Norwalk-headquartered Xerox Holdings Corp. (NASDAQ: XRX) announced an agreement to repurchase all of the company’s shares of common stock beneficially owned by investor Carl Icahn and certain of his affiliates at a purchase price of $15.84 per share – a transaction that will be worth approximately $542 million.

The company said it expected to fund the deal with a new debt facility. Concurrent with the closing of the repurchase, Jesse Lynn and Steven Miller, who are employed by Icahn’s operations, and James Nelson, an independent director, will resign from the company’s board of directors. Scott Letier, who has served on the board since 2018, has been appointed chairman of the board effective upon the closing of the repurchase transaction.

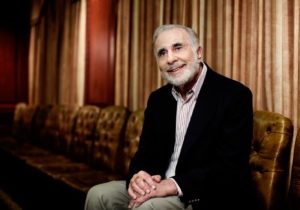

Icahn, who played a key role in scuttling Xerox’s planned merger with Fujifilm Holdings and in the company’s aborted hostile takeover of HP, declared in a statement, “As a longtime shareholder of Xerox, I’ve watched this iconic brand endure the hardest of times and come out stronger, all while returning substantial amounts of capital back to shareholders. I helped Xerox maintain its independence while pursuing consolidation within the print industry. I will continue to be a champion of the company and hope my activism will long be remembered as Xerox continues its positive momentum.”

“Our decision to repurchase shares is reflective of the confidence we have in our business, our strategy and our ability to improve Xerox profitability and cash performance,” said Steve Bandrowczak, CEO of Xerox. “For nearly a decade, Carl and his affiliates have served as important shareholders to Xerox, providing invaluable counsel, guidance and activism to support our evolution as a workplace technology leader. On behalf of Xerox and the board of directors, I would like to thank Carl and our departing directors for their dedication to Xerox and for contributing to our past, present and future success.”