A new study commissioned by the Connecticut AFL-CIO maintains that, contrary to popular opinion, the state has the lowest total effective business tax rate ”“ the average rate at which an individual or corporation is taxed ”“ in the country, as well as the nation’s lowest ratio of business taxes to state and local taxes.

A new study commissioned by the Connecticut AFL-CIO maintains that, contrary to popular opinion, the state has the lowest total effective business tax rate ”“ the average rate at which an individual or corporation is taxed ”“ in the country, as well as the nation’s lowest ratio of business taxes to state and local taxes.

“Connecticut has economic advantages that few states in the country have and significant opportunities for investment and future growth,” according to “Opportunities for Growth: Business Tax Advantages, Economic Strengths and Quality of Life Perceptions in Connecticut,” conducted by Central Connecticut State University economists.

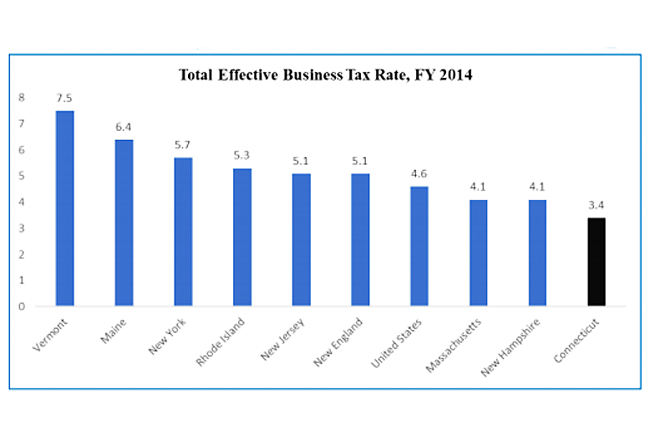

Utilizing Ernst & Young data, the report states that the total effective business tax rate was 3.4 percent in 2014, lower than the 4.6 percent average among all states and the lowest in New England. In addition, the report cited federal data that states a 9.9 percent increase in Connecticut’s household income from 2012 to 2015 was greater than in the other five New England states and the U.S. overall.

While Connecticut suffered significant economic damage from the Great Recession of 2007-09, and like many states that damage continued well into the recovery, the report states that “Throughout this period of recovery, public dialogue surrounding the health and performance of the Connecticut economy has been largely negative.

“Business advocates and elected officials allege that the state has irreversibly entered a period of long-term stagnation, declining quality of life, deteriorating economic competitiveness and a shrinking population,” it stated. “They cite a hostile business climate, a burdensome tax structure and an uncoordinated, undisciplined state budget.”

Maintaining that such negative perceptions “are often anecdotal, limited and very selective, they alone can be very damaging for the economy regardless of the state”™s fundamentals,” the report stated that “a full analysis of Connecticut”™s economic strengths and competitive advantages demonstrate that Connecticut holds significant advantages few states have, which reflect decades of public investment and hold substantial opportunities for future investment and economic growth.”