An entrepreneur whose business plan includes seeking growth capital for a growing business ”” perhaps after initial self-funding or obtaining seed capital from family and friends ”” should be aware of the business and legal attributes an experienced “sophisticated investor” will look for. Regardless of whether the investor is an angel, an angel group, a venture capital firm or a family office, the sophisticated investor will have evaluated hundreds of opportunities, achieved liquidity in some, but also written off others as failures. This investor knows the key markers of a business equipped to grow sustainably.

After meeting with the entrepreneur and showing early indications of interest, the investor”™s preliminary evaluations will focus on the business plan and the people who will execute it. Among his first objectives will be to understand the business, its industry and the opportunity presented.

His starting point is usually a visit to the company”™s website and review of the written business plan, financial statements and any press articles. Many investors place equal weight on the opportunity and the people who manage the enterprise ”” people who can put together a team and execute the business plan. A sophisticated investor will highly value a balanced management team ”” perhaps including a visionary who can inspire others, an experienced operator and a subject-matter expert. He will look for experienced tax and legal counsel and a board of advisers with industry experience and leadership.

ASSESSING MANAGEMENT TALENT

Identifying a talented management team that can adapt to an often rapidly changing marketplace and competitive threats is one of the investor”™s top concerns, as she knows that even the most successful businesses look a lot different than their early business plans. A good reputation with past wins will help command a valuation premium. The investor may conduct a background check on the management team, or at least a Google and social media check. A history of arrests or convictions, or bankruptcies among members of management could be deal killers. She may also want to contact members of the board of directors and any existing investors to gauge their evaluation of the business, the management team and the present opportunity.

After this initial due diligence, if still interested, the investor will proceed with more specific inquiries. The results will provide a basis for the representations and warranties he is likely to require in the securities purchase agreement.

The investor may sign a nonbinding letter of intent or term sheet, but if the investor has not yet signed a confidentiality agreement, the entrepreneur should consider including a binding confidentiality section if the investor is planning to review proprietary or otherwise sensitive information. Note that some investors may want their involvement to be confidential as well.

The investor may begin with a deeper dive into the existing and pro forma financial statements. She will want to see the “fully diluted, as-converted” capitalization table to see how much equity has been issued and to whom. A list of existing equity holders, which includes numerous nonaccredited investors ”” especially ones who are not friends and family ”” might give her pause, as she will have had experience with Regulation D private placements and is aware of their potential rescission rights. She will

also want to know who the other shareholders are and whether they are participating

in the current offering.

SKIN IN THE GAME

The prospective investor will want to see that the founders have taken substantial risk by having “skin in the game” with their full time and money, and will not be interested in funding their side hobby. He will look to see how much equity is held by management and how much is reserved for future grants to new investors and as incentives to employees. He will want to see that equity grants to the management team are subject to vesting over a period of several years or subject to clawback or forfeiture under certain circumstances. Without these features, he will be concerned that a key employee may leave the company with a large block of stock.

The investor will evaluate how many securities offerings the business has previously closed with a critical eye focused on sale of any securities at a valuation lower than previous sales ”” a “down round.” This will give her insight as to how well the entrepreneurs have planned and executed their business plan to date.

When she analyzes the company”™s financial statements, the investor may prepare her own cash burn analysis or time to break even and compare it against the CFO”™s analysis. If the runway seems too short, she may want to protect herself against bad dilution by taking a convertible note, instead of preferred stock, having a conversion price pegged at a discount to the next round”™s valuation.

Raising too little capital can lead to subsequent down-round offerings, which may be preceded by ugly scenarios such as cutting the customer service budget or even asking employees to forego salary, which could be signs of a team that is in over its head. If a down round is currently contemplated, the investor will ask legal counsel to analyze any anti-dilution rights given to previous investors.

The investor will also want to see the company’s organizational documents, including any shareholders agreement or LLC agreement, and any side letters between the company and its existing investors. He will analyze the rights and preferences of the different classes of stock or equity membership units, and any special rights granted to particular investors. Depending on the relative size of his potential investment, he may demand the same, if not better, rights and may also ask for a most favored nation provision in his side letter as to favorable terms that may be agreed to with future investors.

The investor will want proof that the company actually owns its intellectual property. The IP should not be registered in the name of the founder or, worse, a friend of the company. Short of that, she will want counsel to review any licensing agreement between the company and the IP owner. She will also want disclosure of IP infringement claims or any other litigation, or a representation that there are none. The investor will want to confirm that agreements with consultants and employees contain restrictive covenants, assign inventions to the company, preserve confidentiality and protect trade secrets.

GOVERNANCE CHECK

Further down on the investor’s checklist will be an assessment of the quality of the company”™s corporate governance. Was the company formed properly? How many board seats are authorized in the bylaws? How many are filled? Are the books and records organized, accurate and readily accessible? Are fiduciary duties disclaimed? Are personal expenses commingled?

She will understand that formalities, such as meeting minutes and formal election of directors and officers, protect the company and its owners. If the investor is able to negotiate a seat on the board, she will want to be indemnified to the fullest extent permitted by law. She will be further assured by a directors and officers liability insurance policy which purports to protect board members against claims from third parties.

Management, investment history, ownership structure, IP portfolio, governance quality: a sophisticated investor will scour all. Make sure your corporate home is ready before you put a portion of it up for sale.

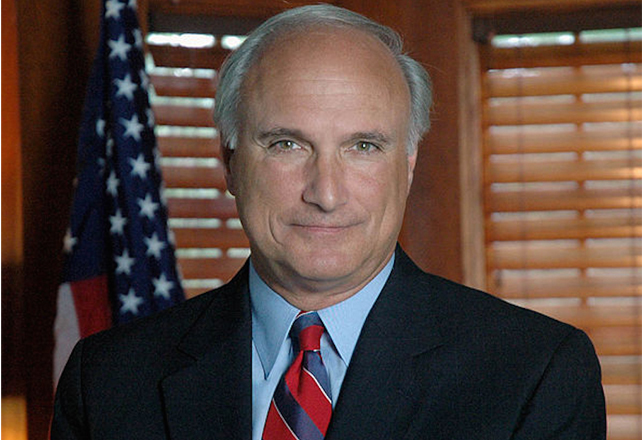

Attorney Andrew M. Walsh is a shareholder in Anderson Kill’s Stamford and New York City law offices and a member of the firm’s corporate and securities group, advising family offices, entrepreneurs and emerging companies. He can be reached at awalsh@andersonkill.com or 203-388-7950.

Comments 1