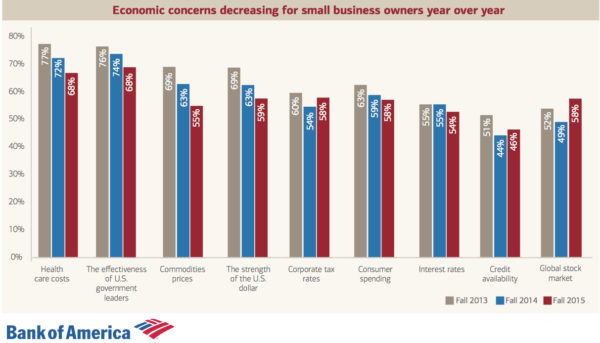

- The majority of concerns of small business owners are decreasing with only a few exceptions. Image courtesy of Bank of America

In its latest survey of small-business owners, including those in Fairfield and Westchester counties, Bank of America found that both regionally and nationally entrepreneurs are more optimistic about the future growth of their businesses and the health of the economy than in recent years.

“We”™re happy to say that confidence in the economy has risen dramatically. It”™s at the highest levels we”™ve seen since the survey began in 2012,” wrote Bank of America Small Business Executive Robb Hilson. “Small business owners not only anticipate a healthier economy, but they also report plans to grow their businesses and to hire more employees over the next 12 months, all at a much higher rate than in recent years.”

In the metro New York region alone a majority (61 percent) of small-business owners plan to hire ”” approximately double what it was two years ago.

Seventy percent are confident their revenue will increase in the coming year, a 10-percent jump from the previous year, and 57 percent believe their local economy will improve in the next year; up 6 percent from the previous year.

Working closely with an array of small businesses through The Business Council of Fairfield County, Gary Breitbart, the council”™s director of growth company advisory services, agrees small-business owners are confident, but cautiously so.

“I wouldn”™t say people feel they are fully out of recession, but they are feeling like growth is starting and that is helping them become a little more bullish,” he said.

Regarding hiring, Breitbart expects an increase of 10 percent to 15 percent in job creation from the previous year for Fairfield County small businesses.

The Bank of America survey indicates 61 percent of metro New York ”” which includes Fairfield and Westchester ”” small-business owners plan to hire more employees, a 13 percentage point increase from last year.

Nationally optimism is even greater with 67 percent of owners planning to hire more staff over the next 12 months, compared with 51 percent in fall 2014.

Plans to increase staff are particularly high among millennial and gen-x small-business owners with 80 percent and 73 percent respectively planning to hire compared with 43 percent of baby boomer small business owners.

Loan demand is also up ”” a key indicator of the growth trajectory of small businesses and the health of national economy, Hilson said.

Increased growth goes hand in hand with the need for more capital and according to the survey, 33 percent of respondents from the metro New York plan to apply for a loan in 2016, 8 percentage points higher than a year ago.

Nationally one in three (35 percent) said they intend apply for a loan in 2016, a considerable (11 percent) jump year over year. In addition, the number of small-business owners who report they have applied for a loan in the past two years has increased by more than 50 percent in the last 12 months, rising from 29 to 44 percent, according to the survey.

Breitbart said he has also observed an increasing need for funding among small businesses in Fairfield County, describing it as an “ongoing systemic” need, but one that needs to be addressed by more than just the traditional lenders to include venture capital firms and angel investors.

“We need more Connecticut capital for Connecticut companies,” he said. “We have capital here, but it is not being invested in some of our growth companies.”

While hopes are high for the coming year some concerns still loom large over the heads of small-business owners.

Top concerns found by the survey included the possibility of a hike in the minimum wage or increase in interest rates by the Federal Reserve as well as uncertainty as to the outcome of the 2016 presidential election.

Healthcare costs and the effectiveness of U.S. government leaders ranked highest with 68 percent of respondents stating they were among their concerns, though the number of small-business owners concerned about these topics has steadily decreased since the fall of 2013.

Breitbart said his Fairfield County Small business clients are not hesitating to hire because of a possible future increase in the minimum wage, though it does create uncertainty and could be a possible damper on growth activity.

“I don”™t have too many companies focused on the minimum wage, even those who have that kind of workforce are paying a little more already, but they are wondering how high the bar is going to be raised,” he said. “They don”™t know what legislatively is going to be thrust upon them.”

A possible increase in interest rates has steadily remained on the minds of small-business owners with 55 percent citing it as a concern in the fall of 2013 and 2014 and 54 percent in the current survey.

While the survey found a number of differences between confidence among the generations of small-business owners, it also found varying levels of optimism between old and young businesses.

The survey found new small-business owners to be more optimistic than established owners, with 71 percent of small-business owners in business for up to 10 years stating they were optimistic their local economy would improve in the coming year. Of owners in business for more than 11 years, 47 percent said they were confident.

Brietbart has not found the discrepancy between business longevity to hold true for the cohort of small businesses with which he works.

“I just haven”™t seen that distinction,” he said. “I see manufacturing companies that have been around for 25 years and they are excited. I see small companies that are employing new technologies and they are excited.”

Enjoyed reading this positive article that sheds light on the upward movement of business owners. As an organization that supports positive women business growth, it is great to read. We will share this post with our readership. Thanks, Reece and Westfair!