It”™s no secret that banks are competing against each other to deliver the digital services customers are increasingly looking for. But People”™s United Bank believes it is differentiating itself from its competitors with a range of services to create a “digital bank” like no other.

It”™s no secret that banks are competing against each other to deliver the digital services customers are increasingly looking for. But People”™s United Bank believes it is differentiating itself from its competitors with a range of services to create a “digital bank” like no other.

“We”™re constantly focused on how, where and when we interface with our customers,” said

Senior Executive Vice President, Retail Banking Sara Longobardi at the bank”™s Bridgeport headquarters. “We continue to evolve and are now investing in the necessary data to provide personalized solutions to all of our customers, but tailored for each customer”™s needs.”

People”™s has launched a strategic initiative to provide customers with online and digital solutions for a suite of its most popular offerings, including:

Ӣ Online and mobile home loan and home equity applications with real-time virtual assistance from mortgage officers.

Ӣ Online and mobile checking and savings account-opening solutions.

Ӣ Online and mobile small- business loan applications for loans of $250,000 or less.

Ӣ A direct-to-client robo-advisory solution, designed to put advice and investment ideas into the hands of investors.

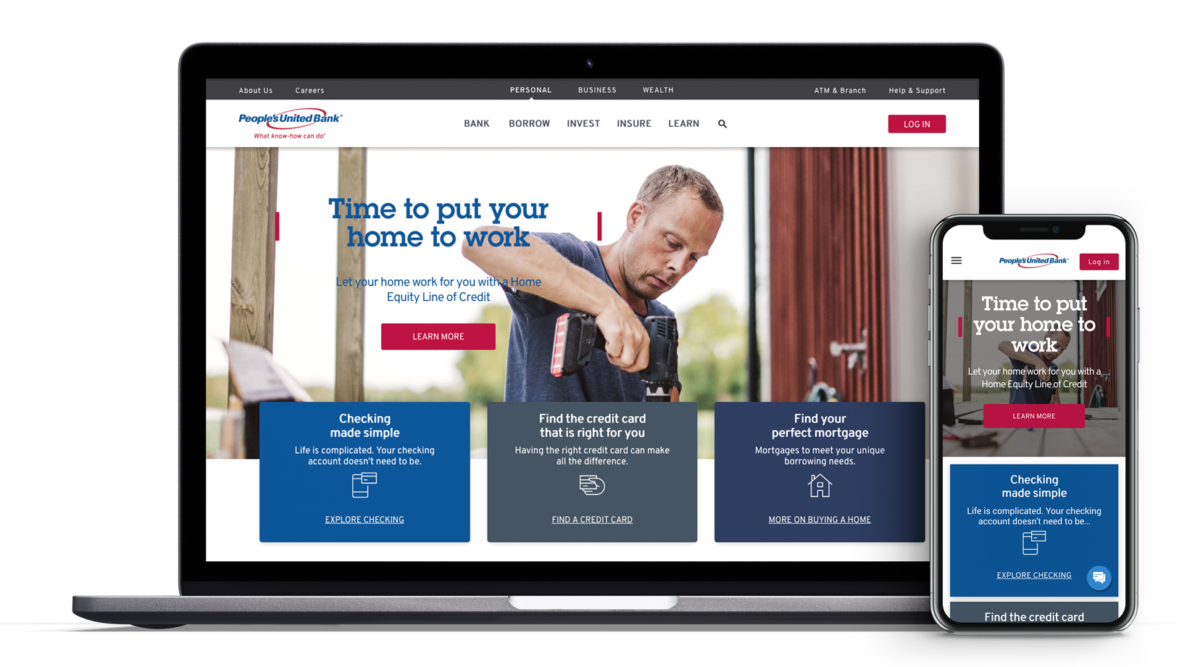

”¢ A new website featuring individual “storefronts” for personalized areas based on specific product types.

According to The New Digital Demand in Retail Banking, a report published last year by Oracle, 67% of customers globally are active on digital platforms and frequently access their bank accounts through digital channels, including mobile banking apps and web-based banking platforms. At least 60% of customers are looking to open a bank account online. Eighty-six percent want to make payments and transfers via those same channels.

“Our goal is to fully integrate the customer”™s experience at the branch and online,” she explained. “Our branch call center serves as an extension of our digital platform. If a customer walks into a branch to set up an account, our staff members can act as digital advocates and help them download and set up our app on their mobile devices so they can transfer money, make payments or, for example, consult with a mortgage officer who can see in real time what they”™re trying to do and help them on an individual, personalized basis.”

The new website will offer more advice and mobile-friendly options than does the current site, “with information and unique solutions for each customer, depending on how they journey through it,” she said.

The bank has added a new financial literacy program that allows it to educate customers about the inner workings of a small business loan.

The bank earlier this month completed the $327 million acquisition of BSB Bancorp Inc., the holding company of Belmont Savings Bank, which operates in the greater Boston area. In January it acquired VAR Technology Finance, a private, independent leasing and finance company that was folded into its LEAF Commercial Capital subsidiary, which was acquired by People”™s in 2017. Last year it acquired First Connecticut Bancorp, the holding company for Farmington Bank, in a 100 percent stock transaction valued at $544 million.