During the course of this year, there has been an expanding interest among investors in the non-fungible token (NFT) market.

Many prominent artists, celebrities and athletes have become involved in this market ”” Kings of Leon released its latest album “When You See Yourself” in this format, Mick Jagger and Foo Fighters”™ Dave Grohl teamed with 3D artist Oliver Latta on a 30-second loop of their song “Easy Sleazy,” and filmmaker Kevin Smith is releasing his undistributed horror flick “Killroy Was Here” as an NFT.

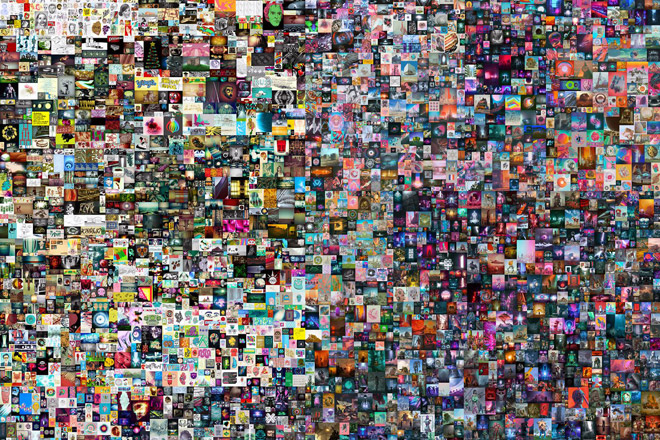

The digital artist known as Beeple sold an NFT of his work “Everydays – The First Five Thousand Days” at a Christie”™s auction for $69 million, a record sum for this market. Some higher profile NFTs are being sold as charity auctions ”” the Jagger-Grohl NFT was auctioned to assist music industry personnel impacted by the Covid-19 pandemic. NFTs have become so trendy that the subject inspired a song parody on “Saturday Night Live” that generated more than 3.3 million views on YouTube.

But what exactly is the NFT market all about, and what are some of the rewards and risks inherent to this digital environment?

Cliff Ennico, a Trumbull-based attorney and author of the books “Small Business Survival Guide” and “The Crowdfunding Handbook,” explored the NFT experience in a May 25 webinar presented by the Inventor”™s Association of Connecticut (IACT) in conjunction with Fairfield University”™s School of Engineering.

Ennico acknowledged that for the uninitiated, the NFT concept could be confusing, adding that “it”™s easier to say what they”™re not than what they are.”

“A non-fungible token basically takes digital works of art and turns them into a verifiable asset,” he explained. “Think of the NFT as a certificate of authentication. And those of you who have ever bought an antique or a highly valuable collectible, like a 1956 Mickey Mantle rookie card, usually there”™s a certificate of authentication attached that can be very valuable depending on who issues it.”

Ennico pointed out that artists do not create the NFTs, but instead they are created by marketplaces that host the NFTs on their digital platforms.

“Each person and sale of an art NFT is recorded on a blockchain, which makes it almost impossible for someone to sell knockoffs of the artwork without getting a caught,” he continued. “If someone is selling that same artwork and it”™s not tied to an NFT, it”™s a fake.”

Likewise, he added, if a person”™s name does not appear in the chain of title, they have no legal right to the artwork unless it is an authorized reproduction.

And this is where things get a bit tricky. Ennico explained that artists are now using NFTs to “prove their date of first publication without having to go through the tedious and often inefficient process of registering a copyright.”

However, the buyer of the NFT does not have full ownership of the digital item.

“When you buy an NFT, you”™re buying only the artwork itself,” Ennico said. “You”™re not getting the artist”™s copyright, the legal monopoly that gives the artist exclusive right to exploit the artwork commercially for a period of years. That artist is absolutely free to generate multiple copies of that NFT artwork.

“That NFT is not a copyright,” he added. “It can be used to establish the date of publication for copyright purposes, but it is not itself a copyright.”

Ennico also highlighted an often-overlooked aspect of NFTs: whenever the owner of the NFT sells it, the artist gets a percentage of the purchase price.

“That”™s going to transform the art world in a very big way,” he said, noting that an artist never receives another cent if their painting or sculpture first displayed in a brick-and-mortar gallery is resold over the years.