who have not filed, have underreported or have existing liabilities related to taxes owed to the state for any tax period ending on or before Dec. 31, 2020.

“This represents a significant opportunity to collect revenue,” Boughton said, estimating that the state could retrieve some $40 million in unpaid taxes. “55% of people and businesses pay their full share, which means that 45% don”™t pay their full share, or only a part,” he said.

Reaction to the amnesty program so far has been encouraging, he said, with a number of accountants and attorneys encouraging their clients to take advantage of what is, after all, a limited-time offer. “We just settled a dispute a few days ago from 2014 over a $3.2 million tax bill,” for which DRS collected $1.2 million, he said.

“Cleaning it up and getting people right with the state in terms of what you owe ”” why wouldn”™t you want to do that?” Boughton asked.

Enrollment in the amnesty program is relatively simple, he said, with all applications needing to be filed electronically. Taxpayers seeking amnesty can access all program information, including a link to the state”™s secure online payment portal myconneCT, at GetRightCT.com. Boughton said a public information campaign, including television, out-of-home and digital ads are also being rolled out, with additional outreach being made to those with known existing liabilities and suspected non filers, as well as to local chambers and tax service organizations to help inform and guide businesses and individuals through the process.

All taxes administered by the Connecticut DRS, except for Connecticut motor carrier road tax (IFTA), are eligible for the Tax Amnesty program.

Boughton said that in some cases, “you could save 50, 60, 70%” in interest and other penalties, as long as payments are made in full by Jan. 31. Once the amnesty period ends, taxpayers will be liable for the full tax, penalty and interest on any amount owed.

The commissioner allowed that taxpayers can appeal their audit to the DRS, but if it rules against them, “they are required to pay. If they don”™t pay, we can put a lien on their property, cause their business to close down and arrest them. It”™s rare that that happens ”” but it can.”

Though never an official tax collector ”” Boughton”™s career includes working on the Danbury Planning Commission from 1995 to 1998 and serving as the state representative for the 138th District of Connecticut from Jan. 3, 1999 to Jan. 1, 2002, when he took office as the city”™s mayor ”” he said, “I feel I have experience managing large companies because we had 1,000 employees in Danbury. There”™s only 700 or so in DRS.”

He also ran for governor in 2010, 2014 and 2018; he won the endorsement of the state”™s Republican party in the last contest but lost the primary to businessman Bob Stefanowski, who in turn was defeated by Lamont.

Today, electoral politics are behind him ”” at least for now ”” as he continues rethinking what DRS is all about.

“We”™re building an analytical division with AI and algorithms to look at revenue ”” how you raise it, how and why you audit it, and building predictive models,” he said. “What happens in the next five to 10 years? What happens when everyone has migrated to electric cars and the gas tax goes away?”