Buffalo-based M&T Bank is slated by mid-year to complete the acquisition of New Jersey-based Hudson City Bancorp, both with regional footprints. The banks are public and shareholder approval is required. The votes are slated for April 16 for M&T and April 18 for Hudson City.

“We have complete confidence the shareholders will approve the acquisition,” said Paula Mandell, M&T”™s Tarrytown-based regional president. “All indications are favorable.”

If approved, M&T will gain 135 Hudson City branches, 10 of them in Westchester, upping its county presence to 17 branches. There are no plans now to close branches, according to Mandell.

M&T”™s most recent financial 2012 data from January lists assets of $83 billion, deposits of $65.6 billion, loans and leases of $66.6 billion, and net income of $1 billion ($296 million in the fourth quarter of 2012). It posted equity capital at $10.2 billion in that report.

M&T offers the spectrum of banking services, while Hudson City”™s emphasis has been on the consumer end.

“This acquisition is good for M&T, bringing us an institution ”“ Hudson City ”“ that has enjoyed a fine reputation for over 100 years,” said Mandell. “What it provides is the opportunity to expand goods and services and to expand and grow the M&T brand in an area where we already operate.”

Positive change is already afoot: M&T is bolstering its small business lending division in Tarrytown by 12 employees, with additional jobs to come as needed in the mid-market and commercial real estate arenas, a process that to date has brought on another four employees.

With the Hudson City accounts added to the M&T tally sheets, M&T would become the sixth-largest deposit holder in Westchester County, Mandell said.

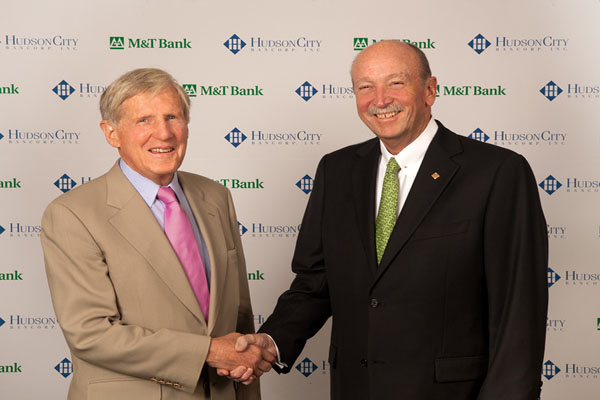

“M&T, which was established in 1856, and Hudson City, founded in 1868, have been serving their customers and communities for generations, and we look forward to building on that long history and tradition together in the future,” said Robert G. Wilmers, M&T chairman and CEO, in a prepared statement. “As a thrift, Hudson City focused primarily on deposits and mortgages. M&T will build on Hudson City”™s loyal customer base to create a comprehensive community banking franchise that provides a full range of checking and savings accounts, debit and credit cards, home equity loans and other lending options, plus small business and commercial banking services and our premier wealth management and corporate trust solutions through Wilmington Trust.”

Wilmington Trust ”“ acquired by M&T in 2010 ”“ has offices coast to coast and internationally, including in Manhattan and in Stamford, Conn., specializing in asset protection and trust management.

“This merger creates tremendous opportunities to build on the successes that each company has achieved individually in its own markets,” Hudson City Chairman and CEO Ronald E. Hermance Jr. reported. “Hudson City recently embarked on a diversification of our product lines and our balance sheet. This transaction accelerates that transformation. As we combine Hudson City”™s attractive retail network with M&T”™s full service commercial banking suite, our stakeholders will participate in the growth of one of the nation”™s strongest and most successful banking franchises.”

Hudson City”™s 135 branch offices are located in New Jersey (97 branches), downstate New York (29 branches) and Connecticut (nine branches), beginning in Greenwich. The two banks have noted “very little overlap” in their branch presences.

M&T expects to gain approximately $25 billion in deposits and $28 billion in loans from the acquisition, before acquisition accounting adjustments.

There are a total 725 commercial and retail facilities bearing the M&T name down the East Coast as far as West Virginia. Its largest presence remains in the Empire State, where 7,462 of its 15,050 employees work.

Hudson City, with headquarters in Paramus, N.J., for the moment remains the largest savings bank headquartered in New Jersey. It maintains branches also in Westchester, Fairfield, Putnam and Rockland counties, as well as on Long Island. It serves Philadelphia through branches in the New Jersey suburbs.