David Ormsby, chairman of the Friends of Nathaniel Witherell Inc. ”“ the 2-year-old nonprofit that is helping remake the Nathaniel Witherell Short-Term and Skilled Nursing Center owned by the town of Greenwich ”“ said his group has helped obtain a $4.49 million state historic income tax credit to offset the construction costs of Project Renew, the push to modernize and refurbish the facility on Parsonage Road.

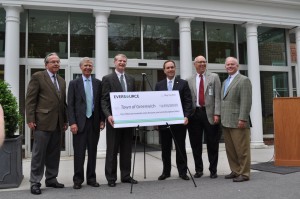

- From left, Lloyd Bankson III, Witherell board member; David Ormsby, chairman of the Friends of Nathaniel Witherell; Ken Bowes, vice president of distribution for Eversource Energy; Greenwich First Selectman Peter J. Tesei; Allen Brown, Witherell’s executive director; and H. Andrew Fox, chairman of the Witherell Town Building Committee.

Eversource Energy turned the credit into cash, swapping the tax credit for a dollar-for-dollar check to Witherell.

“This brings the total to over $9 million that the Friends has raised from generous private citizens, foundations and public sources to date,” Ormsby said in a statement. “By facilitating this historic tax credit, we are helping to insure that Nathaniel Witherell can continue its 112-year tradition of serving our community’s needs and assisting our town’s most vulnerable elderly residents.”

Project Renew has increased the number of private rooms at Witherell from 26 to 64, eliminating 10 four-bedded rooms, and remodeling and redecorating 86 resident rooms.

Public space has been enhanced, including a new 4,000-square-foot Rehabilitation Center; new family reception areas; the modernization of three existing elevators and the addition of a fourth; a new emergency generator, and other facility upgrades.

Total Project Renew construction costs are $27 million, with the state of Connecticut providing up to $12 million across a 20-year period.

The Friends began the process of applying for the historic income tax credit in 2009, completing the National Park Service”™s Historic Preservation Certification application on behalf of Witherell to list the facility and its 20-acre campus on the National Register of Historic Places.

The Friends retained Nils Kerschus, an architectural historian, to research the architectural design and development of the 1933 Administration building, which constitutes the centerpiece of the campus.

On June 9, 2010, Greenwich was notified that the Nathaniel Witherell Historic District was officially listed in the National Register of Historic Places by the National Park Service.

Subsequent applications prepared by the Friends to the state under its Historic Preservation Program resulted in the award of a $4,490,918 tax credit.

The credit is transferable and, since the town of Greenwich pays no state income tax, the credit was sold to Eversource Energy (formerly Connecticut Light & Power Co.), which agreed to pay the town the full principal amount of the credit.

The facility handles Greenwich residents”™ needs first, with most of its clients referred by Greenwich Hospital, but when space is available it welcomes clients from surrounding areas.