It”™s said that bigger is better, but does the expression hold up when it comes to business banking? Are bigger banks a better option than smaller ones?

Sometimes.

In general, larger banks, typically those that operate in various geographic areas and with higher sums of assets, offer a comprehensive selection of financial products and services, including a variety of banking, wealth management and insurance products. Going with a provider that has a diversity of products and services at its disposal allows businesses to streamline how their finances and associated needs are managed by working with one provider instead of having to deal with multiple companies for their separate financial needs.

In general, larger banks, typically those that operate in various geographic areas and with higher sums of assets, offer a comprehensive selection of financial products and services, including a variety of banking, wealth management and insurance products. Going with a provider that has a diversity of products and services at its disposal allows businesses to streamline how their finances and associated needs are managed by working with one provider instead of having to deal with multiple companies for their separate financial needs.

Big banks, along with some smaller ones, tend to be technologically savvy, providing their clients with a robust flexibility of banking digitally, including through mobile applications. They also enjoy the benefit of increased brand recognition, especially in more populated areas. This strength benefits customers because they always know they can access an ATM or speak to someone in person no matter where they are. Smaller banks are often part of partnership networks where these benefits can also be accessed, but the larger banks have the built-in name recognition.

Then again, there are benefits to working with smaller banks too.

Community, savings and other smaller or intermediate banks normally are associated with specific geographic regions, giving them a close affiliation to the local communities they serve and the region”™s needs. The banks typically provide a high level of personal service, with customers often having direct access to the bank”™s decision-makers, including those involved in the underwriting process through the company”™s president. Additionally, some smaller banks are affiliated with a network of providers, thereby widening their scope of customer services, such as investment and insurance products. These smaller banks that are associated with a larger network or partnership often can provide the many services that larger banks offer with the personal touch of your neighborhood banker.

Because smaller banks tend to invest in personal relationships with their customers, their officers develop deep connections with them, along with a clear understanding of their client”™s business”™ needs. That allows the officers to cater products and services that best serve their clients”™ financial and borrowing needs, in the present day and throughout its evolution. Essentially, customers are not looked at as just a number and they are viewed as key to the bank”™s success.

Take a customer that applies for a $100,000 business loan. With a large bank, the decision can largely be based on the company”™s credit score and documented financial standing. The primary focus might be the business”™ ability to meet the terms of the loan with less emphasis on finding the right financial product to meet the business owner”™s needs.

Conversely, because smaller banks are relationship-focused, it”™s likely that a decision-maker with the bank would meet with the business owner to discuss the company”™s financial standing and ability to satisfy the loan, plus why the advance was needed and the best solutions to meet those needs.

Perhaps one of the most important advantages of working with a smaller bank is internal ”“ the culture is often not overly focused on numbers and sales goals. This is the kind of environment needed to ensure that customers and employees feel valued. Without such an emphasis on “the numbers,” smaller banks have a unique ability to build relationships with their current and potential customers.

We live in a society where ideas and innovation are flourishing, especially when it comes to small business. Young and seasoned professionals will find comfort knowing that both large and smaller banks are rooting for their successes.

With the expansive reach, offerings and reputation of larger banks, myriad solutions are available for business people”™s varied needs. Then again, the personal service, relationship-building, positive culture and local decision-making enjoyed at the smaller level means those seeking business loans can be assured that their vision, business plan and ideas will be taken into account.

The less exciting part of starting a business is securing financing and dealing with the logistical issues associated with the money side of things. Whether large or small, banks excel at, and are important for, helping new business owners navigate these challenges.

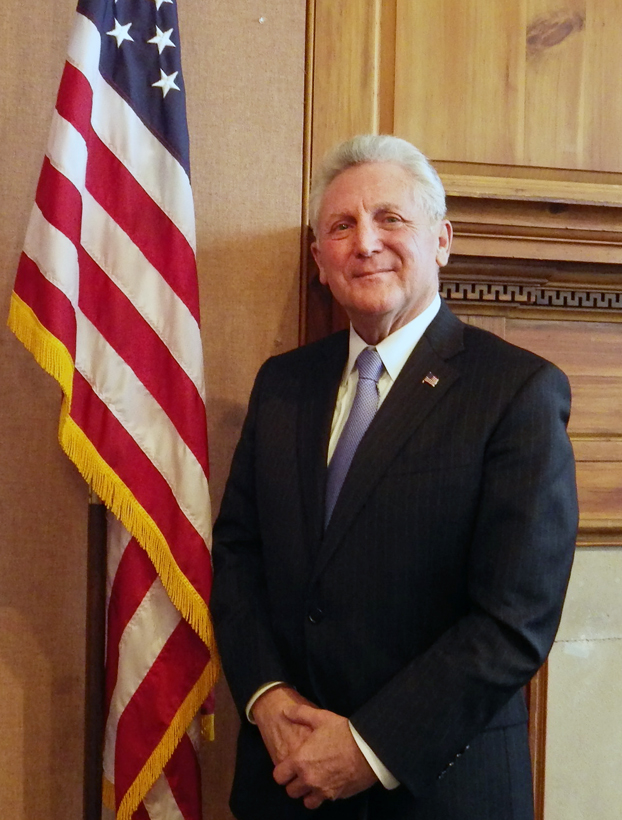

David DeMilia is senior vice president of commercial lending at Tompkins Mahopac Bank, Westchester. He can be reached at 914-524-1957 or at ddemilia@tompkinsfinancial.com.