SALT, the cap on using state and local taxes as deductions on federal income tax returns, had an effect on the local real estate market in the first quarter of 2019, according to a new report from Better Homes and Gardens Rand Realty, but the effect has been limited.

The changes to tax law as crafted by congressional Republicans and the Trump administration put a $10,000 cap on the amount of state and local taxes, including property taxes, which can be taken as deductions on federal returns.

Joe Rand, managing partner of the brokerage, told the Business Journal that SALT has had a modest but meaningful effect on the high end of the market. “I don”™t think it”™s had any effect on the market in the mid to lower end because buyers and homeowners in those markets don”™t itemize their taxes. They take the standard deduction,” he said. The standard deduction was doubled for 2018, while personal exemptions were eliminated and changes were made to the tax brackets. “It”™s pretty clear from the numbers in 2018 and now in the first quarter of 2019 that the SALT cap did have an effect on behavior in the higher end. It didn”™t destroy the market; it has just slowed,” Rand said.

Rand Realty”™s first quarter market report for the Hudson Valley said that the SALT cap is “hampering what would otherwise be a fairly robust seller”™s market.” It said SALT was suppressing sales and price appreciation in the higher-priced markets like single-family homes in Westchester.

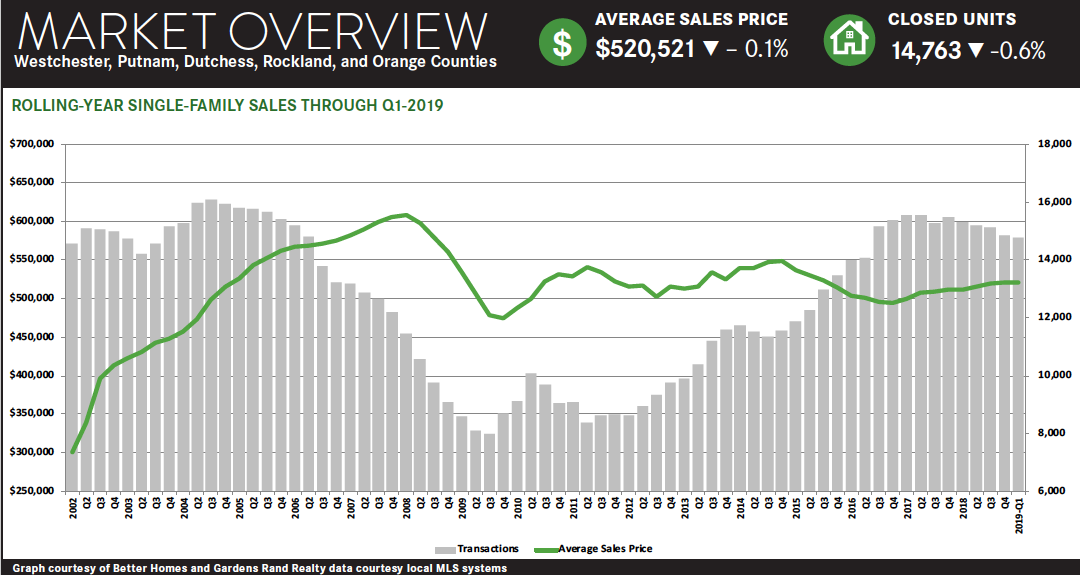

The report made first-quarter and rolling-year sales comparisons for sales in Westchester, Putnam, Dutchess, Rockland and Orange counties. A rolling year is a period of 12 consecutive months in which the start date of the period changes as a new month begins.

In Westchester, sales dropped almost 5% for the first quarter and 4% for the rolling year. In the first quarter of 2019, 982 single-family homes were sold compared with 1,029 in the first quarter of 2018. The average selling price Rand showed dropped 4.7% for the quarter and 0.3% for the rolling year. It was $758,867 in 2019 compared with $796,656 in 2018”™s first quarter.

Rand reported 259 condo units sold in the first quarter of 2019, compared with 262 for the first quarter of 2018. The average selling price in the first quarter of 2019 was $425,320, compared with $431,401 in the first quarter of 2018.

There were 447 co-op properties sold in the first quarter of 2019 at an average price of $193,968. In the first quarter of 2018, the numbers had been 453 units at an average price of $188,656. While the number of units sold dropped by 1.3%, the average price rose by 2.8%.

In Putnam, single-family home prices fell 3.7% quarter-over-quarter to an average of 341,357 with 223 sold, a drop of 5.1%.

In Dutchess, the average single-family home sale price jumped 18.7% to $348,467 while the number of houses sold dropped 15.1% to 365 from the first quarter of 2018.

The Rand report showed an 8% increase in single-family sales in Rockland with the average price up 2%. The number of houses sold went up 8% to 390. The average selling price of condos was up 11% to $283,579 for the first quarter of 2019, compared with $255,520 for the first quarter of last year. The number of condos sold dropped by 4.8% to 118.

In Orange County, there were 776 homes sold in the first quarter of 2019 at an average price of $263,625. That compared with 766 homes sold in the first quarter of 2018 at an average price of $259,608. The number of condos sold in Orange rose to 123 units sold in 2019 compared with 94 in 2018”™s first quarter. The quarter-over-quarter selling price was up to $171,156 compared with $160,905 a year earlier.

“Look at Orange County, look at Rockland County, look at Putnam and Dutchess. The market is doing very well. You look at Westchester condos and co-ops, the market is doing very well,” Rand said. “The one place where you see a little bit of negativity is in the Westchester single-family market and I think that negativity is largely confined to the highest end of that market which is really struggling right now. But, if you ask agents in the field, if they get a mid-priced listing in Westchester County ”¦ it”™s moving very quickly.”

Rand expressed the opinion that housing is generally a bargain in historical terms. “The market fundamentals are very strong, demand is high, prices are at historical levels where they”™re still kind of bargains, interest rates are at historical lows, and inventory is low. That has all the earmarks of a seller”™s market that still has room to run.”