Remember Opportunity Zones?

As defined by the IRS, a Qualified Opportunity Zone ”” created by the Tax Cuts and Jobs Act of 2017 ”” is “an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment.”

Many of Connecticut”™s 72 approved Qualified Opportunity Zones in 27 municipalities, which include 17 in Fairfield County (seven in Bridgeport, five in Stamford, three in Norwalk and one each in Danbury and Stratford), were reportedly gaining traction with investors, mainly from Connecticut and New York, before COVID-19 arrived.

Then, like so much else in life, the idea of investing in these zones was pretty much sidelined.

The Economic Innovation Group, a think tank based in Washington, D.C., recently surveyed more than 100 investors and other people involved in Qualified Opportunity Zones. It found 52% of respondents saying the pandemic continues to have a “negative impact” on their activities, with about 71% saying that, while still interested in the concept, they are reluctant to commit due the ongoing uncertainty about the economy.

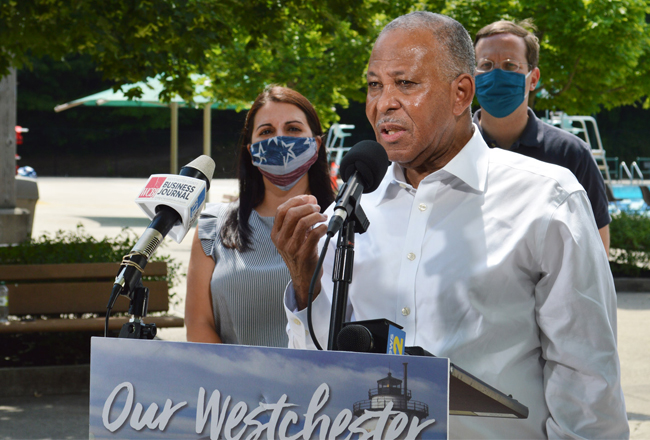

But Greenwich resident Jim White, a serial entrepreneur whose business turnaround strategy has generated over $1.8 billion in revenue, said that now is the time to get back into the Opportunity Zone business.

“Right now there are 8,743 Qualified Opportunity Zones throughout the United States and its territories,” White said. “Not only that, there are still the same incentives for investors to get involved with them.”

Investors uncertain about getting involved in anything at the moment ”” the Dow has gone from the 29,000s in February to 20,700 in March, and has been gaining and losing haphazardly ever since ”” should seize the chance to get in (or back in) to these zones now, White said. In fact, he recently created the PHT Opportunity Fund, which makes strategic investments in the zones.

The potential positives are impressive, he said, outlining four major benefits:

”¢ Investors can defer recognition of the capital gains invested until up to Dec. 31, 2026 ”” and postpone paying the federal tax obligation until the tax return due date in 2027.

Ӣ If an investor holds their Quality Opportunity Fund interest for five years, their federal deferred capital gains amount will be reduced by 10%, provided they invest their capital gains no later than Dec. 31, 2021.

Ӣ If an investor holds their fund investment for 10 years, any additional gain (in excess of the deferred gain recognized in 2026) on the sale of that investment is not subject to federal income tax if sold before 2048.

Ӣ Income distributions can also be received from the fundӪs earnings.

White further cited Economic Innovation Group research that estimates the potential capital eligible for reinvestment in Qualified Opportunity Zones is in the $6 trillion range.

“And not only that,” he said, “but project sponsors and developers can go into the zones and update the real estate, the infrastructure, start new businesses, collaborate with nonprofits, start hospitals ”” all kinds of different things.”

The fact that altruism is a part of the Opportunity Zone equation ”” the point is to help low-income communities by creating jobs and thus aiding the local economy through payroll and taxes ”” should play a major role in such investments, White said.

Not, he noted ruefully, that that has always been the case. News stories about Michael Milken and Jared Kushner lobbying for preferential treatment “resulted in a lot of bad press,” White acknowledged. “There was a feeling that, ”˜This is just another thing for the buddies,”™ if you will.”

While he and PHT are now helping rebuild interest in the zones around the country, White said that, so far at least, there is little serious activity taking place in Fairfield County or in Connecticut at large.

Still, he said, “I”™d say there”™s more interest today than there was prior to COVID-19. It”™s a matter of educating or re-educating people on what kind of investments these can be.

“We”™ll get there,” he said.