Rising residential demand ”” and a declining interest in Class B and C office buildings ”” is continuing to fuel a wave of adaptive repurposing and reuse in Fairfield County, according to Tom Pajolek, an executive vice president in CBRE”™s Stamford office.

While converting otherwise unwanted office properties to medical use has been trending for some time now, Pajolek said the office-to-multifamily movement is still gaining steam.

“When a market starts to soften, like we”™re seeing here, demand obviously slackens,” Pajolek said. “Those people who are in the market tend to go for the best-in-class, Class A office buildings that are modern, well-situated and well-maintained.”

When it comes to office buildings not in prime downtown, or proximate to attractive waterfront and/or highway locations, he said, “Developers see those as opportunities to reposition” as multifamily residences.

One of those,

Sold for $6,800,000. Photo courtesy of Angel Commercial

in Westport, was a 42,624-square-foot, multitenanted office building erected in 1980 by the Kowalsky Brothers Construction Co. It was sold for $6.8 million in 2016 to Investment Capital Holdings, which set about converting it into a recently opened 94-unit complex rebranded as 1177 Greens Farms development.

“It”™s doing really well,” Pajolek said, noting that Investment Capital built it with affordable housing in mind. Thirty of the units fall under that designation, which helped Westport earlier this month gain a “Certificate of Affordable Housing Completion” from the state Department of Housing, which grants the town a four-year moratorium on 8-30g applications.

The 8-30g statute allows a developer to override local zoning regulations if a town does not have 10 percent of its housing stock deemed affordable. Although Westport has about 4 percent, it qualified for the certificate due to the significant progress it has made in supplying affordable housing.

“The granting of the moratorium will allow the commission to continue their efforts to create affordable housing opportunities that are in scale with and can be integrated with the community,” said Westport Planning and Zoning Commission Chairman Paul Lebowitz. “The four-year moratorium will not stifle our efforts to provide affordable housing in Westport.”

Pajolek said efforts at trying to renovate the property as a still-viable office space would probably have been for naught. “It was just time” for the next stage in its evolution, he said.

Another Westport property, the former Save the Children building at 54 Wilton Road, was partially demolished by developer David Waldman to create a 16-unit apartment building totaling roughly 13,500 square feet, with the remaining 13,500-square-foot space modernized for office use. Last year private equity firm Gemspring Capital signed on as the first tenant at what is now called Bankside at National Hall. It is fully leased, Pajolek said.

In Trumbull, where development has been booming of late, Woodbridge, New Jersey”™s Continental Properties is in the process of reconfiguring the 79,000-square-foot former Canon Solutions America headquarters at 100 Oakview Drive into a 202-unit luxury apartment complex. The $30 million, four-year project will result in 119 two-bedroom apartments and 83 one-bedroom units, a 6,400-square-foot clubhouse with a fitness center, an outdoor pool and recreation area.

That project pales next to the long-vacant 250,000-square-foot office building and parking garage at 48 Monroe Turnpike in Trumbull, which represented more than half of the empty space in the town since 2015, when United Healthcare left for more modern accommodations on Research Drive in Shelton.

Senior Living Development LLC and Silver Heights Development LLC, which have developed a number of age-restricted residential projects throughout Fairfield County, acquired the property last September for about $3.4 million. Plans call for the existing building to be converted into a 200-unit independent, assisted and memory care community, while another 160 units of active adult housing will be added elsewhere on the 17.6-acre site.

“There are not that many tracts of that size in eastern Fairfield County,” Pajolek said, “at least not for some time. But it”™s a wonderful spot, with great access to Route 25.” Although its time as a corporate headquarters clearly had passed, he said, repurposing it for the county”™s growing senior population should prove to be a winner.

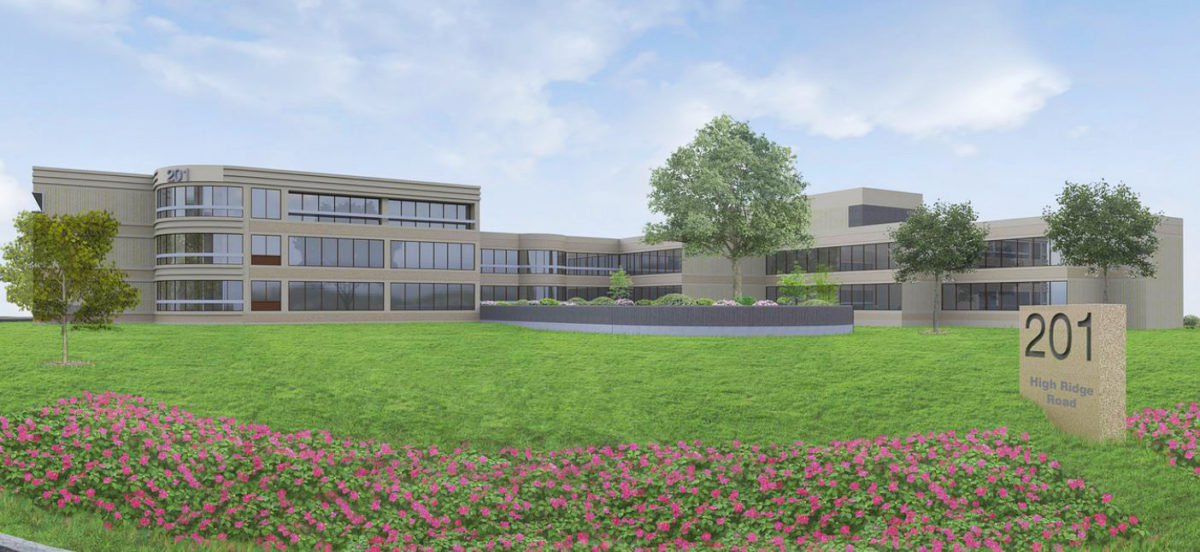

Also being converted into senior housing is 201 High Ridge Road in Stamford. The one-time home of General Electric Capital Corp. is being converted into a senior housing community, Waterstone at Stamford, with approximately 95 independent living and 35 assisted-living rental units. Construction is expected to begin this year.

Pajolek said the real driving force behind such conversions is millennials.

“As we experience more millennial-type activity in lower Fairfield County, it”™s making the demographic younger and making us more attractive to companies looking to hire that demographic,” Pajolek said. “It all comes back to jobs.”

And those jobs are changing as well, he noted. “There”™s this whole collaborative nature now, where people are working physically closer together, which results in more open space and is more economical,” Pajolek said. “Then you have all the M&A and consolidations that are going on, which results in the elimination of so-called redundant jobs ”” plus you have more telecommuting going on, where people don”™t come into the office as much as they used to. That all means the need for square footage in an office environment is less than it used to be.”