If you own either a home or a commercial property in Bridgeport, Fairfield, Greenwich, Westport, Shelton or Stratford, you’ve already received your revaluation notice of assessment. And, depending on which type of property you own, you were either shocked by the high figures or nonplussed by a minimal change.

Based on social media posts and a perusal of at least one of those notices, homeowners are taking the brunt of the higher property values that will ultimately lead to higher taxes come next July. That should not come as any big surprise since the recent five-year revaluation period (2020-2025) is the first one since the pandemic, which in the past couple of years has led to an extraordinary spike in home values.

Home property values

For the five Fairfield County municipalities that just completed the process, first selectmen and mayors are in a bit of quandary. They are faced with having to increase property tax rates no matter how low they set the mill rate while the tax burden further shifts to homeowners from commercial property owners.

That’s because as homes in some areas have increased by as much as 70% since Oct. 1, 2020, commercial properties have not kept pace. A pent-up demand following the pandemic led to a much higher demand for homes. But at the same time fewer new housing stock was being built.

“The values are supposed to be reflective of fair market value,” Gregory Servodidio, Pullman & Comley Property Tax and Valuation attorney, told the Fairfield County Business Journal. “The short answer is that when you study the market, certain types of properties are increasing more significantly in value.”

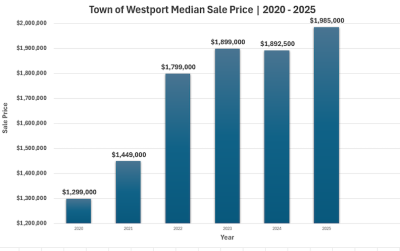

Consider a couple of examples of the spike in home value in Fairfield and Westport. According to a table released by the Town of Westport, the median sales price of a home in 2020 was $1.299 million compared to $1.985 million in 2025. That’s a 53% jump in value in just five years.

Meanwhile, according to an anonymous Fairfield revaluation notice a single-family, four-bedroom house’s assessed value increased to $553,490 in 2025 compared to $312,970 in 2020. That’s an increase of 77% in the same period.

For Fairfield County as a whole, the increase in sales price value was 58% ($500,000 in 2020 vs. $789,900 in 2025).

Commercial property values

When it comes to commercial properties, it has been a completely different story in Connecticut. Except for the end of the pandemic in 2021, the market has struggled to get back to 2018 levels in the number of transactions and volume, according to Northeast Private Client Group figures released in September 2025.

The volume of commercial sales hit a high-water mark of $2.58 billion in 2021 with 585 transactions and an average price of $5.03 million. Since then, the average price has spiked at $5.56 million in 2022 and continued to fall the past three years to only $3.18 million in 2025 as of September.

Servodidio sees the drop in commercial volume and sales a result of office space being difficult to fill since Covid.

“People working from home has diminished the demand for office space,” he said. “You are seeing that play out on the commercial side. Even some hotels have struggled to fill rooms and are being repurposed into housing.”

Municipal property tax strategy

Most of the five Fairfield County municipalities have sent out warning notices to property owners as part of the revaluation notices. For the most part, they tell owners not to attempt to calculate property taxes based on the current mill rate because that rate will most likely change before tax bills go out in July.

For example, the Town of Fairfield letter states: “The October 1, 2025, assessment shown on this statement will be used for July 1, 2026 Tax bills. Note that the mill rate for these bills will not be set until the spring of 2026. PLEASE DO NOT USE THE CURRENT MILL RATE TO ESTIMATE YOUR TAXES FOR THESE PAYMENTS.” (For the record, the current mill rate for Fairfield is 28.)

As part of a FAQ on the Town of Fairfield website, the town included some facts such as “the average rise in home prices in Connecticut over the past five years is 67%, in line with the average increase of 65% in Fairfield.”

In Westport, newly elected First Selectman Kevin Christie issued a similar boiler plate notice with the same warning (the current mill rate for Westport is 40.20). He did add an additional fact: “Estimates indicate an average increase of about 61% for residential properties and about 17% for commercial properties.”

All the municipalities have until the end of January to hold hearings for owners who want to appeal their assessments. For example, Fairfield’s deadline to register for an informal hearing is Jan. 9 at 4 p.m.

Bridgeport, Greenwich, Shelton, Stratford and Westport have set up similar deadlines for appeals hearings this month. Those deadlines are set by the state. Residents can contact the Assessors’ offices in each municipality for more information.

The final tax rates will not be set until later in the spring when all the municipalities have completed the annual budget process and the final mill rate is set following public hearings.