Gov. Dannel P. Malloy proposed plans Jan. 29 to create a $25 million advanced manufacturing fund to help companies modernize, grow, train employees and develop new technologies.

Manufacturers such as Boeing, Airbus and United Technologies Corp. are expected to aggressively increase production schedules and the state”™s aerospace supply chain needs to prepare to nearly double its capacity, Malloy said.

“Although Connecticut”™s manufacturers are among the best at what they do, a major ramp-up in production activity could pose a challenge for our smaller producers,” Malloy said in a written statement.

The fund would start with an initial $25 million investment and would be used to attract new companies to the state, he said. As of press time, Malloy was expected to propose the legislation during the upcoming session, which began Feb. 5.

Manufacturing represents 10.5 percent of the gross state product, exceeding $24 billion in revenue, and employs roughly 10 percent of the state”™s population.

“This fund is the answer,” Malloy said. “It is a long-term commitment that will usher in a new era of innovation and economic growth; one that promises to bring skilled manufacturing jobs back to the state and solidify our place as a world-wide leader in advanced manufacturing for generations to come.”

Though military contracts are expected to decrease over the next decade as the nation wraps up its wars, United Technologies Corp. and other aerospace manufacturers say they plan to increase consumer-based orders to make up the difference.

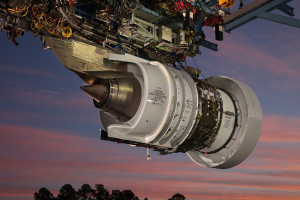

At Pratt & Whitney, a UTC subsidiary based in East Hartford, engine production is expected to decrease through 2015. But by 2017 sales are expected to exceed 2012 levels with further growth into 2020, due to more than 5,000 orders for the company”™s PurePower engine family.

Company officials plan to more than double engine production by the end of the decade, “rivaling levels not seen since the 1980s,” said Shawn A. Watson a P&W manager of operations and engineering communications.

“This will mean a substantial amount of work for our supply base,” he added in an email. “Here in Connecticut we have more than 80 product suppliers working on parts and components for our engines. We value our supply base and need their support to be successful.”

Watson said the company welcomed Malloy”™s support, mentioning the competitive environment it operates in.

“If the state can help manufacturers succeed, that”™s a good thing,” he said.

Watson didn”™t comment specifically on whether there would be a long-term need for smaller manufacturers to double their capacity to meet P&W”™s demands past its recent spout of engine orders, but reiterated the bright outlook the company holds.

“We”™re fortunate to be part of an exciting industry that is both challenging and rewarding,” Watson said. “Our long-term outlook and the outlook for our industry is very bright. With a number of companies building new aircraft and with more than 5,000 announced firm orders and options for our PurePower engines, it”™s clear that there”™s lots be optimistic about.”

Malloy said the fund could serve as a catalyst for further strategic investments in the state”™s manufacturing sector, allowing it to remain competitive and build a skilled workforce.

“Now is the right time for the state to make this investment to build up our core industrial capability and ensure we remain competitive in the global marketplace,” he said.