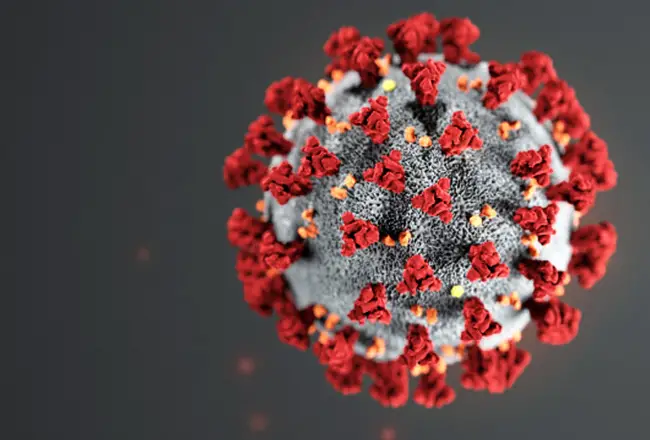

The chief economist for the National Association of Realtors (NAR), Lawrence Yun, says while the COVID-19 pandemic and societal response such as social distancing have affected the real estate market, the future might not be all that bad.

“With fewer listings in what”™s already a housing shortage environment, home prices are likely to hold steady,” Yun said. “The temporary softening of the real estate market will likely be followed by a strong rebound once the economic ”˜quarantine”™ is lifted, and it”™s critical that supply is sufficient to meet pent-up demand.”

Yun’s comments coincided with NAR’s release of an economic survey it conducted March 16 and 17 that asked its members about how their businesses were doing during the crisis.

Nearly half, 48%, said home buyer interest has decreased due to the outbreak. Just a week before, the number who reported a downturn was only 16%. The number of association members who said there”™s no change in the number of homes on the market due to the coronavirus outbreak dropped to 69%, down from 87% a week ago.

No significant change in buyer behavior was reported by 45% of the association members. They said the stock market drop and lower mortgage rates roughly balanced out.

More than half of NAR members in the commercial real estate sector reported a decline in leasing clients. A week ago it had been 18%. In the latest survey the number was 54%.

The members reported that 83% of commercial buildings have changed their practices in the era of COVID-19 with the most common changes including offering more hand sanitizer, doing more frequent cleaning of buildings and having increasing number of their tenants working remotely.

The NAR is the country’s largest trade association with more than 1.4 million members. The survey went to 72,734 of the members and had 3,059 usable responses. For 96 percent of respondents, the majority of their business is residential. For 2 percent of respondents, the majority of their business is commercial. Seventy-seven percent of respondents are in a state that has declared a state of emergency. Fifty-six percent of members work in a local market where there are presumed or confirmed cases of COVID-19.

The survey was released as mortgage capital giant Freddie Mac, which supplies capital to lenders for mortgages, announced actions to protect homeowners affected directly or indirectly by the coronavirus.

Freddie Mac announced a nationwide suspension of all foreclosure sales and evictions of its borrowers for single-family homes. It expanded its forbearance program that provides borrowers with payment relief for up to 12 months and suspend borrower late charges and penalties. It also suspends reporting to credit bureaus of past due payments of borrowers who are in a forbearance plan as a result of hardships attributable to the national emergency.

Freddie Mac encouraged borrowers who may be experiencing financial challenges due to COVID-19 to contact their mortgage servicer so they can explore one of the Freddie Mac workout options.

“We are committed to helping families affected by the virus and we are instructing servicers to work with borrowers who are unable to make their mortgage payments to ensure they are evaluated for a forbearance plan or other appropriate assistance,” said Kevin Palmer, senior vice president of single-family portfolio management at Freddie Mac.

The suspension of foreclosure sales and evictions is effective immediately, applies until May 17 and may be extended.

Freddie Mac said that as of March 19, its 30-year fixed-rate mortgages carried average interest rates of 3.69%, up a bit from the week before when the rate averaged 3.36%. Fifteen-year mortgage rates were averaging 3.06% up from 2.77% the week before.

Freddie Mac was created by Congress in 1970.