While business startups drive much of the economic productivity and hiring in the U.S., numbers in a recent survey show that entrepreneurs face a daunting path in financing their ventures.

While business startups drive much of the economic productivity and hiring in the U.S., numbers in a recent survey show that entrepreneurs face a daunting path in financing their ventures.

The survey, released in August by the New York Federal Reserve, looked at the funding and credit experiences of startups throughout the country. The Fed found that new firms often struggle to find financing needed to stay operational and grow. About one in three startups fail within two years, and half of them fail within five years, according to data cited in the report.

About 61 percent of firms no more than 2 years old expect to add jobs, according to the survey, compared with 29 percent of established firms 5 years or older.

To help with that growth, startups are seeking funding for expansion at higher rates than established firms. But finding that financing isn”™t easy. The Fed found that 58 percent of firms 2 years old or younger reported difficulty with credit availability or accessing funds for expansion, well above the 39 percent of established firms that reported the same problems.

Thomas Morley, director of the Rockland Regional Center for the New York Small Business Development Center, said those numbers are consistent with what he sees in this region.

“The common sense is that, since much of credit is based on financial history, lenders will look at your financial history. Can you demonstrate an ability to pay?” said Morley. “Well, startups don’t have that history.”

Kim Jacobs, executive director of Community Capital New York, a nonprofit alternative lender to small businesses headquartered in Elmsford, said about half of her organization’s clients are startup businesses.

Community Capital works with businesses in the Hudson Valley and Fairfield County unable to secure financing from traditional lenders. Jacobs said the organization works more frequently with startups “because it’s just very difficult for them to get fair, responsible, transparent and affordable financing other places.”

That can be particularly true in the Hudson Valley and Fairfield County, where “it’s a very high-cost area, so the barriers to entry are high,” Jacobs said. “A lot of entrepreneurs start their business with their own resources.”

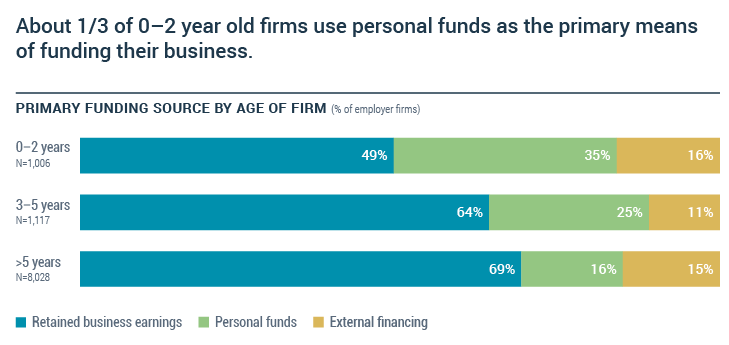

The Fed survey found that nationally, about one-third of startup firms used personal funds as the primary means for the business.

“Our experience is that, you start a business, whose money are you using?” Morley said. “The only money that’s around is your own.”

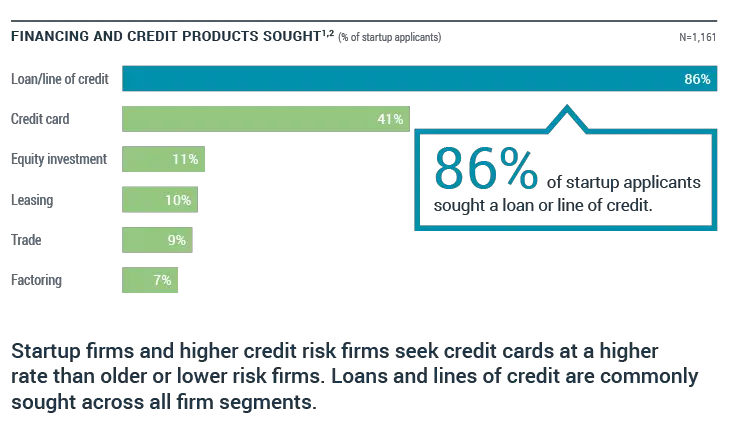

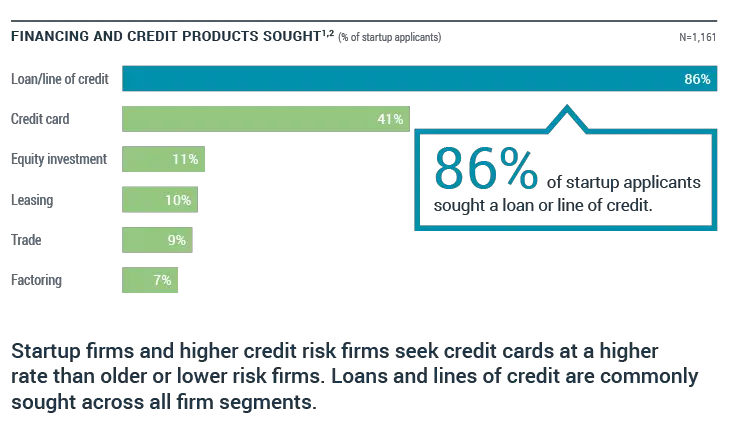

The survey also found credit cards were the second most commonly sought product from banks for startups, behind only a loan or line of credit. About 41 percent of startups surveyed applied for a credit card, while 86 percent applied for a loan or line of credit. Startup applicants were much more likely than established firms to use credit cards for their businesses on a regular basis, the survey found.

Startup firms with a higher credit risk are also increasingly seeking out online lending sources. About 39 percent of medium and high credit-risk startups reported using online lenders, compared with 10 percent of established firms and 11 percent of low credit-risk startups.

For those using online lenders, Jacobs said it’s “important to know the right questions to ask.” She said that while online lenders can quickly turn around a loan, the terms are not always transparent. They may include higher interest rates or a daily repayment schedule that doesn’t match a young business’ needs.

“The online lenders are particularly tough for startup businesses,” Jacobs said. “They may be more useful to more mature businesses because they can manage their limitations better.”

Citing outside research, the Federal Reserve report noted that the rate of startup creation has been declining for several years.

Asked if that applied to Westchester County and the Hudson Valley region, Morley at the Small Business Development Center said it can be hard to measure exactly how many new businesses are startups, rather than LLC entities or spinoffs of established businesses, but overall characterized the area as strong for startups.

Still, he said the startup activity his office sees usually has ups and downs. For example, the Rockland center saw an increase in people launching businesses during economic recession in 2008 and 2009, often because they had lost their jobs and had limited employment options.

“Employment seems to be a better correlation,” Morley said. “The stronger the job market, the less likely someone is to start a business. Because I can go get a paycheck, I don’t take any risk, save some money and I can start a business in a couple years. So, we do see deferral of entrepreneurship when the job market is good.”

Jacobs said one advantage for the area is the number of organizations offering help to new businesses, including the New York Small Business Development Center, the SCORE Westchester small-business mentoring group and Westchester Community College’s training programs.

“We are still seeing a lot of really exciting small businesses,” Jacobs said. “Everything from great mom-and-pops and on that really add to the vitality of local communities they serve. Locally owned businesses are terrific contributors. They create jobs, pay taxes and are also terrific community stakeholders.”