The special master of the Madoff Victim Fund announced Tuesday, Dec. 31 the final distribution of money to victims of the $20 billion criminal fraud perpetrated by Madoff Securities.

“On behalf of the Madoff Victim Fund and the U.S. Department of Justice, I am delighted to announce that MVF has initiated our tenth distribution to victims of the criminal fraud at Madoff Securities,” said Richard Breeden, principal of RCB Fund Services and special master of the $4.3 billion Madoff Victim Fund. “MVF is paying $131.4 million to 23,408 victims, which is an incremental payment of 2.71% to each victim. These payments bring each participating victim to a 93.71% recovery from all sources.”

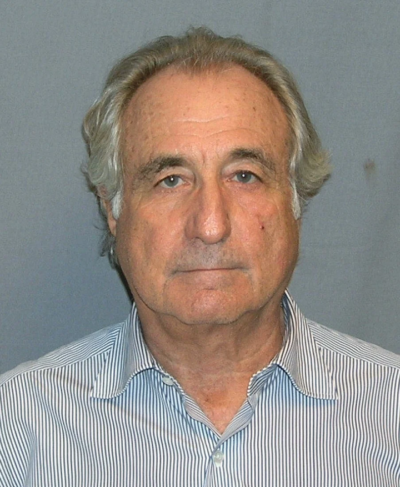

In total, there were 40,930 victims, many of who included retirees and their retirement funds. One such victim was the Town of Fairfield, which was defrauded of nearly $3 million from the decades-long Ponzi scheme operated by the late Bernie Madoff, who died in 2021.

“The Criminal Division, through its Money Laundering and Asset Recovery Section (MLARS), is proud to administer the department’s remission program to compensate victims using forfeited assets,” said Principal Deputy Assistant Attorney General Brent S. Wible, head of the Justice Department’s Criminal Division. “The unprecedented scope and complexity of the Madoff remission process shows the power of forfeiture to recover assets and to compensate victims — a primary goal of the department’s Asset Forfeiture Program.

“When MVF was created, there was a remarkable lack of knowledge of the true dimensions of the fraud,” said Breeden, who was the SEC chair under Presidents Clinton and George W. Bush. “The losses of ‘direct investors’ had been carefully studied in bankruptcy, but the losses of ‘indirect investors,’ who aren’t eligible for bankruptcy recoveries, had not been analyzed. As it turned out, ‘direct investors’ represented only about 6% of Madoff’s known victims.”

In 2013, the Town of Fairfield was awarded nearly $3 million by a Stamford Superior Court judge ruling in favor of the town’s claim against Tremont Partners Inc., an investment firm that indirectly invested money from the town’s retirement fund in the multi-billion-dollar Ponzi scheme – an overall loss to municipal pensions that topped $40 million.

Retirement plans of large and small businesses, labor unions, churches and governmental entities collectively lost more than $750 million. Victims included 162 “defined benefit plans”, 19 profit sharing plans, 112 multi-employer plans, 36 government pension plans, four church retirement systems, and others.

According to a 2013 court filing, for many years, Tremont Partners served as the plaintiffs’ investment advisor. Sandra L. Manzke, who was the president of Tremont Partners, was the individual with whom the plaintiffs dealt in investing their money. Relying on Manzke’s counsel, the plaintiffs invested their funds in a hedge fund established by Tremont Partners, which, in turn, invested its assets with Madoff. The plaintiffs did not invest their funds directly with Madoff.

When Manzke left Tremont Partners in 2005, she formed a new investment and consulting firm, Maxam Capital Management LLC, which established the Maxam Absolute Return Fund, LP (Maxam Fund). Pursuant to Manzke’s advice, the plaintiffs withdrew their funds from the Tremont Partners hedge fund and invested them in the Maxam Fund, which, in turn, invested the plaintiffs’ funds with Madoff.

Noel and Tucker (Fairfield Greenwich defendants) are partners, principals and members of the executive committee or board of directors of the Fairfield Greenwich Group, an asset management company that manages and solicits investments for its own hedge funds and other hedge funds that invested with Madoff. Because the Maxam Fund and Fairfield Greenwich Group made their investments solely through other funds, they are referred to as ‘‘feeder funds.’’

On June 29, 2009, Madoff was sentenced to 150 years in prison for running the largest fraudulent scheme in history. Of the over $4 billion that has been made available to victims, approximately $2.2 billion was collected as part of the historic civil forfeiture recovery from the estate of deceased Madoff investor Jeffry Picower. An additional $1.7 billion was collected as part of a deferred prosecution agreement with JPMorgan Chase Bank N.A. and civilly forfeited in a parallel action. The remaining funds were collected through a civil forfeiture action against investor Carl Shapiro and his family and from civil and criminal forfeiture actions against Bernard L. Madoff, Peter B. Madoff, and their co-conspirators.

“After publishing our Plan of Distribution and petition forms, we received a wave of more than 65,000 petitions covering over $80 billion in losses,” Breeden said. “We knew the total approved losses would be less than that amount as we reviewed petitions, but still far more than the amount available for distribution.”

MVF ultimately recommended to the DOJ that 42,735 petitions from Madoff victims should be approved. We carefully measured how much these victims invested in, or took out, of the fraud. For a significant majority of petitioners, at least two intermediate entities were involved in transmitting investments to Madoff. In thousands of other cases, the investment of a victim passed through three, four or five intermediaries on its way to Madoff.”