Everyone is eager for ideas on how to reduce their tax burden, especially business owners. Here are a trio of ideas that you may wish to consider when the time comes to reconnect with the IRS.

Take a Bad-Debt Deduction

If you are having trouble collecting payments from customers or clients, you might be able to claim a bad debt deduction on your tax return. But if you hope to take the deduction on your 2023 return, you’ll have to get busy, because you must be able to show that you’ve made a “reasonable” effort to collect the debt.

First, a cash-basis taxpayer may claim a business bad-debt deduction only if the amount that’s owed was previously included in gross income. Second, a business must establish that the debt is legitimate and can’t be recovered from the debtor.

This doesn’t necessarily mean you have to file a lawsuit against the debtor. But you can’t just make a single phone call either. Give it your best shot. You might actually be able to collect the debt. But if you can’t, you’ll have put yourself in a position to potentially claim a bad debt deduction.

Often, the specific charge-off method (also called the direct write-off method) is used for writing off bad debts. In this case, you can deduct business bad debts that became either partially or totally worthless during the year.

Partially worthless is defined for tax puproses as the deduction that is limited to the amount charged off on your books. You don’t have to charge off and deduct your partially worthless debts annually, so you can postpone this to a later year. However, you can’t deduct any part of a debt after the year it becomes totally worthless.

Totally worthless is when a debt becomes totally worthless in the current tax year, you can deduct the entire amount (less any amount deducted in an earlier tax year when the debt was partially worthless).

Remember, you don’t have to make an actual charge-off on your books to claim a bad debt deduction for a totally worthless debt. But if you don’t record a charge-off and the IRS later rules the debt is only partially worthless, you won’t be allowed a deduction for the debt in that tax year. This is because a deduction of a partially worthless bad debt is limited to the amount that is charged off.

If you haven’t started your collection efforts yet but hope to claim a business bad debt deduction for 2023, time is short. So, spring into action now. For instance, you might start collection efforts through phone and email contacts. If that doesn’t work, you may want to follow up with a series of letters or even hire a collection agency.

Claim a Charitable Deduction

Donating cash and property to your favorite charity is beneficial to the charity, but also to you in the form of a tax deduction if you itemize. However, to be deductible, your donation must meet certain IRS criteria.

First, the charity you’re donating to must be a qualified charitable organization, with tax-exempt status. The Exempt Organizations Search tool on the IRS website allows users to search for a specific organization and check its federal tax-exempt status.

Second, contributions must be actually paid, not simply pledged. So, if you pledge $5,000 in 2023 but have paid only $1,500 by Dec. 31, 2023, you can deduct only $1,500 on your 2023 tax return.

Third, substantiation rules apply, and they vary based on the type and amount of the donation. For example, some donated property may require you to obtain a professional appraisal of value.

Transfer funds from an IRA to a Health Savings Account

You can transfer funds directly from your IRA to a Health Savings Account (HSA) without taxes or penalties. Under current law, you’re permitted to make one such “qualified HSA funding distribution” during your lifetime.

Typically, if you have an IRA and an HSA, it’s a good idea to contribute as much as possible to both to maximize their tax benefits. But if you’re hit with high medical expenses and have an insufficient balance in your HSA, transferring funds from your IRA may be a solution.

An HSA is a savings account that can be used to pay qualified medical expenses with pre-tax dollars. It’s generally available to individuals with eligible high-deductible health plans. For 2023, the annual limit on tax-deductible or pre-tax contributions to an HSA is $3,850 for individuals with self-only coverage and $7,750 for individuals with family coverage. If you’re 55 or older, the limits are $4,850 and $8,750, respectively. Those same limits apply to an IRA-to-HSA transfer, reduced by any contributions already made to the HSA during the year.

If you decide to transfer funds from your IRA to your HSA, keep in mind that the distribution must be made directly by the IRA trustee to the HSA trustee, and, again, the transfer counts toward your maximum annual HSA contribution for the year.

Also, funds transferred to the HSA in this case aren’t tax deductible. But, because the IRA distribution is excluded from your income, the effect is the same (at least for federal tax purposes). IRA-to-HSA transfers are literally a once-in-a-lifetime opportunity, but that doesn’t mean they’re the right move for everyone.

This column is for information only and should not be considered advice. Tax matters are almost always complex and mistakes can be costly in both time and money. If you think any of the moves above could benefit you, consider contacting a tax professional.

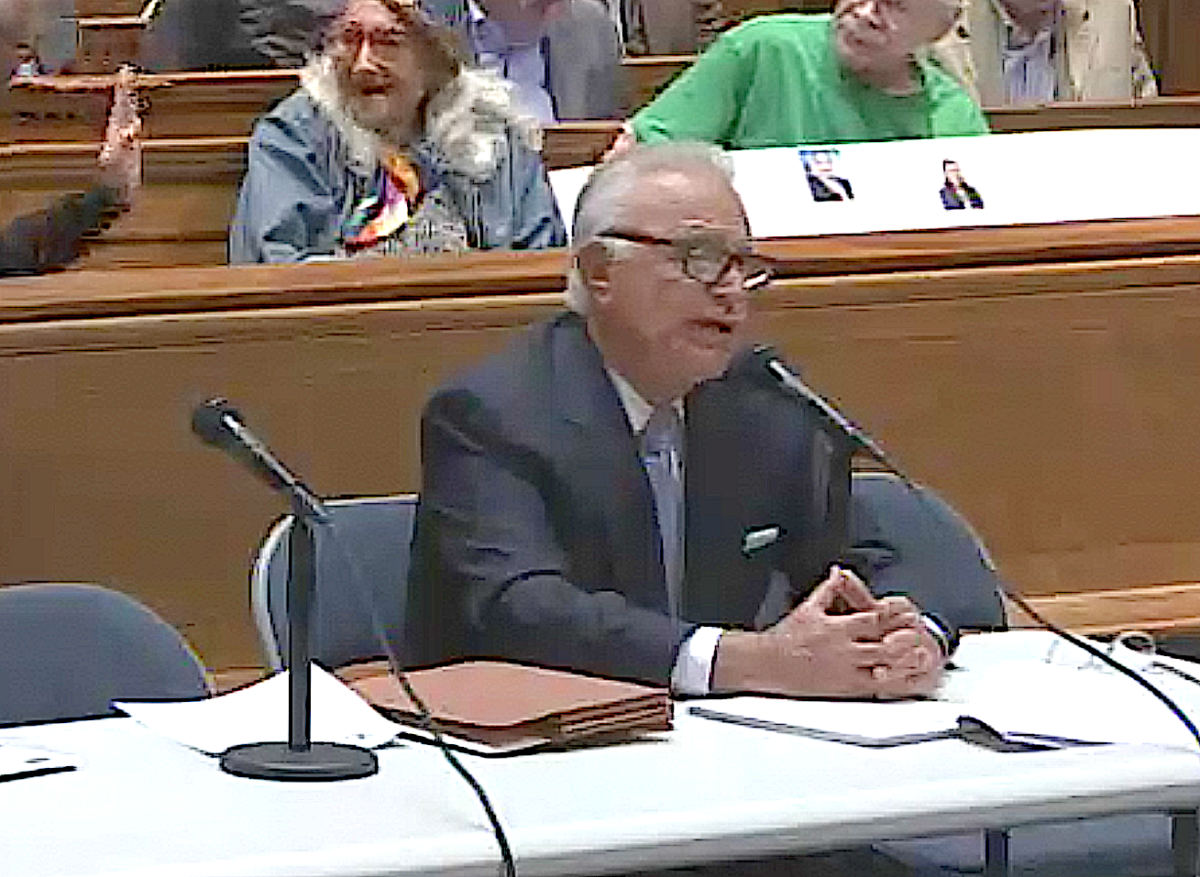

Norman G. Grill is managing partner of Grill & Partners LLC, certified public accountants and consultants to closely held companies and high-net-worth individuals, with offices in Fairfield and Darien.