Listening to new ideas can of course a critical skill in business. But for Rosanna Guardavaccaro, it was her son”™s listening in on one of her conversations that led to a new business venture.

“I”™ve been a financial planner for about 20 years now,” Guardavaccaro, who joined the Barnum Financial Group on May 4, said. “My son would sometimes listen to some of the advice I was giving to adult clients ”” he was six or seven at the time ”” and one day he comes running over and says, ”˜I think I know what life insurance is.”™”

Indeed he did. The boy, Vito (now 12 years old), told his mother that it”™s “when someone passes away and goes to heaven, their money goes to their family.”

Indeed he did. The boy, Vito (now 12 years old), told his mother that it”™s “when someone passes away and goes to heaven, their money goes to their family.”

“I was trying to speak privately, especially when I”™m working from home,” Guardavaccaro said. “But he was paying attention a bit more than I”™d thought. Children are always listening.”

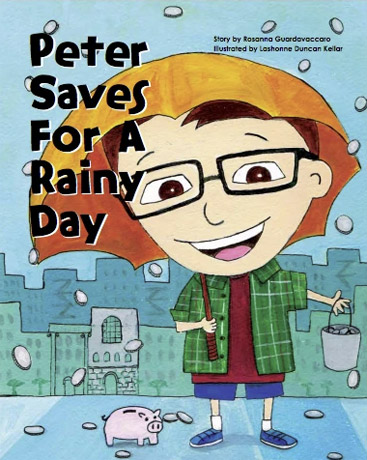

Inspired not only by Vito”™s interest, but also by what she knew was a general lack of financial basics at most schools, Guardavaccaro decided to write “Peter Saves for a Rainy Day.” Self-published in 2016, the 32-page book introduces basic financial planning and savings concepts and features colorful illustrations by Lashonne Duncan Kellar.

That connection was also serendipitous, she said.

“My very first client has a daughter who works for JetBlue, doing different designs for them,” Guardavaccaro said. “I went to her with the idea, and she helped make it even more attractive.”

“Peter Takes the Train” ”” expanding on the basic “wants vs. needs” concept ”” followed in 2020, and Guardavaccaro is now putting the finishing touches on “Peter Moves to the Big City,” to be published later this year. The third book will be aimed at junior high students, reflecting Vito”™s own maturing, and will explore budgeting as well as how debit and credit cards work. The “save for a rainy day” theme runs throughout the series.

“When I was in college I worked as an intern at a financial planning firm,” she said. “I was lucky enough to find a career path. But for a lot of kids, they may understand ”˜income,”™ but not where it then goes, and why.

“I wanted to fill that gap” with the “Peter” books, she continued. Asked when the ideal time is to start learning about finance, Guardavaccaro said, “The earlier the better. Children are just as smart as adults ”” they”™re just smaller.”

Admitting that some financial concepts still can be difficult even for adults to fully grasp, Guardavaccaro said she hopes to keep the series”™ focus on the economic ABCs.

As for Vito, she said he”™s enjoying his double life as the model for Peter. “I think he wants to be the author,” she said. “He thinks that it”™s cool and it”™s a great way for us to bond.

“The other morning he came in and said, ”˜Mommy, how do people make money if they”™re retired?”™ And I said, ”˜Hold that thought, Vito!” she laughed.

Guardavaccaro said she was convinced that Shelton”™s Barnum Financial would be her next stop during her interview with CEO Paul Blanco.

“He said, ”˜You”™re good at what you do because you”™re an educator,”™ and I thought, ”˜That”™s right,”™” she said. “I”™m educating my clients and at the same time trying to educate children it”™s two worlds coming together.”