WWE posted record financial results for 2017, but its fourth-quarter figures took a hit from the new tax code.

Full-year revenue increased 10 percent to $801 million, the highest in the company”™s history. Operating income increased 36 percent to $75.6 million. Adjusted operating income before depreciation and amortization increased 40 percent to $111.9 million, which was within the range of the Stamford firm”™s guidance and represented an all-time record performance

In addition, digital engagement continued to grow with video views up 32 percent to 20 billion and social media engagements up 4 percent to approximately 1.2 billion from the prior year.

For the quarter ended Dec. 31, WWE reported net income of $4.8 million, compared with net income of $8 million in the prior year quarter. The company said that figure reflected charges totaling $11.3 million arising from the enactment of the new tax law. Those charges included a $10.9 million noncash charge due to the remeasurement of its deferred tax assets and $400,000 associated with the deemed repatriation of foreign earnings.

The remeasurement was due to the reduction of the corporate tax rate from 35 percent to 21 percent, which reduced the future benefit WWE will realize associated with those assets. WWE said it believes the tax bill will provide a long-term benefit to the company.

Operating income for the quarter increased to $27 million from $13.9 million.

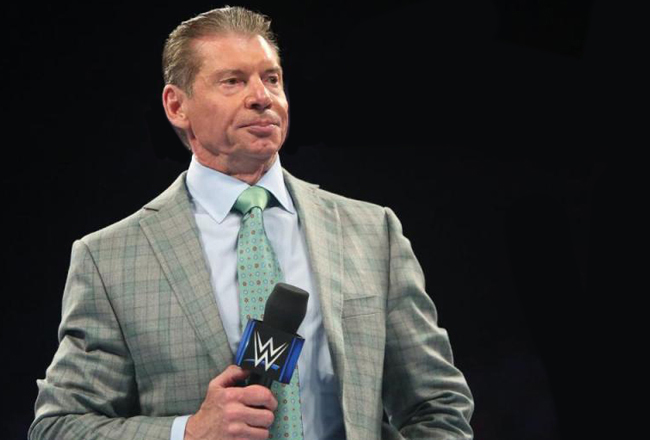

Meanwhile, a story has been circulating that longtime WWE Chairman and CEO Vince McMahon is stepping down from producing its “WWE 205 Live” series, which features cruiserweight division matches and airs on the WWE Network.

According to a report by PWInsider.com, McMahon has ceded control of the show to his son-in-law Paul Michael Levesque, a.k.a. Triple H, with whom he created the program.

A WWE spokesman declined to comment on the story.