Aquarion Co. will acquire all outstanding shares of New England Service Co. (NESC), with the latter becoming a wholly owned subsidiary of Aquarion.

Under the agreement, which was unanimously approved by the boards of directors of both Aquarion and NESC, the acquisition will be executed through a stock-for-stock transaction that is structured to be a tax-free reorganization.

Over the last 10 years, Aquarion has integrated about 70 water systems into its operations.

The agreement provides that the stockholders of NESC will receive 0.51208 shares of the common shares of Aquarion”™s parent, Eversource Energy, in exchange for each share of NESC common stock. The fixed exchange ratio implies a $44.90 per share price based on the $87.68 closing price of Eversource Energy common shares on April 6.

The agreement provides that the stockholders of NESC will receive 0.51208 shares of the common shares of Aquarion”™s parent, Eversource Energy, in exchange for each share of NESC common stock. The fixed exchange ratio implies a $44.90 per share price based on the $87.68 closing price of Eversource Energy common shares on April 6.

In connection with the exchange, Eversource will issue approximately 463,000 shares of ES Common Stock at closing.

The merger includes NESC”™s Valley Water System in Connecticut, Colonial Water Co. and Mountain Water Systems in Massachusetts, and Abenaki Water Co. in New Hampshire, as well as unregulated service operations throughout New England. The merger will add nearly 10,000 customers to Aquarion”™s existing base of 216,000 customers.

Under the agreement, all NESC employees will be retained.

Aquarion is based in Bridgeport, while NESC is headquartered in Plainville; both provide regulated water service to customers in Connecticut, Massachusetts, and New Hampshire.

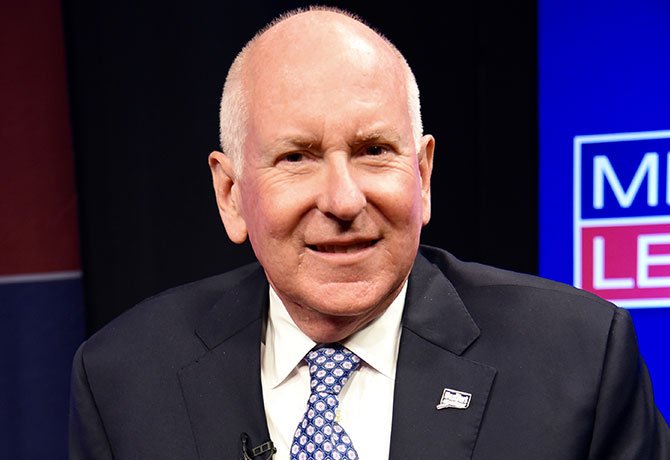

“This merger will create long-term benefits for customers, employees, and the communities we serve,” Aquarion Water Co. President Donald Morrissey said in a statement. “We will make investments in these water systems focused on reliability and water quality and deliver a superior customer experience.”

The completion of the transaction will require approval by the stockholders of NESC. The NESC board of directors has resolved to recommend the adoption of the merger agreement by the stockholders. The transaction is also subject to the approval of regulatory authorities, including the Connecticut Public Utilities Regulatory Authority, Massachusetts Department of Public Utilities, and New Hampshire Public Utilities Commission, and satisfaction of several other conditions.

The parties plan to file all required regulatory applications over the coming months with an anticipated closing by the end of the year.

Ropes & Gray LLP served as counsel to Aquarion and Eversource in the transaction. Boenning & Scattergood Inc. provided a fairness opinion to, and Cranmore, FitzGerald and Meaney served as counsel to, NESC.