Bloomberg reported Dec. 12 that President-elect Trump’s economic advisory team working on the transition favors keeping the prohibition on full deductibility of state and local taxes from federal income tax returns. Known as SALT, the restriction puts a $10,000 cap on the amount of local and state taxes that can be deducted. Taxpayers in Democrat-controlled states such as New York and California, where property taxes are higher than in many Republican-controlled states, have been hurt by SALT.

Bloomberg says that it was told by economist Stephen Moore that Trump’s economic advisory transition team has been considering a plan to keep the SALT restriction in place but raise the limit to $20,000 from the current $10,000 deduction limit. Moore was reported to have expressed an opinion that doubling the amount would solve the problem for middle-class families living in Democrat-controlled states.

During the campaign, Trump had said he would eliminate the SALT deduction cap. Bloomberg reported that Moore had said the Trump transition economic team was opposed to eliminating the SALT cap.

SALT went into effect along with other revisions to the tax code in 2017 during Trump’s first term. Those changes are due to expire at the end of next year.

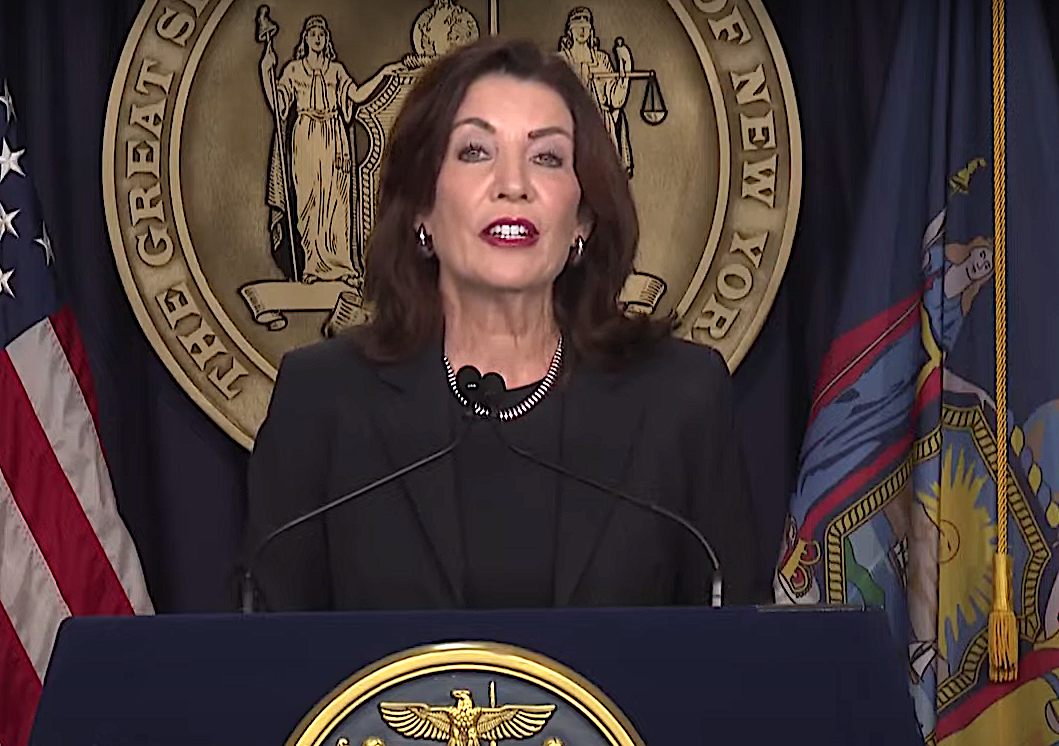

New York Gov. Kathy Hochul reacted swiftly to what Bloomberg had reported.

“The SALT tax proposal being floated by advisors to President-elect Trump is nothing more than an empty gesture,” Hochul said. “It fails to deliver the meaningful relief working families desperately need as they struggle with rising costs. Since Republicans eliminated the SALT deduction six years ago, New Yorkers have shouldered an additional $12 billion annually in taxes. This cannot continue, and this half-measure falls woefully short.”

Hochul said that she fully supports a plan to eliminate the SALT cap that was put forth by Congressmen Andrew Garbarino, a Republican, and Congressman Tom Suozzi, a Democrat, both of Long Island. She said she expects every member on New York’s congressional delegation to continue fighting against the SALT limitation.

“New Yorkers deserve nothing less than a full restoration of the SALT deduction, which would put money back in their pockets when they need it most,” Hochul said.