Fresh on the heels of a sizable victory on election night in his campaign for a full term, Westchester County Executive Ken Jenkins late on Nov. 7 unveiled the proposed Operating Budget for the county in 2026. The operating budget totals $2.5 billion and is in addition to the $604 million capital budget proposed by Jenkins on Oct. 15.

The new Operating Budget includes cuts for almost all county departments of 8%, including the County Executive’s Office, and eliminates 180 positions, essentially cutting the county workforce by almost 5%. It includes a 5.27% increase in county property taxes. County property taxes vary from community to community, with each municipality getting a bill from the county equal to its share of the taxable full-value of all property in the county. The municipality then collects the taxes it has to remit to the county from its property owners. For example, when 10.46% of the county’s entire property value was in Yonkers, Yonkers got a bill equal to 10.46% of the county tax levy.

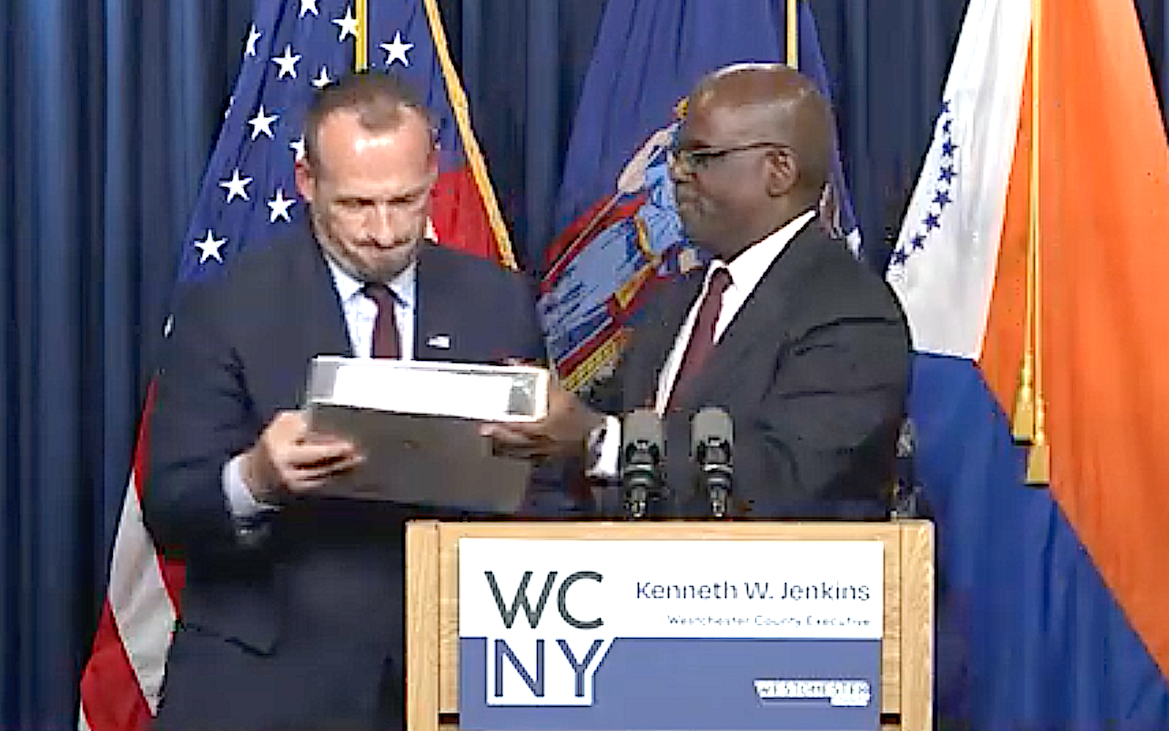

After speaking about the proposed budget at his office in the County Office building in White Plains on Nov. 7, Jenkins formally presented a budget book to Vadat Gashi, chairman of the County Board of Legislators. A final budget must be adopted by the Board no later than Dec. 27.

As the budget was beibg prepared, it became apparent that the county would be facing projected budget gap of $197.7 million. Instituting a hiring freeze and elimination of 180 positions is expected to produce savings of $28 million. Another $34.5 million is planned to be saved by reductions in contracts, as well as cutting technical services and expenses. Reducing overtime and trimming hours worked is expected to save another $11.6 million. Savings in equipment, materials and supplies is expected to cut out $7.1 million. Adjustments in social services acount for $5.2 million in savings.

“This has been an extraordinarily difficult year, and the budget process reflected that,” Jenkins said. “We are operating in a moment of unprecedented uncertainty driven by the Trump administration’s decisions beyond our control. Federal cuts, shifting aid formulas and tariffs have created instability in local planning in a way we have not seen in recent memory. There’s no way to sugarcoat it, this is simply the reality of this moment — and we are committed to leading through it with transparency, partnership and integrity.”

Jenkins described the new proposed budget as being “Trump turmoil.” He warned that the budget does not account for possible future reductions in aid from the federal government.

The proposed Operating Budget is affected by increasing costs of essential services as well as federal government mandates. These include:

- Rising Healthcare Costs – $65 million

- Pension Growth – $22 million

- Increased Social Services Relief – $21 million

- Transportation and Utilization for Children with Special Needs – $10 million

- An Increase in Debt Service – $8 million

Sales tax revenues for 2026 are expected to be only 2.8% higher than the $943.5 million expected to be collected during 2025, which itself is less than the $969.8 million that had been projected in the 2025 budget. MGM’s decision to withdraw its bid to build a full-gaming casino license in Yonkers represents an estimated $17 million in lost annual revenue for the county.

Regarding the softness in sales tax collections, Jenkins said, “People are not spending money because of the chaos and uncertainty coming out of Washington. The instability created under Trump has seeped into Westchester County and is wreaking havoc on our finances — and we are not alone. Local governments across New York state and across the nation are confronting the very same pressures.”

The proposed budget continues supporting social programs including those that ensure people who need food will have it and that victims of domestic violence have the protection and resources they need. The proposed budget maintains free vaccine clinics, recycling opportunities, and maintaining workforce development programs. Among the additional allocated funds for these types of programs are $16.6 million for low-income child care, $3.7 million for access to eviction prevention programs and $1 million for federally qualified health centers.