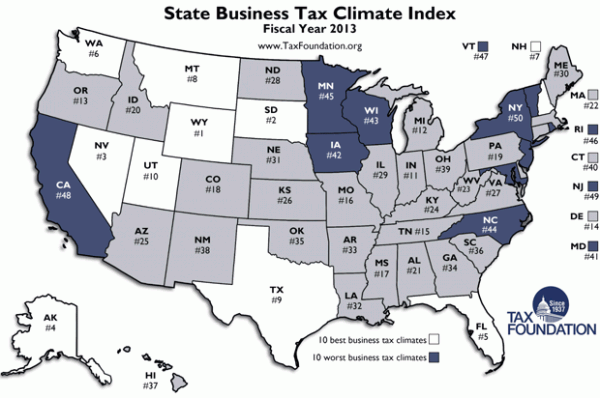

New York state has the worst business tax climate in the nation, according to an annual study published Oct. 9 by the nonprofit Tax Foundation, a Washington D.C. think tank.

In the 2013 Business Tax Climate Index, New York ranked 23rd for corporate taxes, 50th for individual income taxes, 38th for sales taxes, and 45th for unemployment insurance taxes and for property taxes.

Authors Scott Drenkard and Joseph Henchman wrote that the bottom 10 in the rankings all “suffer from the same afflictions: complex, non-neutral taxes with comparatively high rates.”

The Empire State”™s neighbors didn’t fare much better.

New Jersey ranked 49th overall, and was ranked 40th or worse in four of the five areas examined by the Tax Foundation report.

Connecticut was ranked 40th overall, and was ranked 30th or worse in all tax five categories.

The five states with the friendliest business tax climates were Wyoming, South Dakota, Nevada, Alaska and Florida.